This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

AVIC, BOC Launch $ Bonds; Treasuries Stay Stable

August 20, 2024

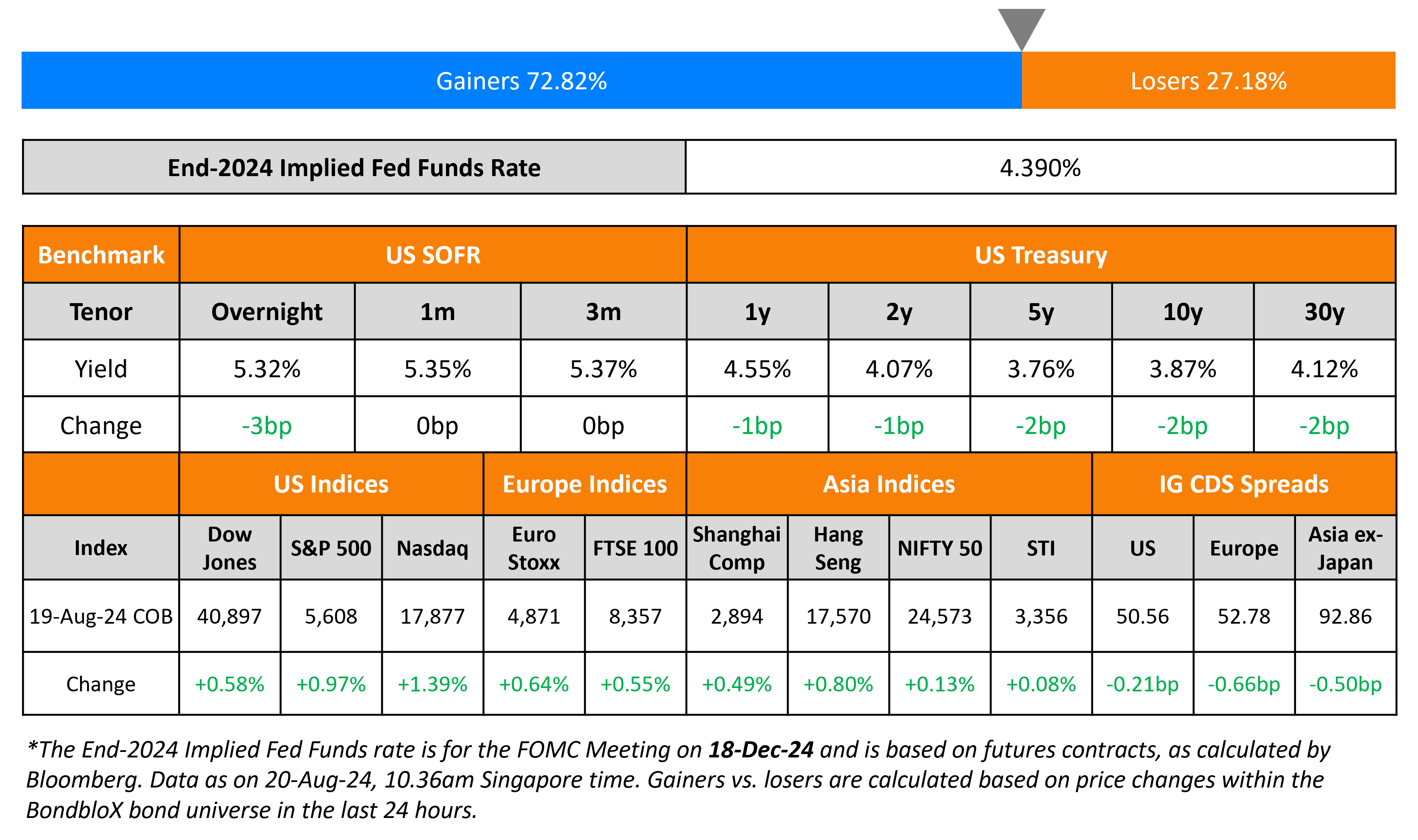

US Treasuries were flat across the curve with no major data points or catalysts. Markets await Fed Chairman Jerome Powell’s speech at the Jackson Hole symposium later this week. Minneapolis Fed President Neel Kashkari said that it was appropriate to discuss cutting interest rates in September due to the rising possibility of a weakening labor market. US IG CDS spreads tightened by 0.2bp while HY CDS spreads tightened by 0.8bp. Looking at US equity indices, the S&P and Nasdaq were up 1% and 1.4% respectively.

New Bond Issues

- DBJ $ 3Y at SOFR MS+55bp area

- EIB $ 5Y at SOFR MS+40bp area

- Avic International Leasing $ 3Y at T+125bp area

- BOC (Dubai) Branch $ 3Y Green at SOFR+105bp area

Bocom Financial raised $650mn via a two-tranche deal. It raised $400mn via a 3Y green FRN at SOFR+75bp, 50bp inside initial guidance of SOFR+125bp area. It also raised $250mn via a 3Y green bond at a yield of 4.513%, 40bp inside initial guidance of T+105bp area. The senior unsecured bonds are rated A3/A (Moody’s/Fitch) and have a keepwell provision by Bank of Communications Financial Leasing Co Ltd. Proceeds will be used to finance and/or refinance eligible green projects as defined in the company’s sustainable finance framework.

Rating Changes

- Moody’s upgrades Lumen’s CFR to Caa1 from Caa2; outlook is positive

- Moody’s Ratings upgrades British American Tobacco to Baa1 from Baa2; outlook stable

- Fitch Downgrades Vertex Energy to ‘CC’

Term of the Day

Keepwell Provision

A keepwell provision is a legal agreement between a parent company and a subsidiary to ensure solvency and financial stability of the subsidiary for the duration of the agreement. Keepwell provisions are included in bond terms to offer bondholders confidence on the issuer’s ability to repay. The keepwell structure emerged around 2012-2013 to assuage concerns of investors over a bond issuer’s creditworthiness. However, it is important for investors to understand that keepwells are not a guarantee that the parent company will support the subsidiary in the event of a default, and there has previously been no precedent on the enforcement of keepwell structures.

Talking Heads

On Shrugging Off EM Rout on Bet for Soft US Landing

Pierre-Yves Bareau, JPMorgan

“EM bonds can deliver — reasonably easily — a double-digit return this year. 400bp is an attractive spread for investors, but it’s not a crisis spread.”

Philip Fielding, co-head of emerging markets at Mackay Shields

“I wouldn’t overinterpret the recent price action. EM have coped with this higher interest rate environment”

Liam Spillane, Aviva Investors Global

The retreat “provides us with some opportunities in some of those high yielding, more idiosyncratic names”

Jennifer Taylor, State Street

“It is important to draw a distinction as to why the Fed is cutting rates”

On Early Easing to Push Inflation Out of Control – RBI Governor Michael Patra

“If high food inflation persists, however, a more cautious monetary policy approach is warranted… conventional treatment of food price perturbations as transitory in the setting of monetary policy is increasingly becoming untenable”

On betting that there is juice in BOJ rate-hike trades

Mark Dowding, BlueBay

“The Japan trade has cost us in the past few weeks… we are under no compulsion to close… data and the news flow supports our thesis… want to be patient with the position”

Ales Koutny, Vanguard’s

“Some people took Uchida’s comments to mean the BOJ won’t ever hike rates again, but I took them as a reassurance to the market”

Top Gainers & Losers-20-August-24*

Go back to Latest bond Market News

Related Posts: