This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

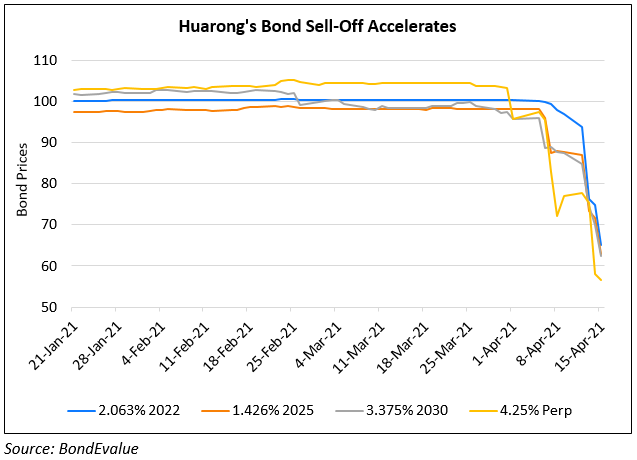

Huarong’s Bonds Slip After Delay in Earnings Release, Share Trading Halt

April 5, 2021

China Huarong Asset Management saw its dollar bonds fall this morning after a trading halt on its shares on Thursday trading over delays in publishing annual results before March 31. Interim President of the company, Wang Wenjie said auditors needed more time to review the 2020 results as certain relevant transactions were still to be determined. He also said the non-disclosure of unaudited statements was due to the fact that it may not accurately reflect the company’s financial performance and may cause confusion and mislead investors. The bad debt asset manager is expected to report CNY 4.9bn ($746mn) in profits for 2020 vs. CNY 2.3bn ($350mn) in 2019, according to analyst estimates compiled by Bloomberg. The asset manager was one among over 50 Hong Kong listed companies whose shares were halted due to delays in publishing earnings. “Many investors could be worried about their earnings and quality of reports… If they report quickly and the audit report doesn’t have a negative opinion on those companies, it should be fine” Mr. So of CMB International said.

China Huarong’s USD 4% Perp fell 2% from Wednesday’s close to 99.4, before recovering to 101.2. A sharp fall was seen in its USD 4.95% 2047s, down over 8 cents since Thursday to 97.63, yielding 5.3%

For the full story, click here

Go back to Latest bond Market News

Related Posts: