This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

August 2024: Yet Another Strong Month as 93% of Dollar Bonds Trade Higher

September 2, 2024

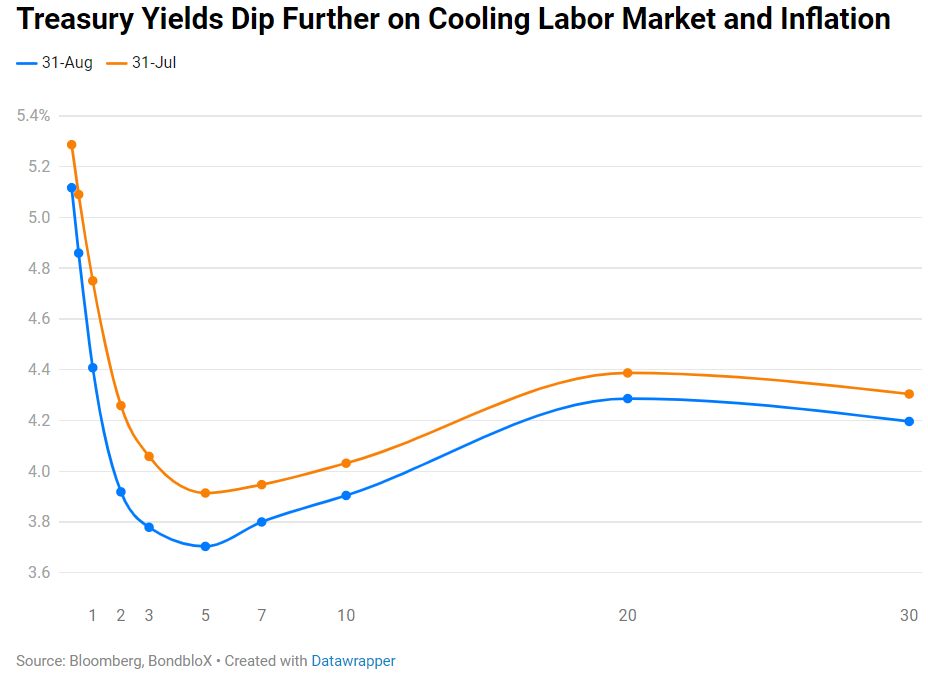

August 2024 was yet another strong month for bond investors with 93% of dollar bonds ending higher (price returns ex-coupons), adding to July’s performance where 91% of dollar bonds ended higher. Both, Investment Grade (IG) bonds and High Yield (HY) dollar bonds witnessed solid performances as jobs and inflation cooled down while the broad economy held steady, alongside expectations of 100bp in rate cuts by the Fed. The Treasury curve shifted further lower through the month. 95% of IG bonds and 85% of HY bonds closed in the green during the month.

During the month, the US Treasury yield curve bull steepened with the 2Y falling by 41bp while the 10Y yield ended 19bp lower, at 3.92% and 3.90% respectively. The first half of the month was dominated by weakness in high frequency economic data, starting with a soft ISM Manufacturing print, declining for a fourth consecutive month to 46.8 in July (vs. expectations of 48.8). At the time, markets fully priced-in three rate cuts of 25bp each by the Fed this year. Later in the month, NFP for July came in at just 114k, significantly below expectations of 175k and the Unemployment Rate rose to 4.3% from 4.1%. The hourly wage rate cooled-off to 3.6% YoY as compared to expectations of a 3.7% print. This saw Treasury yields pullback by over 20bp across the curve. A week later, markets solidified their pricing-in of a 25bp rate cut in September after US CPI and Core CPI rose by 2.9% YoY and 3.2%, both of which eased by 0.1% from the prior month's reading. At that point, markets even priced-in the possibility of 125bp in rate cuts by the Fed this year (50bp more than its initial pricing at the start of the month).

However, such concerns eased after the release of hard economic data as Retail Sales rose by 1.0% MoM (vs. expectations of a 0.4% rise / prior month's -0.2%). Similarly, Durable Goods Orders recovered, rising by 9.9% MoM (vs. expectations of 5.0). US Treasury yields stabilized and moved higher, with markets now pricing-in 100bp in Fed rate cuts by end-2024.

Investment Grade (IG) dollar bonds rallied across the spectrum thanks to the drop in Treasury yields. The biggest gains were seen in Chinese data center provider GDS Holdings after it reported strong earnings amid a recovery in China and its international business. Other gainers included ultra-long dated bonds from issuers such as HSBC, Apple, Alphabet, FedEx, Abu Dhabi and Indonesia amongst others. The biggest losers were Intel's bonds that fell ~5% following its softer than expected earnings, adding that it would cut $10bn in costs by reducing the headcount by 15% and suspend its dividends costing $2.2bn a year.

Among HY issuers, the largest gains were seen in Lumen's bonds, that rallied by over 25% on the back of a new connectivity contract , piggybacking on its Microsoft partnership and a rating upgrade to Caa1. Similarly, Commscope's bonds also rallied by ~20% after bagging in a $2.1bn contract for its wireless network unit. Other gainers included bonds of Canacol, Rio Negro, Domtar and Sotheby's, that gained over 9% during the month. The biggest drop among HY issuers was seen in Maldives' 9.875% 2026s that plummeted by over 22% after reports of negative forex reserves and continued political instability. Azul's 10.875% 2030s also plummeted by 17% after reports about them planning to file for Chapter 11 bankruptcy protection (dismissed later by the CEO), following a $706mn net loss in Q2 whilst also raising its net debt forecast.

Issuance Volumes

Global corporate dollar bond issuances stood at $203bn in August, 22% lower than July. As compared to August 2023, issuance volumes were up 39%. 88% of the issuance volumes came from IG issuers with HY comprising 10% and unrated issuers taking the remaining 2%.

Asia ex-Japan & Middle East G3 issuance stood at $12.2bn, down 66% MoM, while being up 57% YoY. Monthly issuance volumes from the region were at its lowest since December 2023 (as seen in the chart below).

Largest Deals

The largest deals globally were led by Kroger and Meta, both of which raised $10.5bn via five-tranche deals each. This was followed by Eli Lilly’s $5bn five-part deal and Citibank NA’s $4bn three-part deal. In the HY space, some of the largest issuances included the likes of Royal Caribbean and JetBlue’s $2bn deals each, followed by Prime Healthcare and Lightning Power’s $1.5bn deals.

In the APAC and Middle East, NAB’s €1.25bn deal led the table, followed by Nanyang Commercial Bank’s $700mn deal and Bocom Leasing’s $650mn dual-trancher amongst others.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

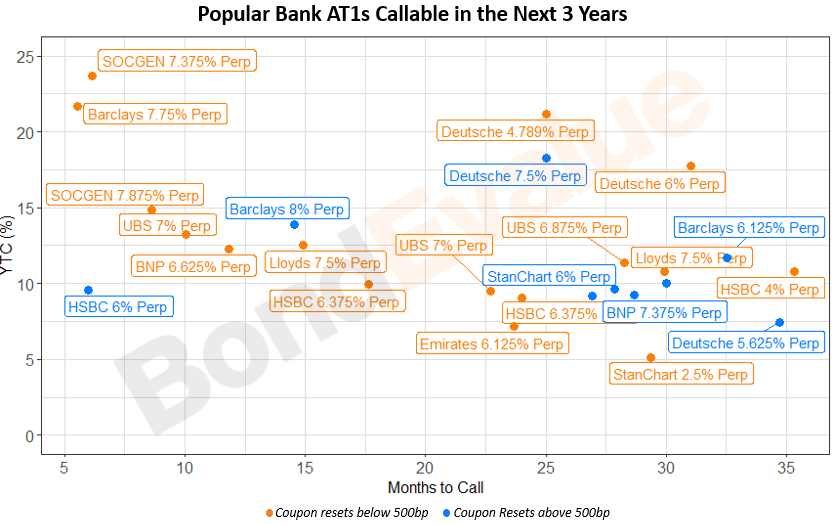

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023