This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

10 New Deals incl. Seazen, Hyundai, OUE; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 14, 2021

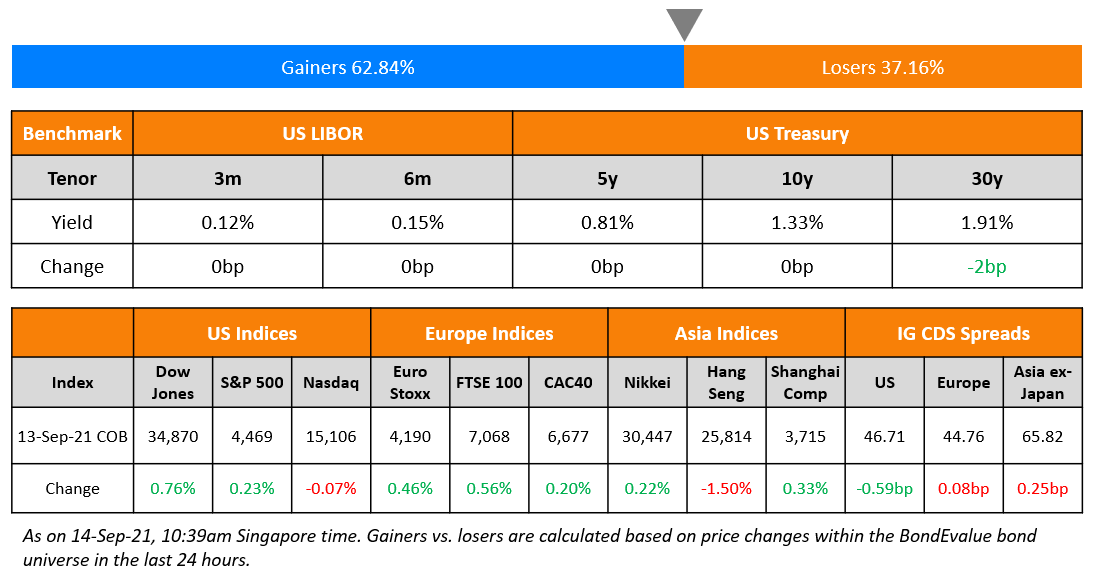

US markets ended the day mixed – S&P was up 0.2% snapping a week-long losing streak while tech heavy Nasdaq slid 0.1% lower making a fourth straight day of losses. Energy and Financials up 2.9% and 1.1% respectively stood out among the gainers while Healthcare was the prominent loser, down 0.6%. European stocks reversed some of last week’s losses – FTSE and DAX gained 0.6% each and CAC added 0.2%. Brazil’s Bovespa surged 1.9% to start the week. Major stock markets in the Gulf ended mixed, with UAE’s ADX falling 0.7% while Saudi’s TASI reversed early losses to close 0.4% higher. Asian markets have started the day in the green – Nikkei was up more than 0.6%, Shanghai and Singapore’s STI were up more than 0.3% and HSI was broadly flat. US 10Y Treasury yields were flat at 1.33%. US IG and HY CDX spreads tightened 0.6bp and 2.1bp respectively. EU Main CDS spreads were 0.1bp wider and Crossover CDS spreads widened 0.5bp. Asia ex-Japan CDS spreads widened 0.3bp. US inflation will be keenly watched out for with the CPI release due today. It’s a rather busy day for the Asian primary markets with 10 new bond deals launched this morning.

Hungary is set to tap the emerging-market sovereign dollar bonds joining Turkey and Indonesia in a busy start to the week. Meanwhile, US inflation will be keenly watched out for with the CPI release due today.

Join Us for The Upcoming 8-Module Course on Bonds – Curated for Investors & Professionals

The course will be conducted via Zoom over 8 modules on 27-30 September and 4-7 October (Monday-Thursday) at 5pm Singapore / 1pm Dubai / 10am London. The course will be conducted by senior debt capital market bankers and professionals who will cover both fundamental concepts as well as the practical aspects of bonds.

New Bond Issues

- Seazen Group $ 200 mn 364-day @ 4.85% area

- Hyundai Capital America $ 3/5/7Y @ T+90/115/130bp

- OUE Treasury S$ 5Y @ 3.7% area

- Hutchison Port Holdings Trust $ 5Y @ T+115bp area

- Norinchukin Bank $ 5/10Y green @ T+75/105bp area

- C C Land Holdings $ 4NC2 @ 5.5% area

- Marubeni $ 5Y green @ T+100bp area

- Guangzhou Metro Group $ 200 mn 5Y green @ T+125bp area

- eHi Car Services $ 5NC3 @ 7.625% area

- Sinochem $ 3/5/10Y @ T+110/120/150bp area

Turkey raised $2.25bn via a two-tranche deal. It raised $750mn via a tap of 6.125% 2028s bond at a yield of 5.7%, 25bp inside the initial guidance of 5.95% area and $1.5bn via a 12Y bond at a yield of 6.5%, 25bp inside the initial guidance of 6.75% area. The new 12Y bond has expected ratings of B2/BB- (Moody’s/Fitch).

Power Finance Corp raised €300mn via a 7Y green bond at a yield of 1.841%, 30bp inside the initial guidance of MS+230bp area. The bonds have expected ratings of Baa3/BBB– (Moody’s/Fitch). Proceeds will be used for on-lending to renewable energy projects in line with “Eligible Green Projects” as per the issuer’s Green Bond Framework. This would be PFC’s first euro-denominated deal. The notes have been certified by the Climate Bonds Initiative and have received third party assurance by KPMG.

Indonesia raised $1.84bn equivalent via a multi-currency deal. It raised:

- $600mn via a tap of its 2.15% 2031s bond at a yield of 2.18%, 32bp inside initial guidance of 2.5% area. The tap is priced 3bp tighter to its existing issue which currently yields 2.21%.

- $650mn via a 40Y bond at a yield of 3.28%, 32bp inside initial guidance of 3.6% area.

- €500mn via a 12Y sustainability bond at a yield of 1.351%, 23-27bp inside initial guidance of MS+140-145bp.

The bonds have expected ratings of Baa2/BBB/BBB, in line with issuer rating, and received combined orders over $6.7bn for the dollar tranche, 5.4x issue size. Proceeds of the dollar tranche will fund a tender for eight of Indonesia’s outstanding notes, while proceeds from the euro tranche will go to projects that will qualify as eligible SDG expenditures under the framework.

Shimao Group raised $1.048bn via a two-tranche deal. It raised:

- $300mn via a 2Y bond at a yield of 3.975%, 40bp inside the initial guidance of 4.375% area.

- $748mn via a 5.3NC3 green bond at a yield of 5.25%, 37.5bp inside the initial guidance of 5.625% area.

The bonds have expected ratings of BBB– (Fitch), and received combined orders over $5.5bn, 5.2x issue size. Proceeds will be used for offshore refinancing and eligible green projects. The new 5.3NC3 bonds are priced 51bp wider to its existing 5.6% 2026s which are yielding 4.74%.

Redsun Properties raised $200mn via a 2Y green bond at a yield of 10.65%, 20bp inside the initial guidance of 10.85% area. The bonds have expected ratings of B3/B+ (Moody’s/Fitch), and received orders over $1.6bn, 8x issue size. Proceeds will be used for offshore debt refinancing.

Sumitomo Mitsui Financial Group (SMFG) raised $5.85bn via a four-tranche deal. It raised:

- $2bn via a 5Y bond at a yield of 1.402%, 20bp inside the initial guidance of T+80bp area.

- $2bn via a 7Y bond at a yield of 1.902%, 20bp inside the initial guidance of T+100bp area.

- $1bn via a 10Y bond at a yield of 2.22%, 20bp inside the initial guidance of T+110bp area.

- $850mn via a 20Y tier 2 bond at a yield of 2.93%, 30bp inside the initial guidance of T+140bp area.

The 5/7/10Y bonds have expected ratings of A1/A– (Moody’s/S&P), in line with the issuer,, while the 20Y tier 2 bond has expected ratings of A2/BBB+ (Moody’s/S&P). Proceeds will be used to extend unsecured and subordinated loans to Sumitomo Mitsui Banking Corporation that would qualify as internal TLAC as well as Tier 2 capital for the subordinated portion.

Industrial Bank of Korea (IBK) raised $500mn via a 3Y sustainability bond at a yield of 0.639%, 30bp inside the initial guidance of T+50bp area. The bonds have expected ratings of Aa2/AA– (Moody’s/Fitch), and received orders over $2bn, 4x issue size. Proceeds will be allocated to finance and/or refinance loans that fall within eligible green and social categories under the IBK’s social, green and sustainability bond framework.

Nissan Motor Acceptance Corp (NMAC) raised $1.85bn via a three-tranche deal. It raised:

- $500mn via a 3Y bond at a yield of 1.141%, 30bp inside initial guidance of T+100bp area

- $1bn via a 5Y bond at a yield of 1.855%, 25-30bp inside initial guidance of T+130-135bp

- $350mn via a 7Y bond at a yield of 2.456%, 30bp inside initial guidance of T+165bp area

Radiance Holdings raised $300mn via a 2.5Y green bond at a yield of 8%, 0bp inside the initial guidance of 8% final. The bonds have expected ratings of B2/B (Moody’s/S&P). Proceeds will be used for debt refinancing. Asian investors bought 100% of the notes. Asset managers, fund managers and hedge funds were allocated 83%, banks and financial institutions 14%, and private banks 3%.

Huzhou Wuxing City Investment raised $200mn via a 3Y bond at a yield of 2.05%, unchanged from initial guidance. The bonds are unrated. Proceeds will be used for the construction of onshore projects and working capital. The bonds will be issued by Wuxing City Investment HK and guaranteed by the parent, which is an infrastructure construction and land development entity in Wuxing district of Huzhou city, Zhejiang province. The bonds are supported by a standby letter of credit from Bank of Shanghai Hangzhou branch.

New Bonds Pipeline

- ICBC hires for $ AT1 bond

- Julius Baer Group hires for $ Perp NC7 AT1 bond

- Weifang Urban Construction and Development hires for $ bond

- Bank Negara Indonesia hires for $ AT1 bond

- Jinan City Construction Group hires for $ bond

- Maldives’ HDC hires for $ sustainability bond

- Oxley Holdings hires for S$ tap of 6.9% 2024s bond

- Korea Electric Power hires for $ 5Y green bond

- Bangkok Bank hires for $ tier 2 bondJSW Steel hires fo

- r $ 5Y and/or 10Y sustainability-linked bond

- Clover Aviation Capital hires for $ bond

- Trafigura hires for $ Perp NC6 bond

- Philippines plans for $ 5/10Y retail bond

Rating Changes

- eHi Car Services Rating Placed On CreditWatch Positive On Improved Liquidity, Maturities After Proposed Notes Issuance

- Fitch Revises Outlook on Guangzhou R&F and Subsidiary to Negative; Affirms at ‘B+’

- Moody’s upgrades Angola’s ratings to B3 from Caa1, outlook stable

- Moody’s rates Gap, Inc.’s proposed senior unsecured notes Ba3; outlook changed to positive

- Fitch Affirms Dana’s IDR at ‘BB+’ and Removes UCO; Outlook Stable

Term of the Day:

Blue Bonds

Blue bonds are a type of sustainable debt wherein the proceeds from such issuance are earmarked for marine/water projects related to ocean conservation (hence the name blue bonds). These are similar to green bonds, which are earmarked for green or environmentally-friendly projects. Blue bonds became popular in late 2018 when Seychelles issued the world’s first sovereign blue bond. The ADB recently issued its first blue bond for ocean investments.

Talking Heads

On Worries about Evergrande and the Property Sector

Anonymous Fixed-Income Asset Manager

“Telling property guys to de-leverage so quickly is like telling a 900-pound guy to drop to under 100 pounds…It won’t be the obesity that kills him, but the process of losing so much weight (so quickly).”

Larry Hu, economist at Macquarie Capital in Hong Kong

“The property sector is under pressure and some developers are under the risk of bankruptcy…the bond market is reflecting that reality…We’re going to see more developers go bankrupt in the coming months.”

Natixis analysts

“Contagion from Evergrande to other developers will be clearer for high-yield and private debtors. The impact on state-owned developers and banks is limited as far as bond prices are concerned”

On SEC Chief Puts Corporate Bonds in Crosshairs for Scrutiny

“This market is so critical to issuers…It is nearly 2.5 times larger than the commercial bank lending of about $10.5 trillion in our economy….I’ve asked staff for recommendations on how we can bring greater efficiency

and transparency to the non-Treasury fixed income markets”

Libby Cantrill, head of public policy at Pimco

“The downside is so great that conventional wisdom [suggests] that Congress will not impose this self-inflicted wound on the US economy, especially in the middle of a pandemic.”

Bret Barker, a portfolio manager at TCW

“It feels like the movie we’ve all seen before and it is getting pretty old…This is something we see every two years and people are catching on that this is showmanship and political posturing.”

“The plan to issue several bonds, in both euros and dollars at once, is quite bold, but considering the state of the market, the issuance will be successful”.

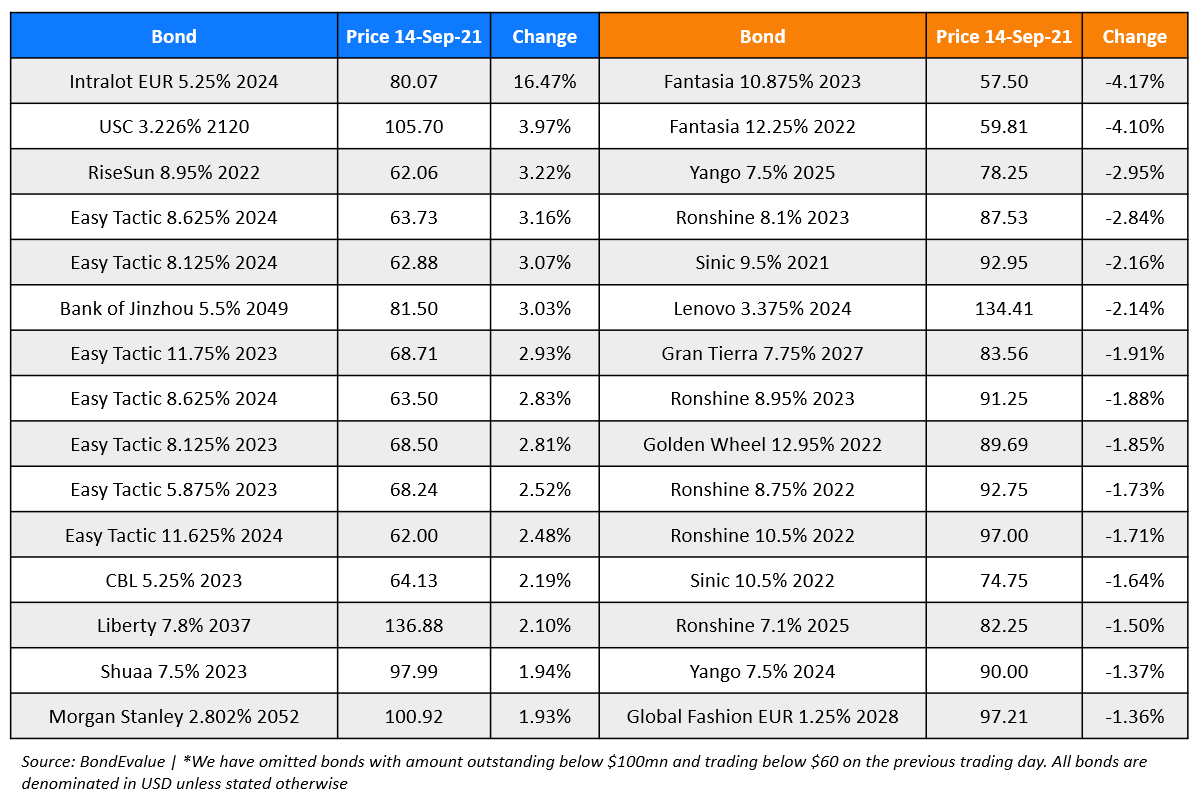

Top Gainers & Losers – 14-Sep-21*

Go back to Latest bond Market News

Related Posts:.png)