This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

July 2024: 91% of Dollar Bonds Rally On Softer Data and Potential Three Fed Rate Cuts

August 1, 2024

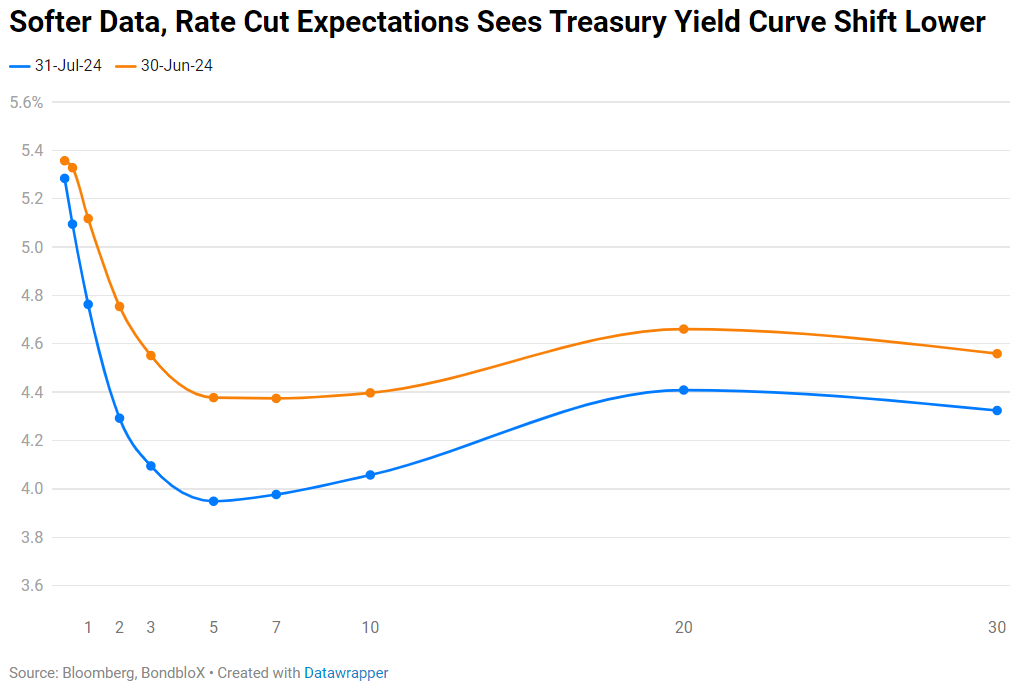

July 2024 was a strong month for bond investors with 91% of dollar bonds ending higher (price returns ex-coupons). Both, Investment Grade (IG) bonds and High Yield dollar bonds witnessed solid performances as softening data and expectations of more rate cuts saw the Treasury curve shift lower. 93% of IG bonds and 86% of HY bonds closed in the green during the month.

During the month, the US Treasury yield curve shifted lower with the 2Y and 10Y yields ending lower by 46bp and 34bp lower during the month, to 4.29% and 4.05% respectively. The US economy showed signs of moderation with some pockets of weakness as evidenced by data. US CPI YoY for June rose 3.0%, softer than expectations of 3.1% and the prior 3.3% print. Core CPI YoY rose 3.3%, again softer than expectations and the prior 3.4% print. Moreover, ISM Manufacturing in June contracted further to 48.5 and the ISM Services also contracted unexpectedly to 48.8, only its second sub-50 print since June 2023. While NFP in June rose by 206k, May's print was revised lower to 218k from 272k. Wage growth eased to 3.9% from 4.1% and the unemployment rate rose to 4.1% from 4.0%. Before the month began, markets had already priced-in a 25bp Fed rate cut each in September and December. As data came out, they are now looking at a possible third rate cut in November too.

Investment Grade (IG) dollar bonds across the spectrum moved higher thanks to the drop in Treasury yields. The biggest gains were seen in Nan Fung's and Hysan's perps. Bloomberg notes that a majority of Nan Fung's revenue comes from stable recurrent income such as rental and dividend income from investments. Most of the losers were seen in longer dated, very high duration notes.

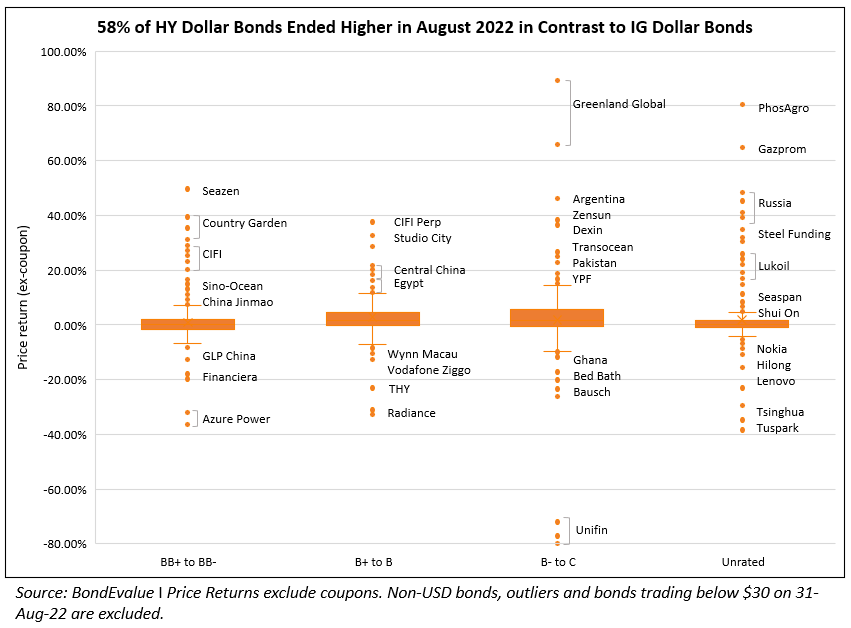

Under the HY segment, Chinese developers Longfor and Seazen continued to tick higher by ~5%, helped by the ongoing stimulus to support the property sector. In the B- to C bucket, Carvana's bonds were among the top gainers, after it forecasted an unexpected bump in current-quarter retail sales and core profits. Rakuten's perps were up over 5% despite the reorganization delay in its fintech operations. Among the losers, Sri Lanka's dollar bonds fell ~5% after creditors had to take a 28% nominal haircut as part of the $12bn restructuring agreement agreed upon.

Issuance Volumes

Global corporate dollar bond issuances stood at $260bn in July, ~25% higher than June. As compared to July 2023, issuance volumes were up 85%. 87% of the issuance volumes came from IG issuers with HY comprising 10% and unrated issuers taking the remaining 2%.

Asia ex-Japan & Middle East G3 issuance stood at $31bn, up 31% MoM and a massive 2.3x YoY. 76% of the volumes came from IG issuers with HY issuing 17% of it and unrated issuers taking the rest.

Largest Deals

The largest deals globally were led by big banks after their earnings reports. JPMorgan’s $9bn and Morgan Stanley’s $8bn four-part deals each, were followed by Goldman Sachs’ $5.5bn two-trancher topping the tables. Others also included by UnitedHealth's $12bn jumbo multi-trancher and Broadcom's $5bn three-trancher.

In the APAC and Middle Easy, Saudi Aramco's $6bn three-trancher led the tables, followed by Greensaif's $3bn issuance and ANZ’s $2bn deal in two-tranches.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

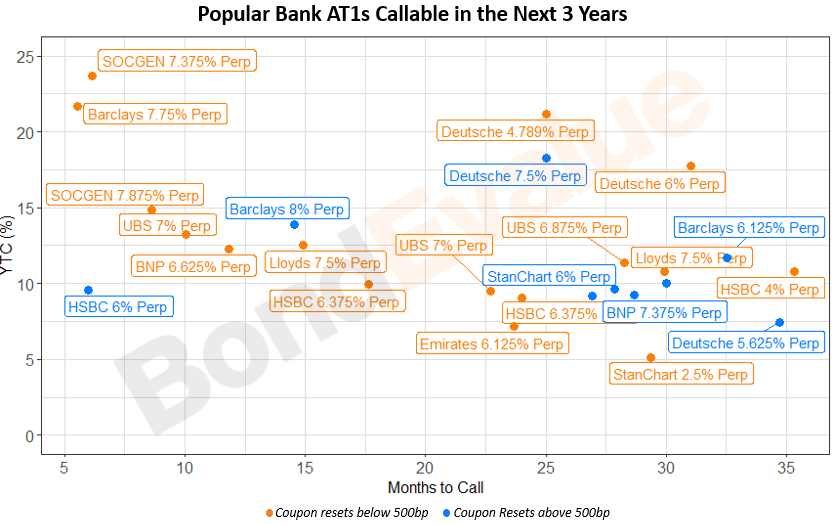

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023