This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

YPF & Argentine Province Bonds Rally, Outperforming the Sovereign YTD

September 28, 2022

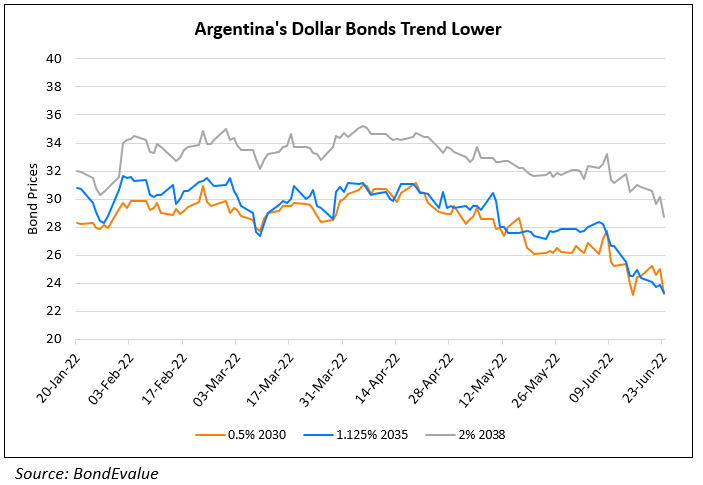

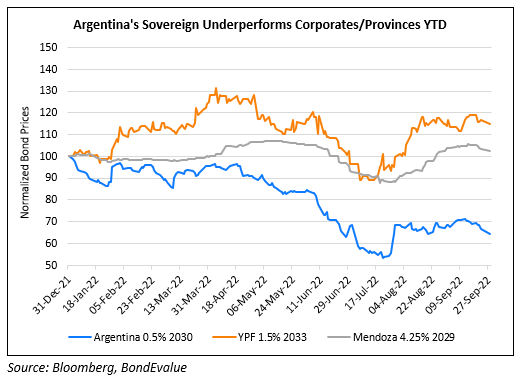

Select corporates and provincial Argentine bonds have rallied this year, with a significant divergence being observed compared to bonds of the sovereign. While Argentina’s sovereign dollar bonds are down 35% YTD, those of state-owned energy company YPF are up ~18% and those from provinces like Mendoza and Cordoba are up ~7%. Bloomberg notes that this divergence is because investors are pessimistic about Argentina’s ability to attract investment, cool inflation and revive growth. However, they are confident that companies and provincial governments can hang on. Edwin Gutierrez, head of EM sovereign debt at Abrdn said, “There’s definitely a survivor bias with Argentina corporates. These are the guys who have managed to survive despite anything the government throws at them”. While this divergence has occurred, analysts note that it may not have further room to go as “companies and provinces aren’t immune from the country’s struggles” which include inflation at nearly 100% and forex reserves at a six-year low.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Argentina Due to pay $730mn to the IMF as Uncertainty Looms

January 28, 2022

Argentina Closes $45bn Deal with IMF

March 4, 2022