This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Bahrain Prices $ Sukuk

November 28, 2024

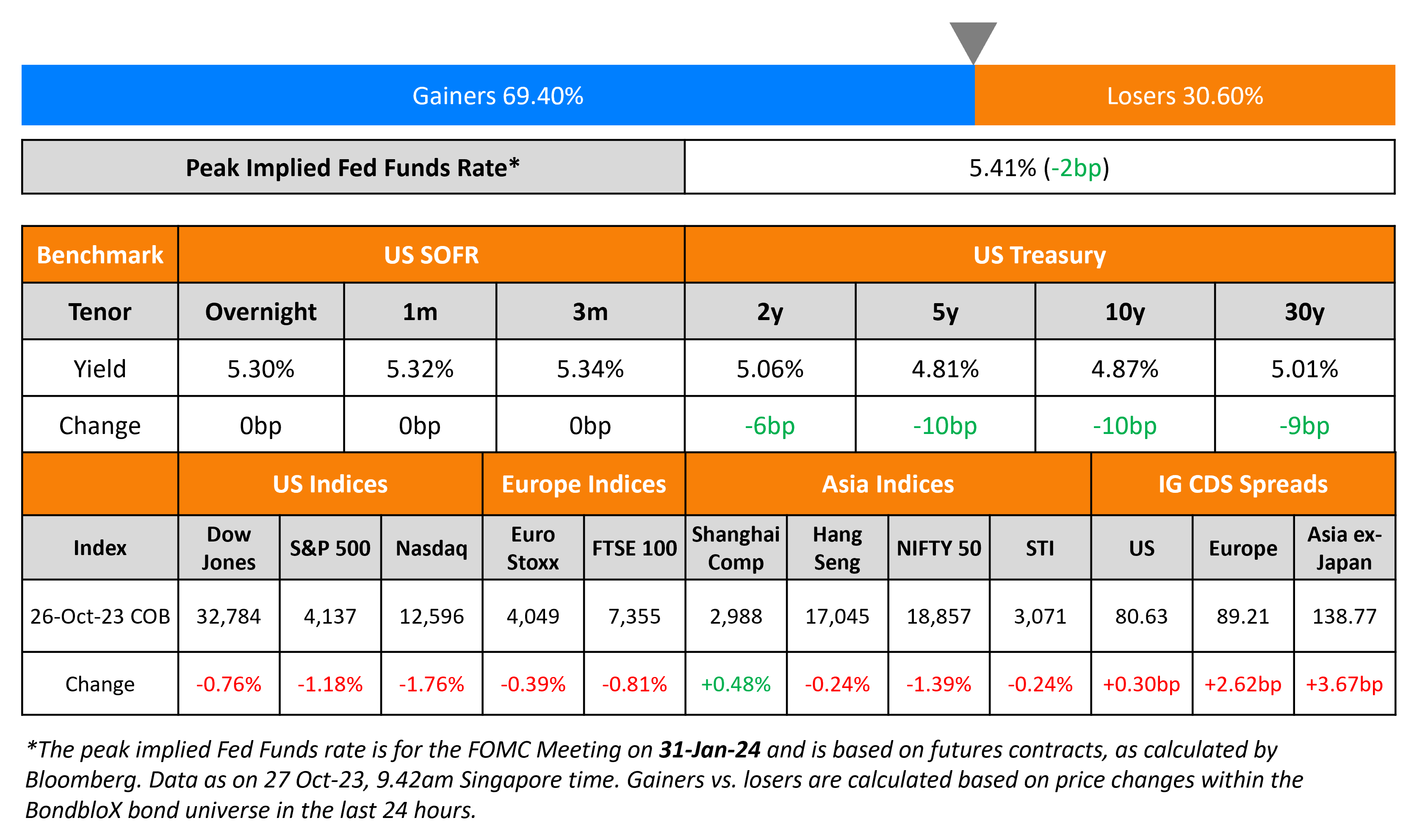

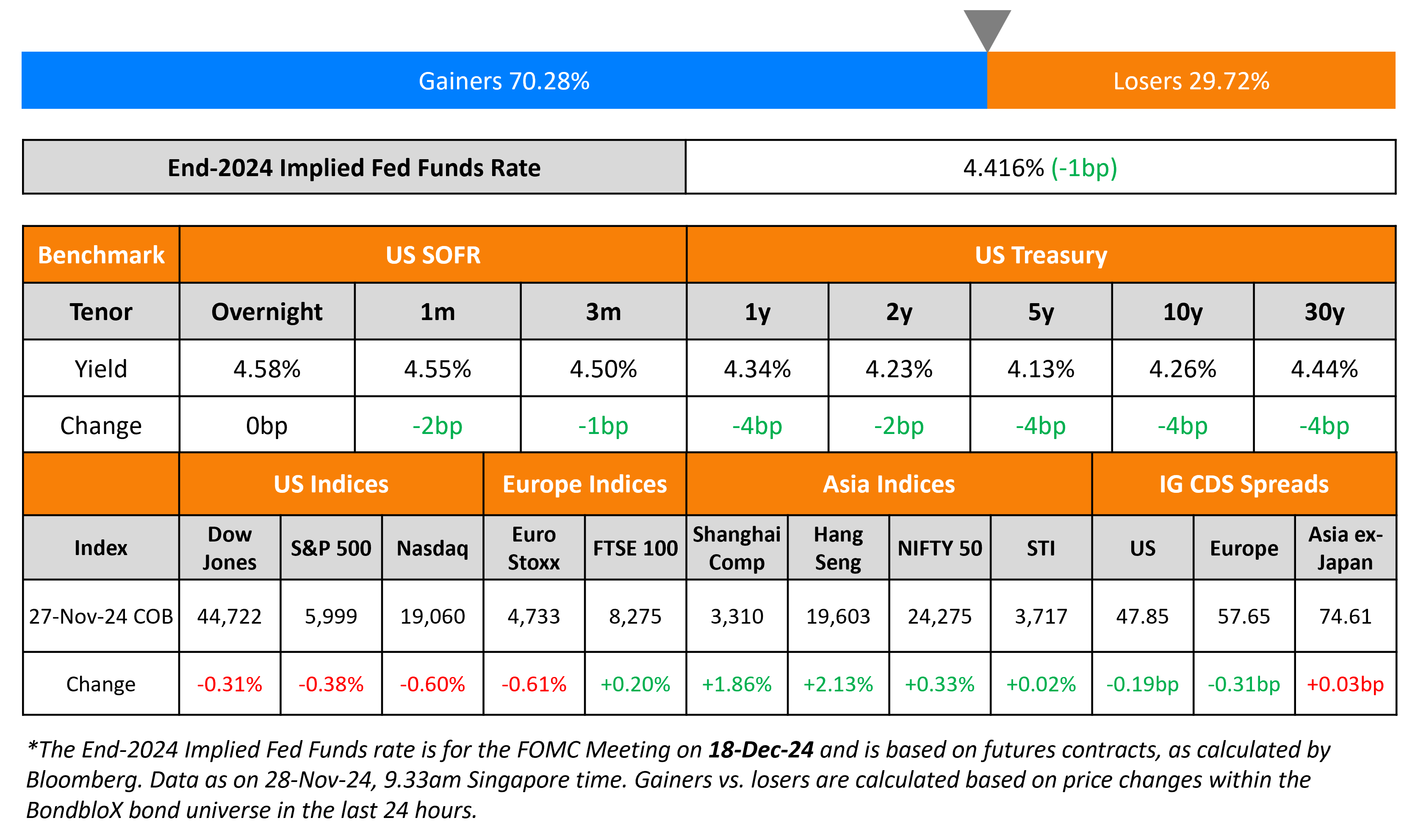

US Treasury yields continued their move lower, by ~4bp across the curve, ahead of the Thanksgiving holiday. The Headline and Core PCE index readings for October, were inline with expectations at 2.3% and 2.8% respectively. However, the preliminary Durable Goods Orders for October were softer, rising by 0.2% (vs. expectations of 0.5%). Similarly the preliminary Capital Goods Orders were also softer at -0.2% (vs. expectations of 0.1%). Separately, initial jobless claims for the prior week came-in at 213k, slightly better than the surveyed 215k.

US IG and HY CDS spreads tightened by 0.2bp and 0.1bp respectively. In terms of the US equity markets, the S&P and Nasdaq closed lower by 0.4% and 0.6% respectively. European equities ended mixed. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.3bp and 1.7bp respectively. Asian equities opened mixed this morning. Asia ex-Japan CDS spreads were flat.

New Bond Issues

Bahrain raised $1.25bn via a long 7Y sukuk at a yield of of 5.875%, 37.5bp inside initial guidance of 6.25% area. The notes are rated B+/B+ (S&P/Fitch), and received orders of $3.5bn, 2.8x issue size. CBB International Sukuk Programme Co WLL is the issuer.

Rating Changes

-

Moody’s Ratings upgrades Vedanta Resources’ CFR to B2 and bonds to B3; outlook stable

-

Moody’s Ratings upgrades Valmont Industries’ senior unsecured rating to Baa2, outlook stable

-

Moody’s Ratings places Sri Lanka on review for upgrade; assigns (P)Caa1 to the new USD-denominated issuances

-

Moody’s Ratings revises SoftBank Group’s outlook to positive from stable, affirms Ba3 corporate family rating

-

Fitch Places Wanda Commercial and Wanda HK on Rating Watch Negative on Distressed Debt Exchange

-

Fitch Removes DIRECTV from Rating Watch Negative; Affirms ‘BB’ Rating

Term of the Day: Restricted Group/Subsidiaries

Restricted Group or restricted subsidiaries refer to a parent or holding company’s subsidiaries that are tied to the debt covenants of the parent issuer. Restricted groups may have covenants that restrict cash upstreaming to shareholders, additional indebtedness, liens, dividend payments, making new investments etc. Unrestricted subsidiaries on the other hand are not bound by the parent or holdco’s bond covenants and are thus not required to support repayment of the debt securities.

Take the case of a parent company that has various subsidiaries, and that the debt is issued at the parent’s or holdco’s level. Here, a restricted subsidiary’s assets are ringfenced such that during normal operations, the parent company is not able to use the cash of these units via transactions like inter-company loans etc. simply because it is a holding company. Therefore, in the event of distress, given that restricted subsidiaries are bound by restrictive debt covenants, bondholders’ credit risk is reduced as they have access to assets of the restricted subsidiary.

Talking Heads

On Asian Bonds to Trail EM Peers If Trump Enacts Milder Tariffs

Goldman Sachs strategists

“EM local yield spreads versus the US are already quite tight across many markets… valuation buffers are higher across LatAm”… significant amount of trade-related fears has been priced in, and “flows to EM assets could rebound” if some of the risks don’t ultimately materialize.

Alvin Tan, RBC Capital Markets

“I would take his threats of tariffs seriously, though also mindful that his starting position is likely negotiable”

On Fixed-Maturity Funds Are Booming In Hot Credit Market

Neal Brooks, M&G Investments

“Over the last 18 months we have seen a massive rise in fixed maturity… Given a perception of higher-for-longer rates, spreads may be narrow but the yield is still attractive”

Simon Blundell, BlackRock

“It’s the yield and the simplicity of them that is attractive to clients”

Raphael Thuin, Tikehau Capital

“There is now a broader consensus that this new regime of higher interest rates is likely here to stay for the foreseeable future”

Deutsche Bank strategists

“Fixed maturity funds have constituted a new investable sub-structure in the investment-grade universe… successful in attracting retail money with the promise of juicy low-risk yields”

On Rising Trade and Geopolitical Tensions – MAS

“The global economy confronts heightened uncertainty, trade tensions and geopolitical conflicts that could raise the probability of adverse shocks”

Top Gainers and Losers- 28-November-24*

Go back to Latest bond Market News

Related Posts: