This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Xerox’s Bonds Rise on Agreement to Acquire Lexmark for $1.5bn

December 24, 2024

Xerox has agreed to acquire Chinese-owned printer and software maker Lexmark International for $1.5bn, with an aim to strengthen its position in Asian markets and compete better in the evolving print industry. Xerox will acquire Lexmark from Ninestar, PAG Asia Capital, and Shanghai Shouda Investment Centre. This would return Lexmark to US ownership after its 2016 sale to Chinese investors for $3.6bn. Xerox has struggled with five consecutive quarters of revenue decline amid shrinking demand for printing equipment and competition from HP and Canon. Lexmark, which is already a supplier to Xerox, will enhance Xerox’s presence in the growing A4 color printing market. The merged entity is expected to serve 200k clients across 170 countries, ranking among the top five firms globally in key print segments. Xerox also expects $200mn in annual cost savings and immediate profit growth from the deal, with plans to reinvest savings into future initiatives. The deal is expected to close in late 2025. Xerox will use cash and debt to finance the acquisition and will cut its annual dividend.

Xerox’s bonds were higher, with its 5.5% 2028s up 1.4 points to 86.46, yielding 10.03%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Xerox Downgraded to Ba3 by Moody’s

March 6, 2024

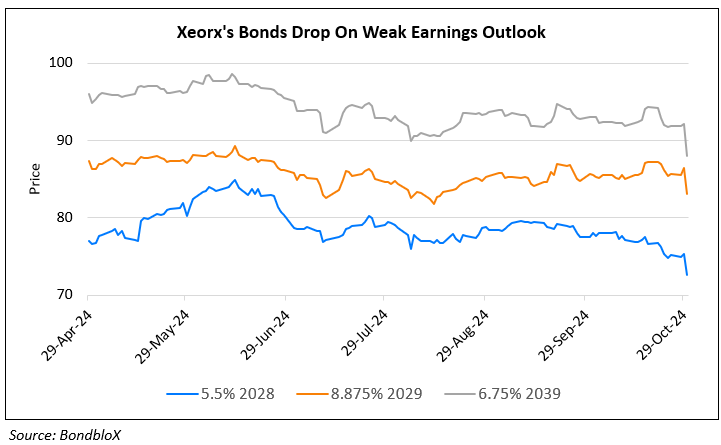

Xerox Bonds Drop on Weak Earnings and Lowered Guidance

October 30, 2024

ReNew Power Reports Narrowing of Losses

June 16, 2022