This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ANZ, ArcelorMittal Price Bonds

December 10, 2024

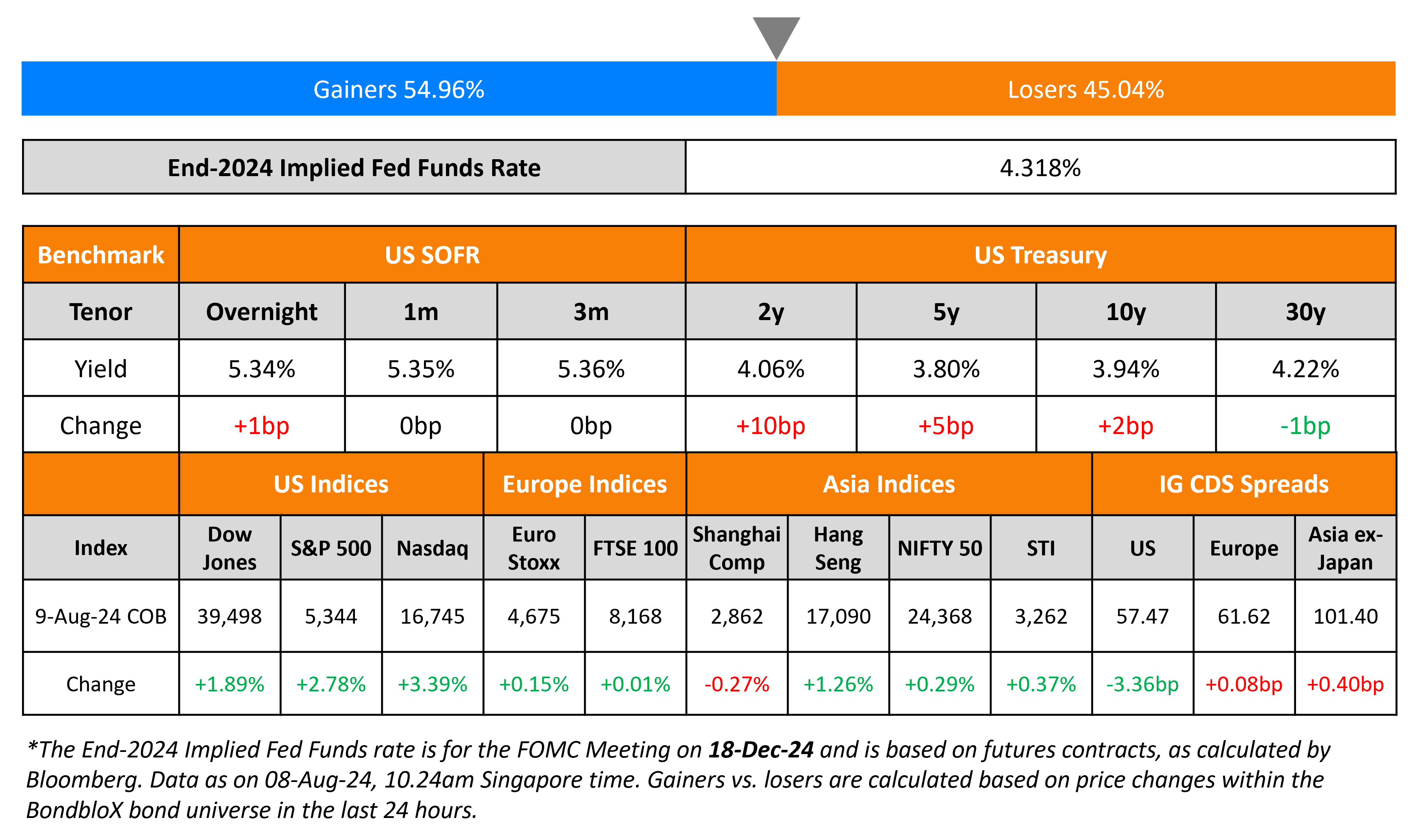

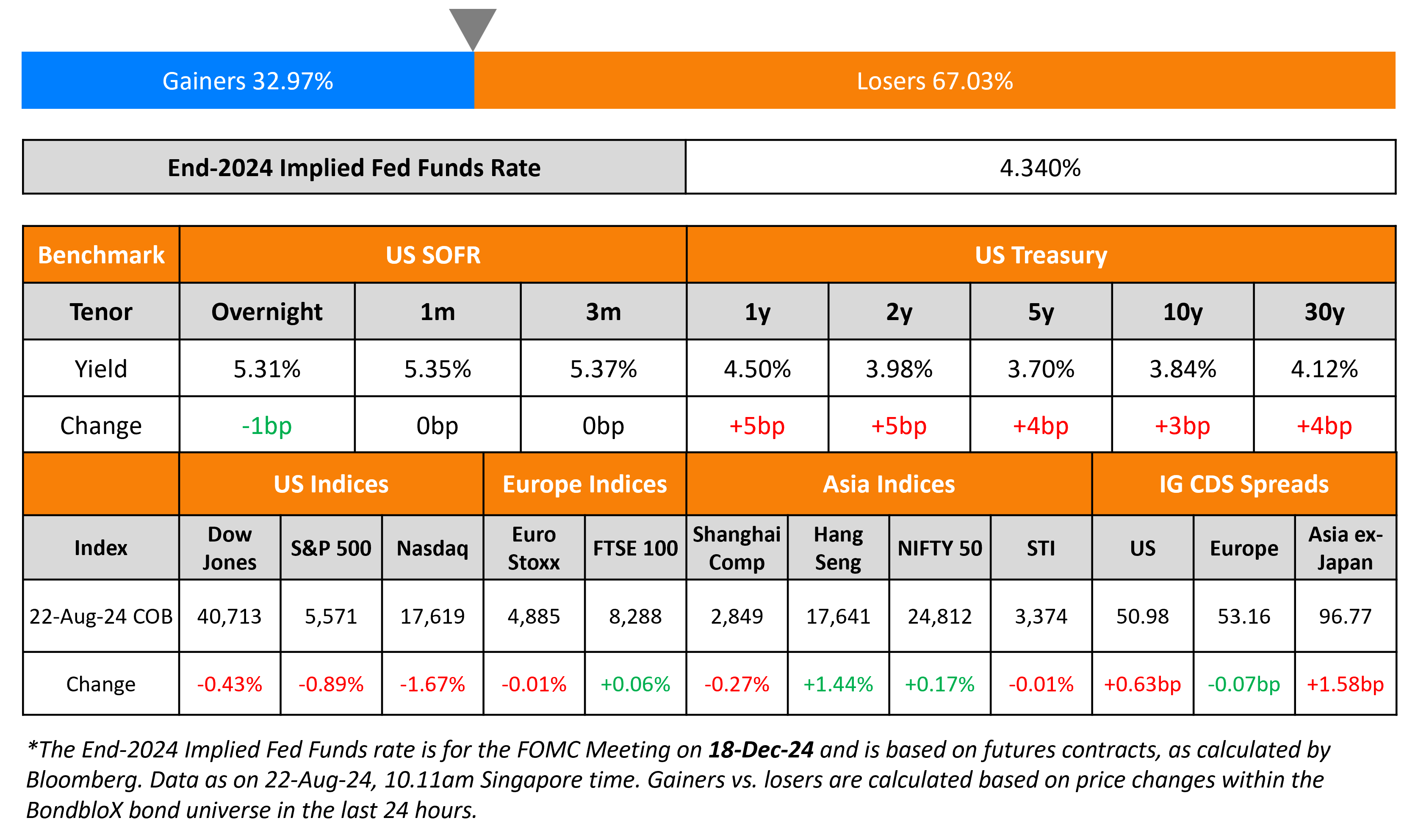

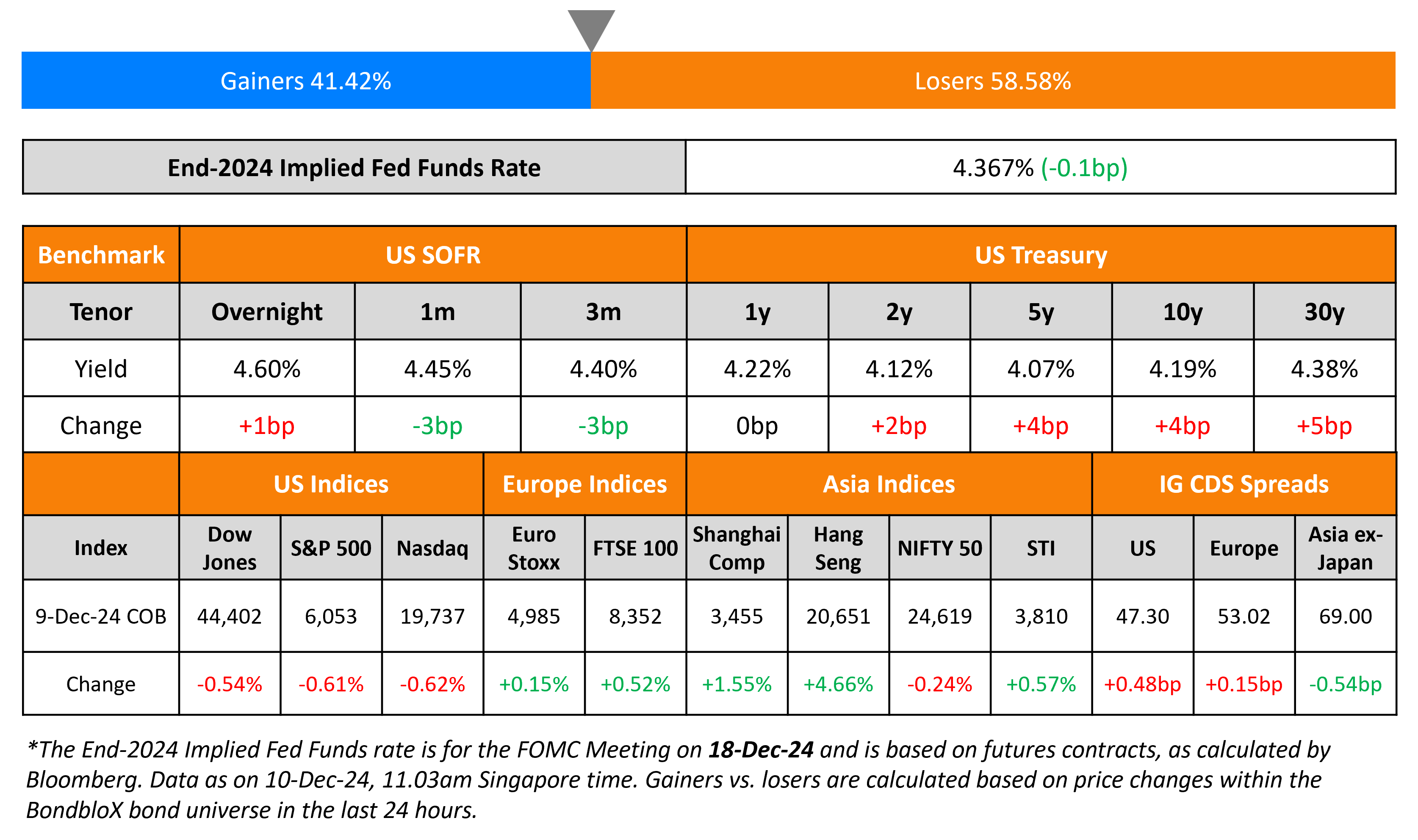

US Treasury yields recovered the drop seen after the jobs report, rising by ~4bp on Monday. Markets continue to price-in an 85% probability of a 25bp rate cut by the Fed next week. The US inflation report is due to come out tomorrow with analysts noting that it could impact the path of rates beginning with the January FOMC meeting.

US IG and HY CDS spreads widened by 0.5bp and 1bp respectively. Looking at US equity markets, the S&P and Nasdaq closed 0.6% lower. European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.2bp and 1.4bp respectively. Asian equities have opened higher this morning. Chinese stocks opened higher by over 2% after the Politburo’s pledge to embrace a “moderately loose” stance for monetary policy in 2025. This is said to be their first major shift in stance since 2011. Asia ex-Japan CDS spreads were 0.5bp tighter.

New Bond Issues

ANZ raised $2.75bn via a four-trancher.

The senior secured notes are rated Aa2/AA-/AA-. The issuer may redeem notes in whole but not in part for certain tax reasons. Proceeds will be used for general corporate purposes.

Pampa Energia raised $360mn via a 10NC5 bond at a yield of 7.875%, inside initial guidance of low-8% area. The senior unsecured notes are rated B. Proceeds will be used to repay and/or refinance debt (including call redemption of 2027s), working capital and other uses permitted under Argentinian law.

ArcelorMittal raised €1bn via a two-trancher. It raised €500mn via a 4Y bond at a yield of 3.256%, 40bp inside initial guidance of MS+160bp area. It also raised €500mn via a 7Y bond at a yield of 3.63%, 40bp inside initial guidance of MS+195bp area. The senior unsecured notes are rated Baa3/BBB-. Proceeds will be used for general corporate purposes including refinancing debt.

Rating Changes

-

Moody’s Ratings upgrades TotalEnergies SE’s rating to Aa3 from A1; stable outlook

-

Eversource Energy Issuer Credit Rating Lowered To ‘BBB+’ From ‘A-‘; Subsidiaries Ratings Also Lowered; Outlooks Stable

-

Fitch Places INEOS Enterprises on RWN Following Composites Sale

-

Moody’s Ratings changes outlook on Elior’s B3 ratings to positive from negative

New Bonds Pipeline

- Buenos Aires hires for $ bond

Term of the Day: Bond Vigilantes

Coined by Edward Yardeni, ‘Bond Vigilantes’ are bond market players who sell bonds in large quantities pushing up interest rates if they believe that the government isn’t protecting the currency. For example, if inflation rises, deficits grow, or a country’s creditworthiness is at risk, the bond vigilantes sell government bonds, which would lead to rising yields and therefore a higher borrowing cost for the government. Episodes of bond vigilantes selling bonds have been seen in the 1980s during the Clinton administration and also during the Obama administration as per Bloomberg.

Talking Heads

On ‘Vigilance Before Vigilantism’ on Rising US Deficit – Pimco

“Over time, and at scale, that’s the kind of investor behavior that can fulfill the bond vigilante role of disciplining governments by demanding more compensation”… On outlook for US Treasuries – “yield curve to steepen, fueled in part by deteriorating deficit dynamics.. implies a relative rise in yields for longer-term bonds”

On Time to Bet Against Rapid ECB Interest-Rate Cuts – Citi

“The ECB mid-year pause currently priced roughly coincides with when the greatest impact from Trump tariffs may be felt”… tariffs would inflict pain on an economy already struggling to gain traction.

On Traders Rushing to Join Fed Rate-Cut Bet – Morgan Stanley strategists

“We think investors should position for a higher market-implied probability of a 25bp rate cut at the January 29 FOMC meeting”

Top Gainers and Losers- 10-December-24*

Go back to Latest bond Market News

Related Posts: