This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

AIA, REC Launches $ Deal

September 23, 2024

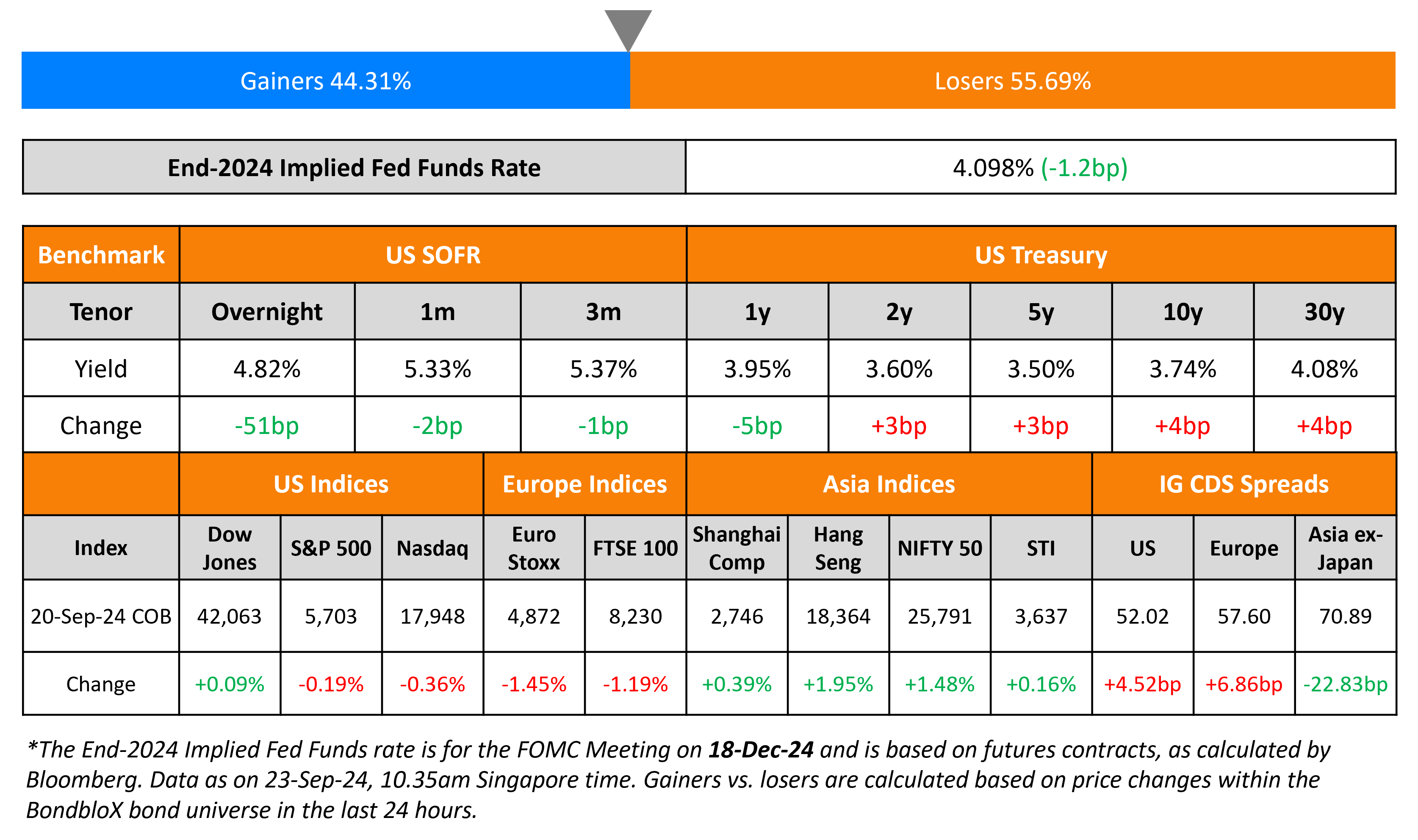

US Treasury yields inched up last Friday, by about 3-4bp across the curve. This week, the Fed would be looking forward to a host of economic data that will be released, to validate its 50bp rate cut last week. These include the August preliminary figures for the S&P Manufacturing and Services PMI, Q3 GDP growth number and Core PCE figures for Q2. In addition to this, investors will also be listening closely to remarks by Fed Governors and regional Fed Presidents who are set to speak at various events. According to Bank of America Corp’s strategist Michael Harnett, last week’s cut has increased the risk of a bubble in equities, making bonds and gold an attractive hedge in investors’ portfolios. US IG and HY CDS widened by 4.5bp and 8.9bp respectively. US equity markets ended lower with S&P and Nasdaq down by 0.2% and 0.4% respectively.

European equity markets also ended lower. Looking at Europe’s CDS spreads, the iTraxx Main widened by 6.9bp and Crossover widened by a remarkable 36.9bp. Asian equity indices have opened broadly higher today morning. Asia ex-Japan IG CDS spreads tightened by a notable 22.8bp.

New Bond Issues

- AIA $ 10.5Y/30Y at T+155/175bp area

- REC $ 5Y Green at T+160bp area

- Bank of China/Sydney $ 3Y FRN at SOFR+105bp area

- Hyundai Capital America $ 3Y/5Y/7Y at T+115/135/145bp area

New Bonds Pipeline

- Agrobank hires for $ bond

- QIIB hires for $ PerpNC5.5 bond

- Shriram Finance hires for $ 3.5Y/5Y bond

Rating Changes

- Fitch Upgrades Embraer’s IDRs to ‘BBB-‘

- Fitch Upgrades Investec Bank plc’s Long-Term IDR to ‘A-‘ on Resolution Debt Buffers

- Ethiopia Long-Term Local Currency Rating Raised To ‘CCC+’; Outlook Stable; Foreign Currency Rating Affirmed At ‘SD’

- Moody’s Ratings downgrades Azul’s ratings to Caa2; outlook changed to negative

- Fitch Places Adaro Indonesia ‘BBB-‘ IDR on Rating Watch Negative

- Outlook On Swedbank Revised To Positive As Governance Deficiencies Largely Addressed; ‘A+/A-1’ Ratings Affirmed

Term of the Day

Rising Star

Rising stars are companies that have recently seen credit rating upgrades that pull its rating to investment grade category from its previous junk or high yield category. They are termed as rising stars as their financial and/or operational metrics show an improving trend. The opposite of rising stars are fallen angels, which are issuers that have been recently downgraded to junk category from its previous investment grade rating category.

Talking Heads

On Valuation Concerns Stoked by Fed’s Big Cut

Simon Matthews, a senior portfolio manager at Neuberger Berman

“You have the US election coming up, and expectations around economic growth in Germany are some of the weakest it’s been since pre-Covid times. Consumers are feeling the pinch and growth in China is slowing. When you pull that all together, it’s not telling you that credit spreads should be close to the tights.”

On Fed Cut Putting Pressure on Money Market Investors

Hannes Hofmann, Head of family office group at Citi Private Bank

“As investors are now more convinced that the Fed will reduce rates in line with its guidance, investors will likely grasp for yields that will not dwindle overnight.”

Ross Mayfield, Investment strategist at Baird Wealth

“Investors may need to look at something different, or longer-term, to lock in rates and not be as exposed to the Fed lowering interest rates.”

On Fed Lowering Rates by 25bp in Nov, Dec

Jonathan Millar, senior U.S. economist at Barclays

“Unless the unemployment rate goes above 4.4%…they would be more inclined to step down to 25 basis point cuts. So, it does set a fairly high bar for them to do further aggressive cuts.”

Top Gainers & Losers 23-September-24*

Other News

Go back to Latest bond Market News

Related Posts: