This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

2s10s Curve Traded Almost Flat; Oman Outlook Raised to Positive by Moody’s

August 30, 2024

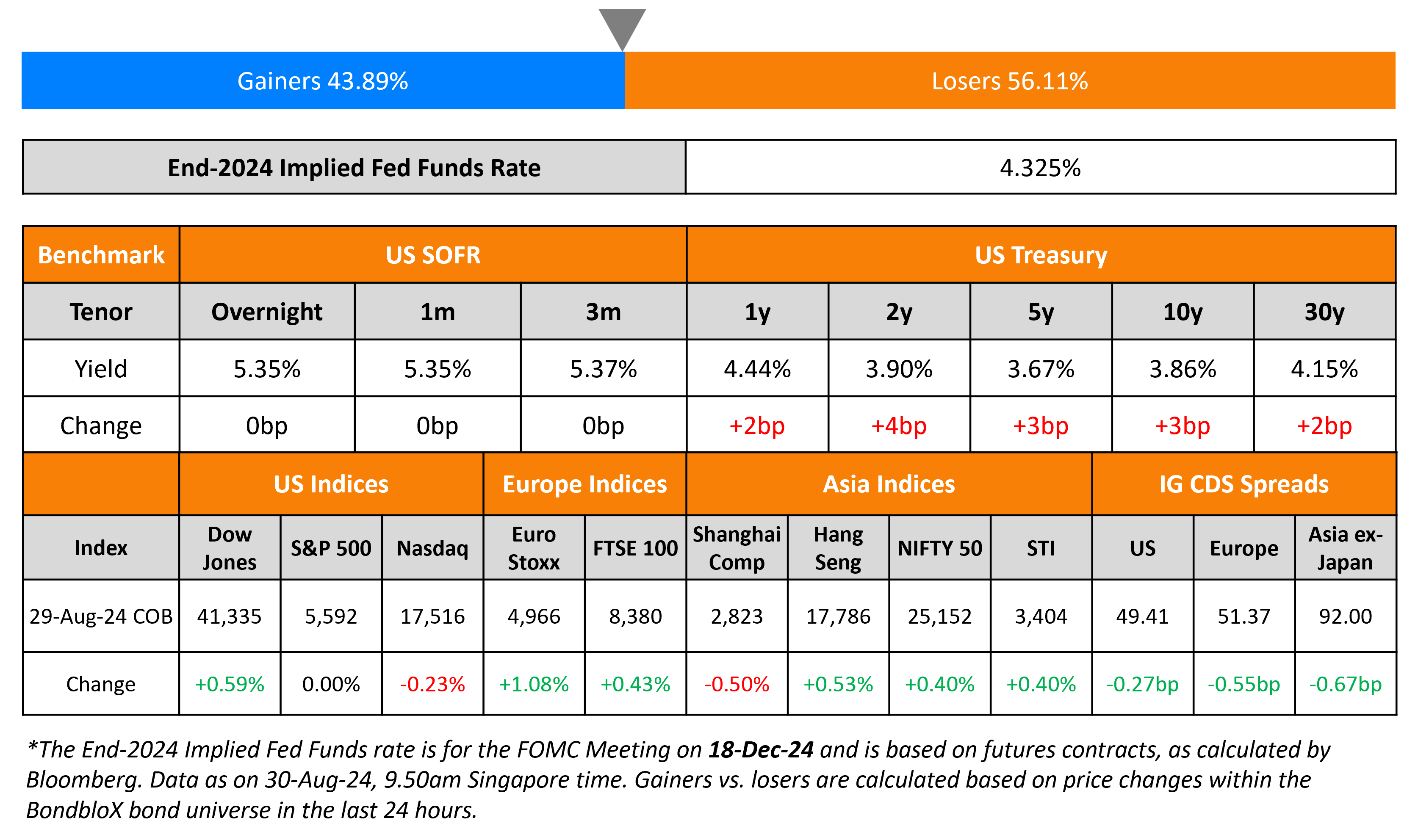

US Treasury yields moved higher across the curve by 3-4bp. The 2s10s curve also traded flat earlier yesterday, post which it has retracted to current levels of -4bp. The second reading of US Q2 GDP showed a 3.0% annualized pick-up vs the first reading and expectations of a 2.8% growth. Also, US initial jobless claims rose by 231k, roughly in-line with expectations of 232k. US IG CDS spreads tightened by 0.3bp and HY CDS spreads tightened by 1.8bp. Looking at US equity indices, the S&P ended flat while the Nasdaq was down by 0.2%.

European equity markets ended higher. Looking at Europe’s CDS spreads, the iTraxx Main spreads tightened 0.6bp and Crossover spreads were tighter by 1.2bp. Asian equity indices have opened higher today morning. Asia ex-Japan CDS spreads were 0.7bp tighter.

New Bond Issues

Rating Changes

- Port of Newcastle Investments (Financing) Pty Ltd. Upgraded To ‘BBB-‘ On Stronger Financials; Outlook Positive

- Moody’s Ratings upgrades Pakistan Water and Power’s rating to Caa2; outlook positive

- Eletrobras Upgraded To ‘BB’ On Improved Metrics From Efficiency Gains; Outlook Stable

- Moody’s Ratings upgrades Novo Banco, S.A.’s senior unsecured debt ratings to Baa3; outlook positive

- Fitch Downgrades Maldives to ‘CC’

- Fitch Revises Outlook on Hanwha Life Insurance to Positive; Affirms IFS Rating at ‘A’

- Moody’s Ratings changes the outlook on Oman to positive, affirms Ba1 ratings

- Moody’s Ratings changes JBS outlook to stable; affirms Baa3 ratings

- Moody’s Ratings places EnLink’s ratings on review for upgrade

Term of the Day

Current Account Deficit (CAD)

The current account deficit is a measurement of a country’s trade where the value of the goods and services it imports exceeds the value of the products it exports. The current account includes net income, such as interest and dividends, and transfers, such as foreign aid. The current account represents a country’s foreign transactions and, like the capital account, is a component of a country’s balance of payments (BOP). A current account deficit is not always detrimental to a nation’s economy—external debt may be used to finance lucrative investments.

Talking Heads

On Dollar Eyeing Biggest Monthly Loss of 2024

Kit Juckes, Chief FX strategist at Societe Generale SA

“There’s a risk that the US economy can remain exceptional, but the mismatch in global balance of payments triggers a big unwind of long dollar positions.”

Valentin Marinov, Head of G-10 FX strategy at Credit Agricole SA

“Confidence that policymakers will soon start easing has emboldened traders to make riskier investments. That’s fueled demand for high-yielding currencies such as the New Zealand dollar.”

On Lumen Trade Turning Into a Big Winner

“It was a “solvent zombie inside an insolvent one”. Norms are always evolving and will continue to adapt to the current environment. For now, however, the best bet is to size positions assuming that you can be screwed.” according to Diameter’s first quarter investment letter, a copy of which was seen by Bloomberg.

On Bond Markets Facing a Reckoning

Guillaume Rigeade, Co-Head of fixed income at Carmignac

“We have many indicators showing that the economy is not falling into a recession. We are just in a soft landing. It’s not justified to us, this acceleration to a cutting cycle so quick. The market is too optimistic in the way it is pricing a perfect normalization.”

Top Gainers & Losers-30-August-24*

Go back to Latest bond Market News

Related Posts: