This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Barclays Launches S$ AT1; CBA, BP Capital Markets Price $ Bonds

November 21, 2024

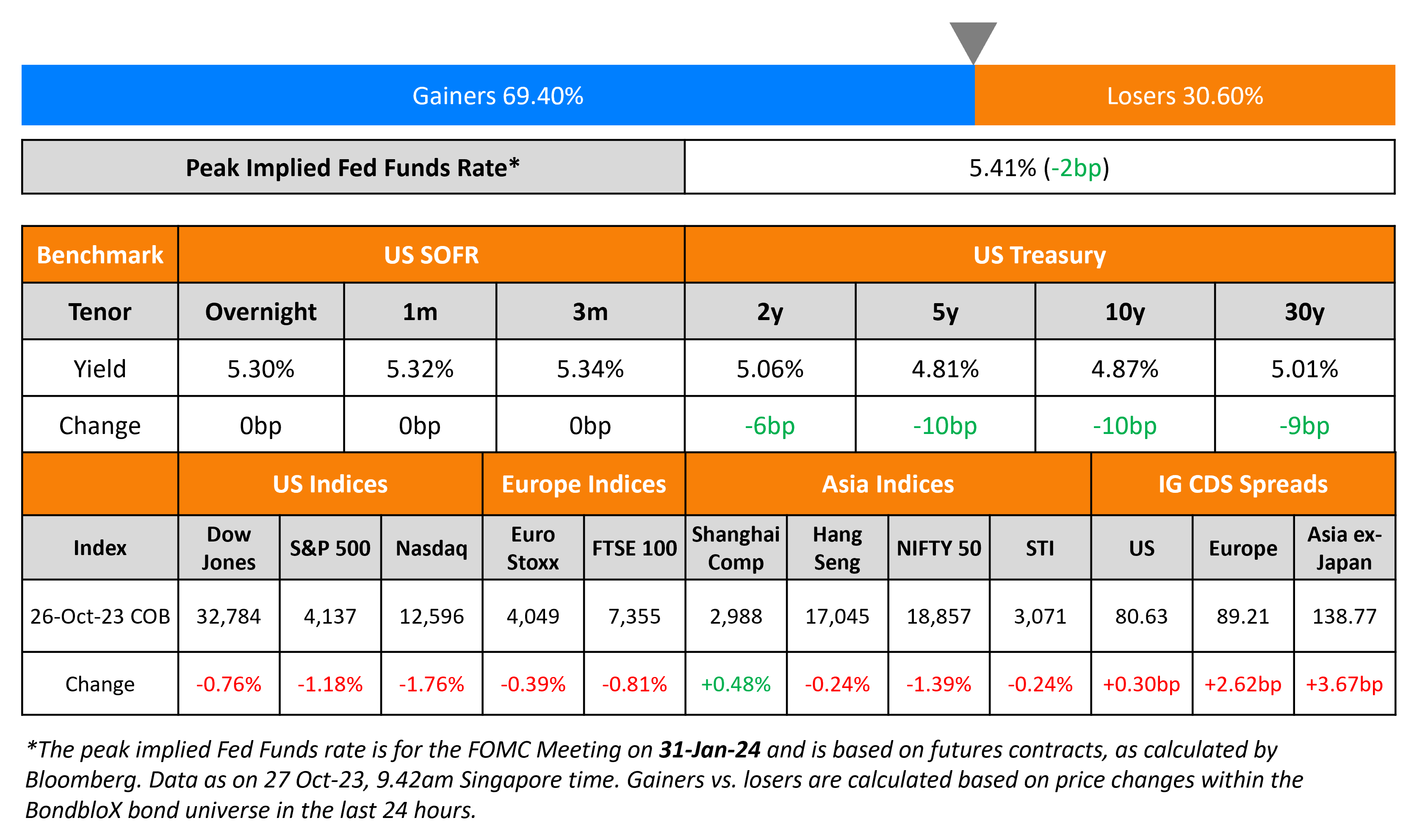

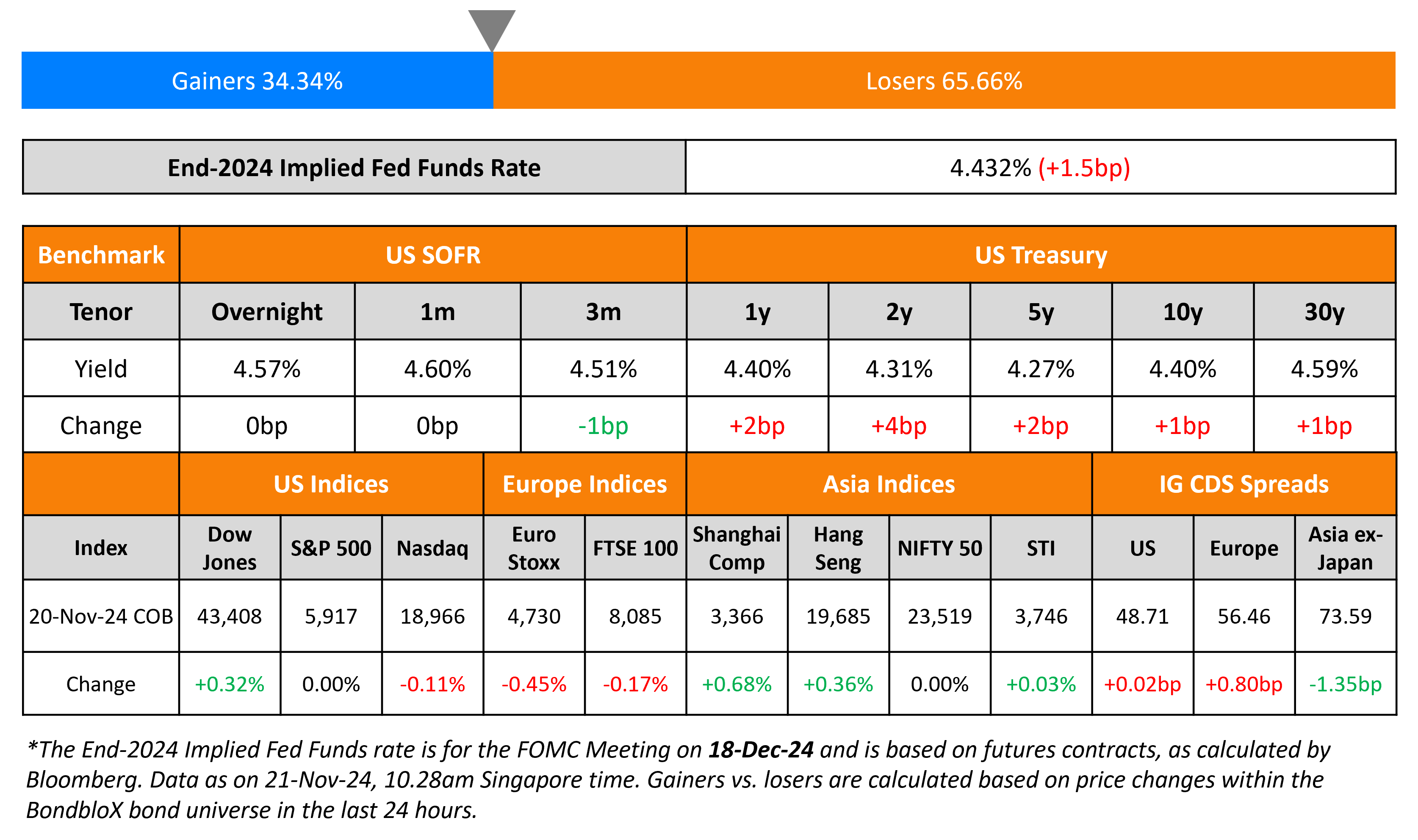

US Treasury yields remained largely stable yesterday. The US Treasury priced a modest 20Y auction with the bid-to-cover ratio coming-in at 2.34x vs. 2.59x last month. The indirect acceptance rate came in at 69.5%, higher than the prior auction’s 67.9%. Some analysts noted the weakness in the 20Y auction signaled tepid demand for long-dated treasuries due to the potential inflationary policies that might ensue under Donald Trump’s administration. Aside from this, Boston Fed President Susan Collins remarked that the interest rate cuts should continue, but policymakers should proceed with caution. She cited that the economy is currently in a good place overall, but inflation is still sticky, and job growth is concentrated within a few sectors.

US IG and HY CDS spreads remained flat. In terms of the US equity markets, the S&P closed flat, and the Nasdaq closed 0.1% lower. European equities closed lower across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.8bp and 1.9bp respectively. Asian equities have opened lower this morning. Asia ex-Japan CDS spreads tightened by 1.4bp.

New Bond Issues

- Barclays S$ PerpNC5.5 AT1 at 5.8% area

CBA raised $2bn via a two-part deal. It raised $1.3bn via a 2Y bond at a yield of 4.577%, 22bp inside initial guidance of T+50bp area. It also raised $700mn via a 2Y FRN at SOFR+46bp vs. initial guidance of SOFR equivalent area. The senior bank notes are rated Aa2/AA-/AA-. Proceeds will be used for general corporate purposes. CBA may redeem notes in whole but not in part for certain tax reasons. The new 2Y fixed-rate notes were priced roughly inline with its existing 3.15% 2027s that yield 4.54%.

BP Capital Markets America raised $2bn via a three-part deal. It raised:

- $400mn via a tap of its 5.017% 2027s at a yield of 4.633%, 22.5bp inside initial guidance of T+60bp area.

- $650mn via a 5Y bond at a yield of 4.868%, 20bp inside initial guidance of T+80bp area. The new bonds were priced ~6bp wider to its 4.97% 2029s that yield 4.81%.

- $950mn via a tap of its 5.227% 2034s at a yield of 5.227%, 22.5bp inside initial guidance of T+110bp area

The senior unsecured notes are rated A1/A-/A+. Proceeds will be used for general corporate purposes, including working capital for BP or other companies in the group, and for repayment of existing borrowings.

SAIB raised $750mn via a PerpNC5.5 AT1 sukuk at a yield of 6.375%, 50bp inside initial guidance of 6.875% area. The notes are unrated and received orders of over $4.8bn, 6.4x issue size. If not called by 27 May 2030, the profit rate will reset to the US 5Y yield plus 208.7bp. Proceeds will be used to finance and/or refinance, in whole or in part, for projects set out in its sustainable finance framework.

New Bond Pipeline

- Vedanta Resources hires for $ 3.5NC1.5/7NC3 bond

Rating Changes

- Fitch Upgrades Metro Bank Holdings to ‘B+’; Outlook Positive

-

China Vanke Downgraded To ‘B+’ On Shrinking Balance Sheet, Weakening Liquidity; Outlook Negative

-

Moody’s Ratings downgrades Ardagh Metal Packaging’s CFR to B3; stable outlook

-

Fitch Publishes Vedanta Resources’ First-Time ‘B-‘ Rating; Outlook Positive

-

Fitch Affirms Braskem Idesa’s Ratings at ‘B+’; Outlook Revised to Stable

Term of the Day

Sukuk

.A Sukuk is a sharia-compliant fixed income instrument that essentially works similar to bonds. In a Sukuk, key differentiators vs. conventional bonds are:

– Investors share partial ownership of an asset rather than it being a debt obligation by the issuer

– The pricing is based on the underlying value of assets rather than credit worthiness

– The holder receives a share of underlying profits rather than interest payments (considered ‘riba’)

Sharia compliance broadly implies that any profits derived from these funding arrangements must be derived from commercial risk-taking and trading only; that interest income is prohibited on lending activities and; that the assets must be halal.

Talking Heads

On Rich Credit Valuations Unlikely to Cheapen in 2025 – Goldman Sachs

“Barring a selloff between now and year-end, investors will likely enter 2025 with the most severe valuation constraints in more than two decades. Owing to the still strong level of yield support, we expect 2025 will feature another solid year for total returns… if the current episode, which is 9-10 months old, ends up resembling the mid-90s, spreads could remain in their current neighborhood for many more quarters”

On EU Bonds Are an Opportunity – Diego Megia, Taula Capital

“This is an opportunity for investors”… spreads could narrow by about 40bp if the bonds are included in major sovereign bond indexes.

On Trump May Pick More Accommodating Fed Chief – Bob Prince, Bridgewater

“There is a desire for cutting interest rates… if the inflation rate holds up, then that can preclude cutting rates, which I think sets up an interesting situation 18 months from now”.. Should US inflation move closer to 3% in about 1.5 years from now, Trump may be inclined to nominate a Fed chairman who would accommodate the higher target and free him to cut interest rates.

Top Gainers and Losers- 21-November-24*

Go back to Latest bond Market News

Related Posts: