This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

August 2023: 64% of Dollar Bonds Trade Weaker as Soft Landing Theme Continues

September 4, 2023

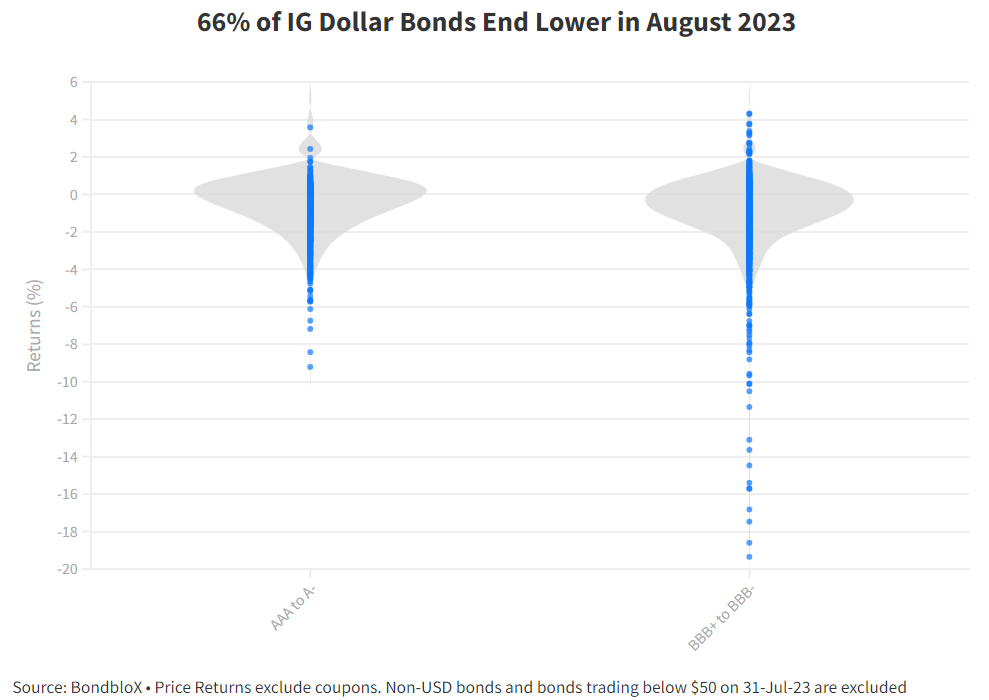

The month of August was a poor one for bond markets with dollar bonds ending lower across the board. There was not much to separate the performance of investment grade and high yield bonds. In August, 66% of IG bonds ended in the red compared to 65% of HY bonds that ended the month lower. This compares to July where 65% of HY bonds ended in the green as compared to 42% of IG bonds that ended with a positive price return.

The month of August saw sentiment shift towards another possible rate hike by the Fed as the case for a ‘soft landing’ continued to stay with inflation being the key factor. Economic data saw a slowdown with Q2 GDP being revised lower to 2.1% from 2.4% while the jobs market showed initial signs of a cooling-off. US Non-Farm Payrolls came at 187k for July, lower than the surveyed 200k. Average Hourly Earnings YoY was at 4.4%, higher than the surveyed 4.2%. Treasury yields dropped following the jobs report. However, US Headline CPI for July came at 3.2%, higher than the previous month’s 3% and lower than expectations of 3.3%. Core CPI was at 4.7%, in-line with expectations of 4.7% and lower than the previous month’s 4.8%. Besides, a weak US Treasury auction saw Treasuries sell-off, before recovering post the recent jobs report. Further data including PPI continued to weigh on Treasuries and yields moved higher approaching the Jackson Hole meeting. At Jackson Hole, Fed Chairman Jerome Powell said that they were "prepared to raise rates further" and that they would "proceed carefully as we decide whether to tighten further". He also mentioned that rates were high enough to be "restrictive". Yields further jumped higher led by the short-end. However, the continued slowdown in manufacturing activity and job openings saw yields reverse the move to end lower. Overall, through the month, longer term yields moved higher (as seen in the chart above).

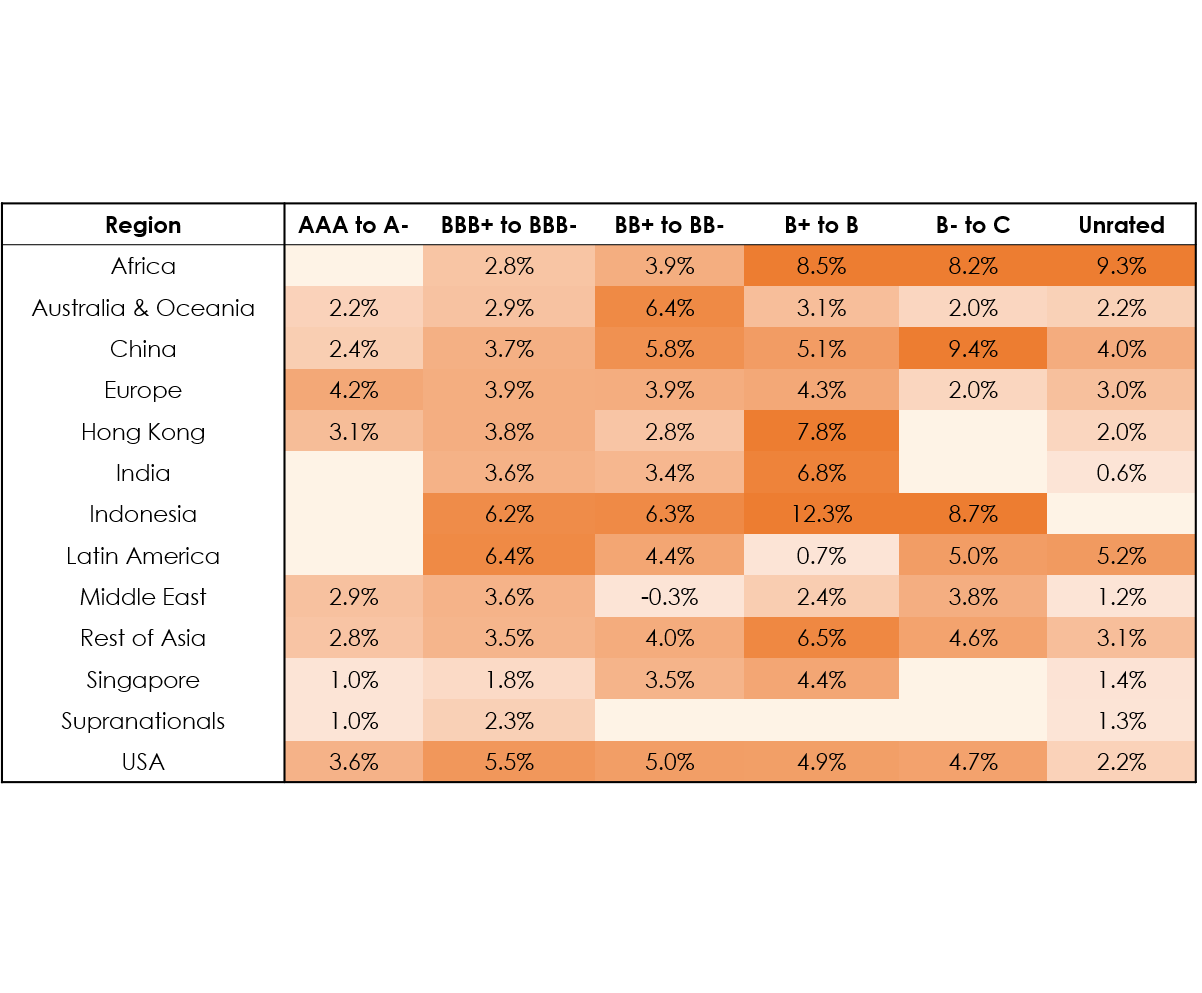

Longer-dated bonds from issuers such as Altria, Meta, Brandywine and some other companies led the IG gainers list. Among the losers, Chinese IG developers Longfor and Vanke dropped the most, by over 15% as the property sector stress worsened by Country Garden's liquidity situation weighed on them. Insurers including China Great Wall, Huarong and Ping An also filled the losers list. With continued losses for Huarong and China Great Wall close to breaching its bond covenants related to a delay in publishing 2022 results, the insurance sector also remained under pressure.

The gainers in the HY space included names like BIM Land after the IFC was said to be planning to invest up to $150mn in the sustainability-linked bonds (SLBs) of the company. US Steel's bonds were higher as it reviews multiple buyout offers, following a $7.3bn acquisition bid from rival Cleveland-Cliffs that US Steel earlier rejected. Also, El Salvador's dollar bonds jumped higher by ~15% after Google Cloud announced plans to establish an office in the country leading to news about foreign inflows leading to potential future foreign direct investment (FDI). Among the losers, AMTD's 7.25% Perp saw a massive drop by over 90%. Dollar bonds of several Hong Kong companies also dropped with New World Development (NWD) being impacted majorly. NWD's bonds fell as much as 30% after rumors that they “had pledged its projects” to obtain financing. Chinese developers like Seazen, China South City, Central Plaza etc. saw their dollar bonds drop lower owing to the broad collapse in the property sector.

Issuance Volumes

Global corporate dollar bond issuances stood at $145.8bn in August, 4% lower than July. As compared to August 2022, issuance volumes were down 15% YoY. 86% of the issuance volumes came from IG issuers with HY and unrated issuers taking the remainder.

Asia ex-Japan & Middle East G3 issuance stood at $6.9bn, down, 62% MoM but up 4x YoY. 93% of the volumes came from IG issuers with HY and unrated issuers taking the rest.

Largest Deals

The largest deals globally were led by Columbia Pipelines’ $5.6bn seven-trancher and ONEOK’s $5.25bn five-trancher, followed by US big banks BofA and Wells Fargo raising $5bn via four-tranchers each. Other large deals included HSBC’s $3bn two-tranche TLAC deal, BMW’s $3bn four-part deal and Santander’s $3.5bn two-trancher.

In the APAC and Middle East region, deal volumes were led by China Life Insurance’s $2bn deal, followed by ANZ NZ’s $1bn issuance and Huatai Securities’ $800mn deal. GCC issuances during the month were non-existent, seeing a lack of dollar deals for six straight weeks.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Bond Investors Up $75.4 Billion in 1Q19

April 10, 2019