This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Adani Hybrid, Korea Land Launch $ Bonds

October 15, 2024

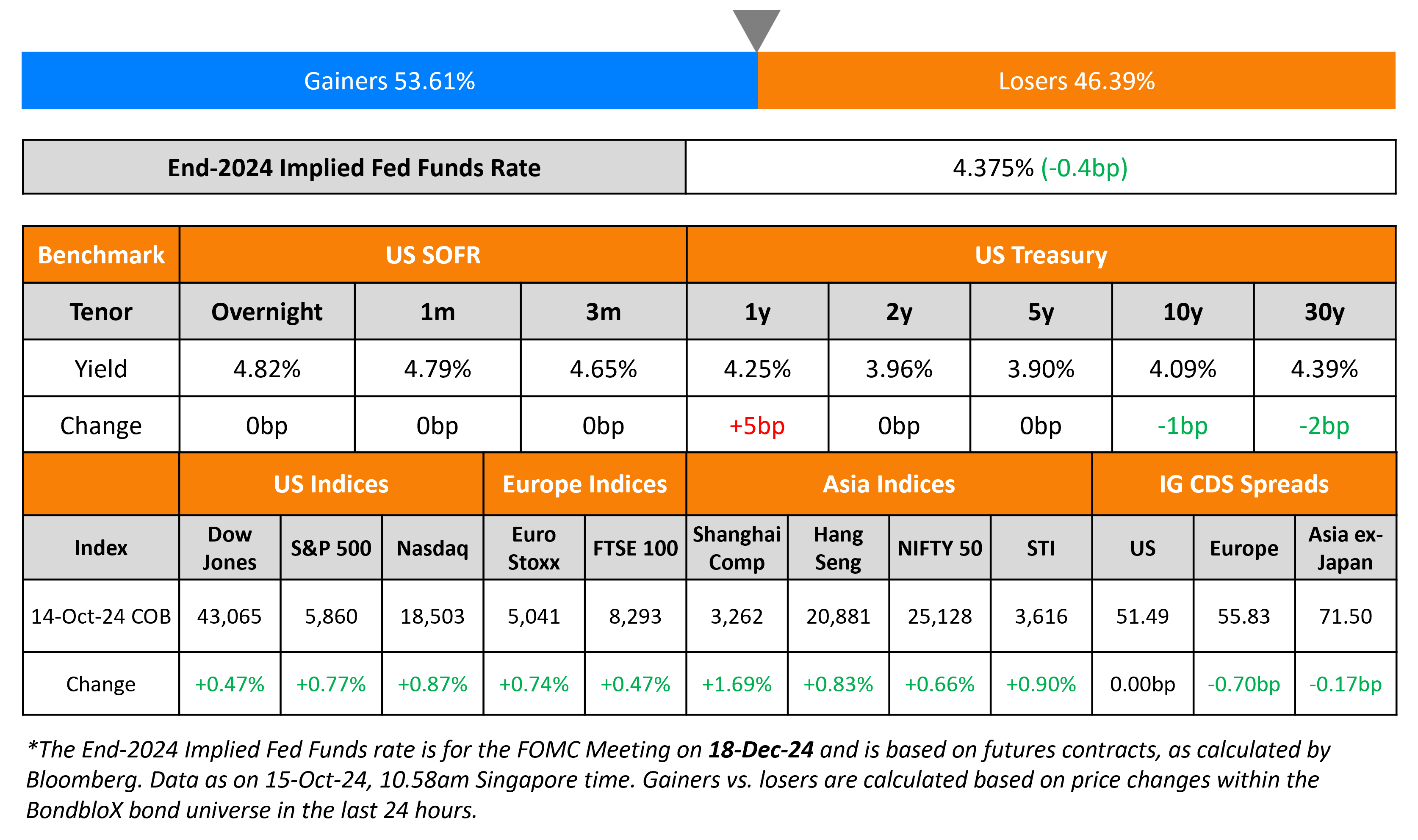

The US Treasury bond market was closed on Wednesday on account of the Columbus Day holiday. Minneapolis Fed President Neel Kashkari said that he believed “further modest reductions” in the Fed’s policy rate will be appropriate over the next few quarters. A similar view was also echoed by Fed Governor Christopher Waller. US credit markets were also closed. However, US equity markets were open with the S&P and Nasdaq both closing higher by 0.8% and 0.9% respectively.

European equities closed higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.7bp and 4bp respectively. Asian equities have opened broadly higher this morning. Asia ex-Japan IG CDS spreads were 0.2bp tighter.

New Bond Issues

- Adani Hybrid Renewables $ 20Y Green at 7% area

- Korea Land & Housing Corp $ 3Y at T+85bp area

- Power Construction Corp of China $ PerpNC5 at 5.05% area

IRB Infra raised $200mn via a tap of its 7.11% 2032s at a yield of %. The initial issuance occurred in March 2024, with the notes being callable in March 2027. As with the initial issuance, the notes are rated Ba2/BB+ (Moody’s/Fitch) and have a change of control put at 101. Proceeds will be used for capex and/or to repay existing debt raised for the purpose of capex.

New Bonds Pipeline

- China Huadian hires for $ PerpNC3 bond

-

Turkiye Wealth Fund hires for $ 5.25Y bond

- Muthoot hires for $ 4.5Y bond

Rating Changes

-

Moody’s Ratings upgrades Danaos’ CFR to Ba1 from Ba2; outlook stable

-

Moody’s Ratings downgrades West China Cement’s CFR to B2; outlook remains negative

-

Moody’s Ratings downgrades Europcar Mobility Group S.A.’s CFR to B3; outlook negative

-

Kilroy Realty Corp. Downgraded To ‘BBB-‘ From ‘BBB’ On Modestly Weaker Credit Metrics, Secular Headwinds; Outlook Stable

-

Moody’s Ratings affirms Schaeffler’s Baa3 long-term issuer rating; changes outlook to negative from stable

-

Moody’s Ratings changes Morrisons’ ratings outlook to stable from negative on improving operating performance, upgrades its secured debt to B1 from B2 reflecting additional debt reduction; affirms B2 CFR

Talking Heads

On S&P Seeing More Sovereign Foreign Debt Defaults Over Next Decade

Predicts increase in foreign-currency debt defaults among sovereigns over the next decade, driven by significantly higher debt levels and increased borrowing costs on hard currency…”Most sovereign foreign currency defaults over 2000-2023 resulted from weak institutional, fiscal, and debt composition factors. A single measure that consistently and reliably predicts sovereign defaults does not exist.

On European Bond Risk Falling to Lowest in a Decade Amid Ample Supply

George Cole, Goldman Sachs

“The path for Bund spreads will hinge on whether the flows of debt supply are manageable enough for the market to digest”

On China May Raise $846bn to Boost Growth – Caixin

Finance Minister Lan Fo’an

The program will be the “largest in recent years”

Top Gainers & Losers 15-October-24*

Go back to Latest bond Market News

Related Posts:

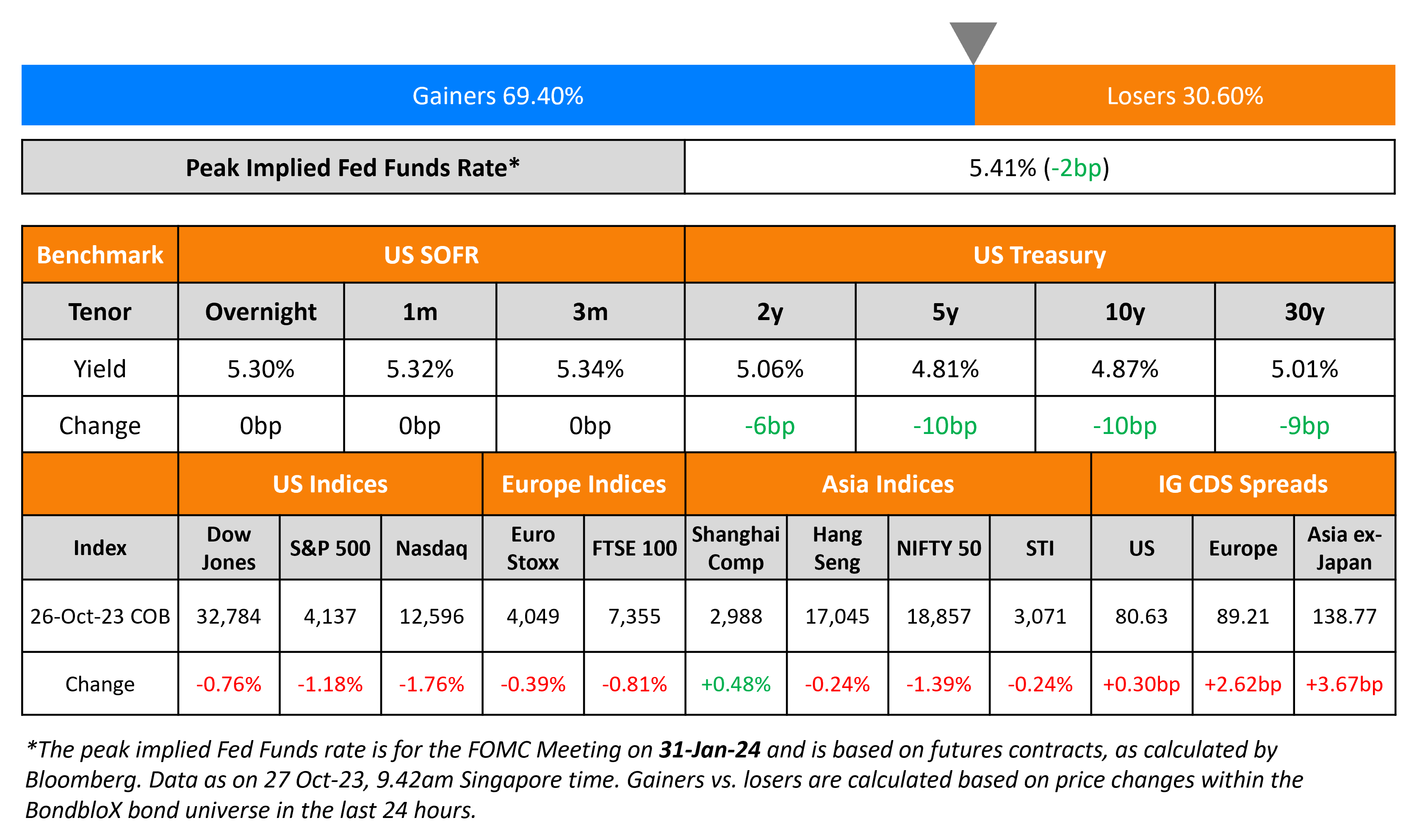

US Economy Grew at 4.9% in Q3; Treasury Yields Move Lower

October 27, 2023

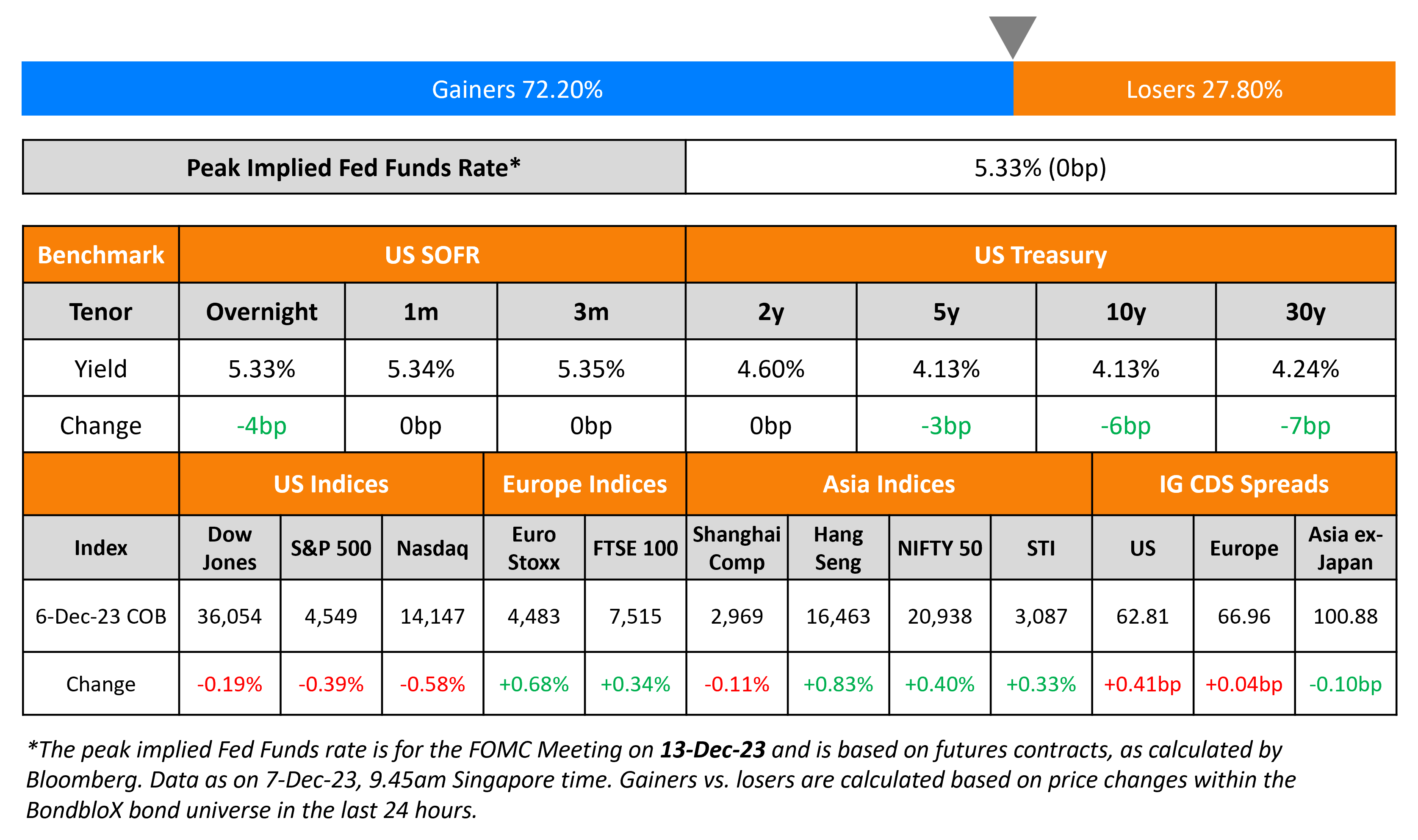

ADP Payrolls Softer Than Expected

December 7, 2023