This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

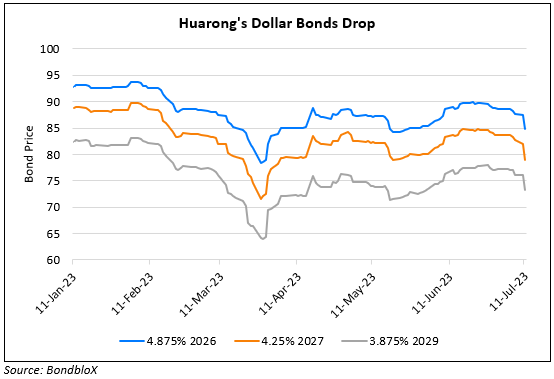

Huarong’s Dollar Bonds Tick Lower; China Great Wall Could See Covenant Breach on Results Delay

August 30, 2023

China Huarong’s dollar bonds inched lower across the curve by 1.0-1.5 points. The company reported net losses for 1H 2023 of RMB 4.92bn ($670mn), an improvement vs. last year’s loss of RMB 18.87bn ($2.6bn). Total income stood at RMB 35.65bn ($4.9bn) vs. RMB 14.74bn ($2.02bn) a year ago. Huarong said that it will take “active measures to improve its cash flow” with an effort to use resources to recover cashflows from existing projects and investments in the upcoming year.

Meanwhile, Huarong’s peer China Great Wall Asset Management’s saw its dollar bonds drop sharply by up to 4 points after reports of a possible covenant breach related to its delay in publishing 2022 results. BNP Paribas said in a note that the covenants on Great Wall’s dollar bonds due 2027 state that the company must publish audited financials within 180 days of a year’s conclusion, with a 60-day grace period. If the company fails to publish the results within the deadline, it could trigger a covenant breach. BNP notes that China Great Wall has not shown any unwillingness to repay its dollar bonds and that the covenants cite that an event of default would require 25% of bondholders to request the trustee to repay immediately.

Go back to Latest bond Market News

Related Posts: