This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

APAC & Middle East Dollar Bond Issuances Rise; 5 New Deals Launched Including Macquarie

June 26, 2024

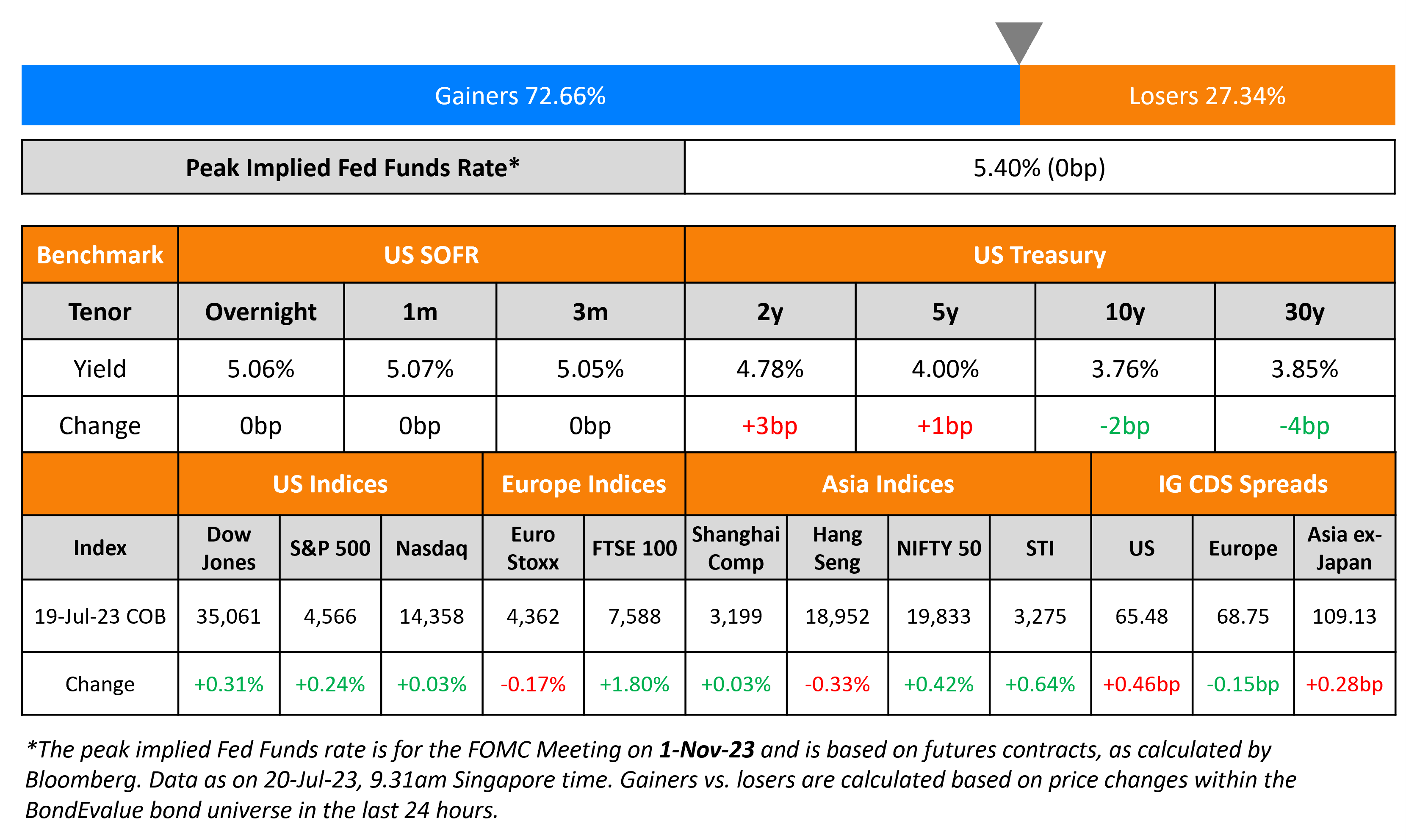

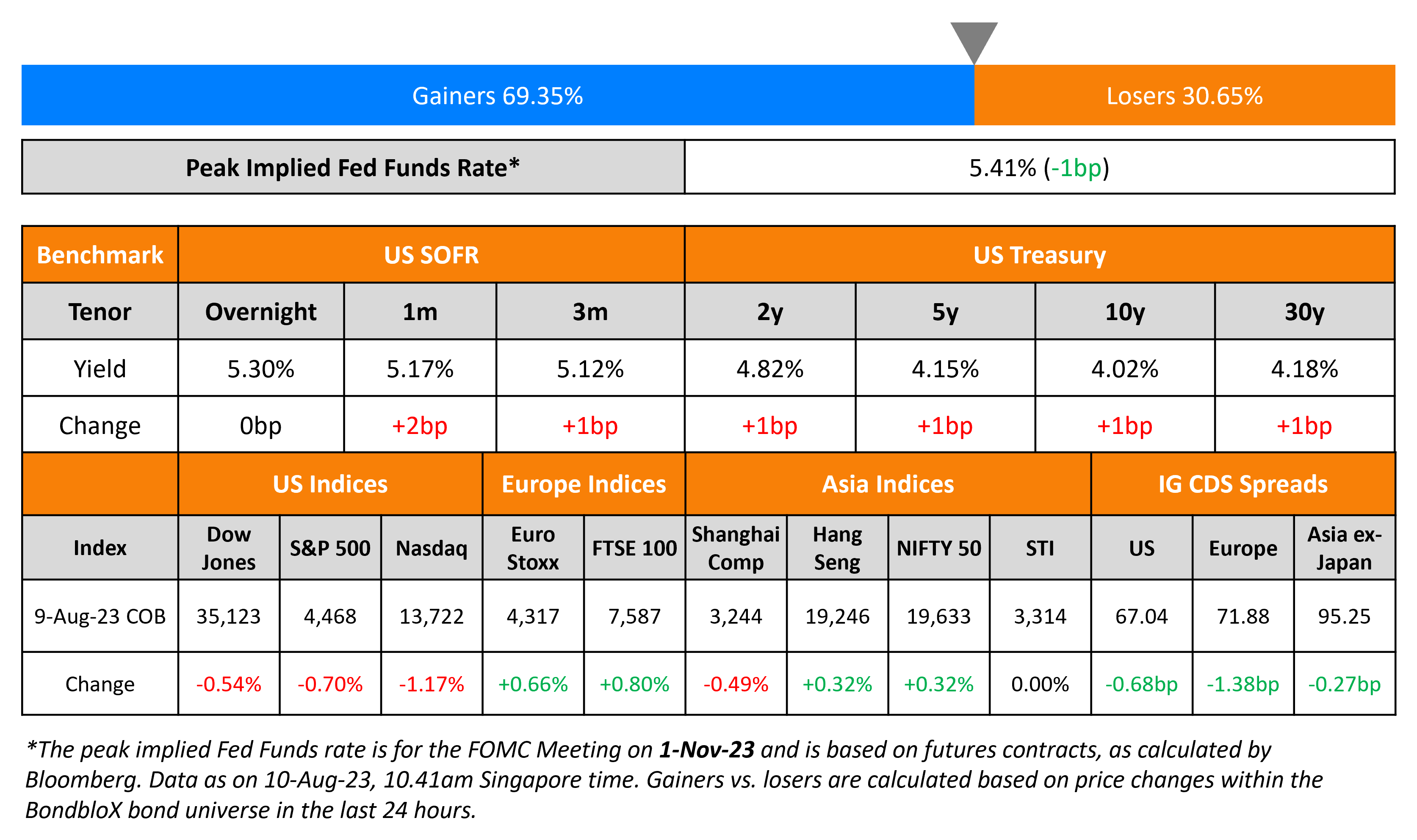

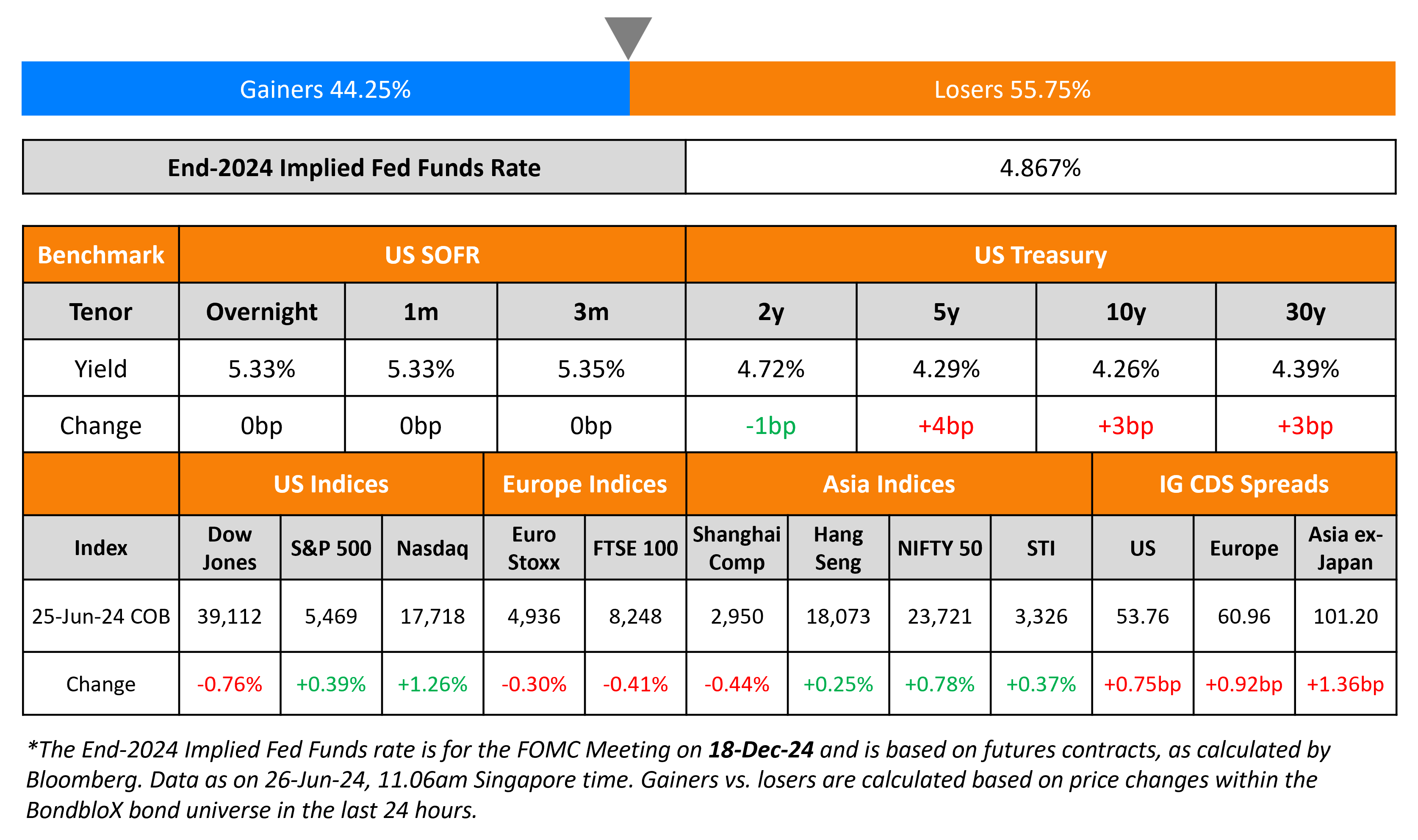

Treasury yields were marginally higher across the curve. The US Conference Board Consumer Sentiment Index dipped to 100.4 in June vs. 101.3 in May, albeit slightly higher than the surveyed 100.0. Fed Governor Michelle Bowman said that the Fed is “not yet at the point where it is appropriate to lower the policy rate”. She added that she does not expect any rate cuts this year. Separately, another Fed Governor Lisa Cook said that it would be appropriate to cut rates at some point, while the timing would be data dependent. Looking at equity markets, S&P and Nasdaq were up 0.4% and 1.3%, respectively. US IG spreads were 0.8bp wider while HY CDS spreads widened by 0.7bp.

European equity indices ended lower across the board. In credit markets, the iTraxx Main and Crossover spreads were wider by 0.9bp and 2.6bp respectively. Asian equity indices have opened broadly lower this morning. Asia ex-Japan CDS spreads were 1.4bp wider.

.png)

New Bond Issues

- Cathay Life $ 10Y T2 at T+205bp area

- Korea $ 5Y at T+25bp area

- China Huaneng $ PerpNC3 at 5.85% area

- Macquarie Bank $ 3Y at T+95bp area

- Mitsubishi Corp. $ 5Y at T+100bp area

Indonesia raised $2.35bn via a three-part offering. It raised:

- $750mn via a 5Y bond at a yield of 5.1%, 30bp inside initial guidance of 5.4% area. The new bonds are priced almost inline with its existing 3.4% bonds due September 2029, that yield 5.08%.

- $1bn via a 10Y green bond at a yield of 5.2%, 30bp inside initial guidance of 5.5% area. The new bonds are priced at a new issue premium of 10bp over its existing 4.7% bonds due February 2034, that yield 5.10%.

- $600mn via a 30Y green sukuk at a yield of 5.5%, 30bp inside initial guidance of 5.8% area. The new bonds are priced at a new issue premium of 8bp over its existing 5.1% bonds due February 2054, that yield 5.42%.

The bonds are rated Baa2/BBB/BBB. Proceeds will be used for general financing requirements. Proceeds for the 30Y green sukuk will be used to finance or re-finance eligible expenditures in the government’s SDG framework.

China Great Wall raised $500mn via a two-trancher. It raised $200mn via a 3.5Y bond at a yield of 6.418%, 45bp inside initial guidance of T+240bp area. It also raised $300mn via a PerpNC3 bond at a yield of 7.15%, 55bp inside initial guidance of 7.7% area. The 3.5Y notes are senior guaranteed bonds, guaranteed by China Great Wall AMC International Holdings. The unsubordinated guaranteed perps are rated BB+ (Fitch). The perps have a dividend stopper, and addition coupon step-up of 500bps upon the occurrence of a change of control trigger, breach of covenant event, relevant indebtedness default event or dividend stopper breach event. Proceeds from both notes will be used to replace foreign debt due in July 2024.

UAE raised $1.5bn via a 10Y bond at a yield of 4.857%, 30bp inside initial guidance of T+90bp area. The bonds are rated Aa2/AA- (Moody’s/Fitch), and received orders of over $5.75bn, 3.8x issue size. Proceeds will be used in accordance with the Public Debt Strategy of the issuer. The new bonds were priced bp over its existing 4.917% bonds due September 2033, that currently yield 4.76%.

Vale raised $1bn via a 30Y bond at a yield of 6.458%, 40bp inside initial guidance of T+250bp area. The senior unsecured bonds are unrated. Proceeds will be used to fund (a) a concurrent tender offer (b)redemption of its 2026s (c) the remainder for general corporate purposes. The issuer is Vale Overseas Limited and the guarantor is Vale S.A.

Vodafone raised $3bn via a two-tranche deal. It raised $2bn via a 30Y bond at a yield of 5.79%, 22bp inside initial guidance of T+165bp area. It also raised $1bn via a 40Y bond at a yield of 5.93%, ~20.5bp inside initial guidance of T+175/180bp area. The senior unsecured bonds are rated Baa2/BBB/BBB (Moody’s/S&P/Fitch). Both notes have a change of control put at 101. Proceeds will be used for general corporate purposes including, funding buybacks of existing Vodafone Group USD and EUR bonds, pursuant to its tender offers.

Commerzbank raised €750mn via a PerpNC7.75 AT1 bond at a yield of 7.884%, 49.1bp inside initial guidance of 8.375% area. The subordinated notes are rated Ba2/BB-, and received orders of over €6.7bn, 8.9x issue size. If not redeemed by 9 April 2032 coupon resets every 5Y at 5Y MS+512.9bp. A trigger event would occur if at any time, the CET1 ratio on either a consolidated basis or an individual basis (if applicable in the future), falls below 5.125%. The new bonds offer a yield pick-up of over 122bp over Intesa’s 5.875% Perp (callable in September 2031), rated Ba3/BB-, that yield 6.66% to call.

Sumitomo Corp raised $1bn via a two-trancher. It raised $500mn via a 5Y bond at a yield of 5.083%, 25bp inside initial guidance of T+105bp area. It also raised $500mn via a 10Y bond at a yield of 5.353%, 15bp inside initial guidance of T+125bp area. The senior unsecured notes are rated Baa1/A-. Proceeds will be used for general corporate purposes, including refinancing of existing debt.

New Bonds Pipeline

- Bangkok Bank hires for $ 10Y bond

- NongHyup Bank hires for $ 3Y/5Y bond

- Sharjah Islamic Bank hires for $ 5Y bond

- Ho Bee Land hires for S$ 5Y Green bond

Rating Changes

- Medco Energi Upgraded To ‘BB-‘ On Increased Financial Flexibility From Amman Stake; Outlook Stable

- Carnival Corp. Upgraded To ‘BB’ On Favorable Bookings And Pricing, Expected Deleveraging; Outlook Stable

- AerCap Holdings N.V. Upgraded To ‘BBB+’ On Strong Aircraft Leasing Market; Outlook Stable

- Fitch Downgrades Domtar Corporation to ‘BB-‘; Outlook Stable

- Adani Ports Outlook Revised To Positive On Improving Scale and Diversification; ‘BBB-‘ Ratings Affirmed

Term of the Day

New Issue Premium

A new issue premium refers to the incremental higher yield (yield premium) on an issuer’s newly issued bond over bonds by the same issuer with a similar maturity. A newly issued bond by an issuer typically offers a higher yield to its own comparable bond to entice investor demand in the security. Sometimes, if an issuer does not have a comparable bond with a similar maturity, but does have a yield curve (i.e., other bonds issued across different maturities), analysts can interpolate and arrive at an estimated yield for a hypothetical comparable. However, while new issue premiums are typically the case, it is not necessary that an issuer’s new bond would always have a new issue premium.

Talking Heads

On Treasury Liquidity Better Than Traders Feared – JPMorgan

“Broad measures of liquidity have been on an improving trend through 2024, supported by declining delivered volatility”

On French Bondholders Fearing Replay of Euro Crisis – Allianz

“Any reminder of the European sovereign debt crisis is a red flag for many international investors… We need some action from the French government, some stabilization, so these large investors are reassured”

On Treasury Basis Trade In Vogue, Unless Volatility Erupts

John Velis, strategist at BNY Mellon

“Should repo markets begin to get stressed, an ugly unwind and hasty and significant short covering could pose a vulnerability for the bond market”

Top Gainers & Losers- 26-June-24*

Go back to Latest bond Market News

Related Posts: