This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Xerox’s Bonds Rise after Revenue Tops Estimates Despite Earnings Miss

May 5, 2025

Xerox’s bonds rallied by as much as 2 points after the company reported its Q1 results. Xerox’s revenue for the quarter came-in at $1.46bn, beating analysts’ estimate of $1.44bn. However, its loss per share was reported at $0.6 vs. estimates of a $0.4 loss. It reported an adjusted operating income of $22mn vs. estimates of $30.7mn. The company still sees adjusted operating margin of at least 5% and free cash flow of $350-400mn. Xerox (rated B2/B+) is emerging from a poor prior quarter where its bonds dropped over 20%. In late-December, as part of its plans to strengthen its position in Asian markets and compete better in the evolving print industry, Xerox had agreed to acquire Chinese-owned printer and software maker Lexmark International for $1.5bn.

Xerox’s 8.875% 2029s were up ~2 points to trade at 63.8, yielding 21.8%. The notes have rallied by over 20% since late-April.

Go back to Latest bond Market News

Related Posts:

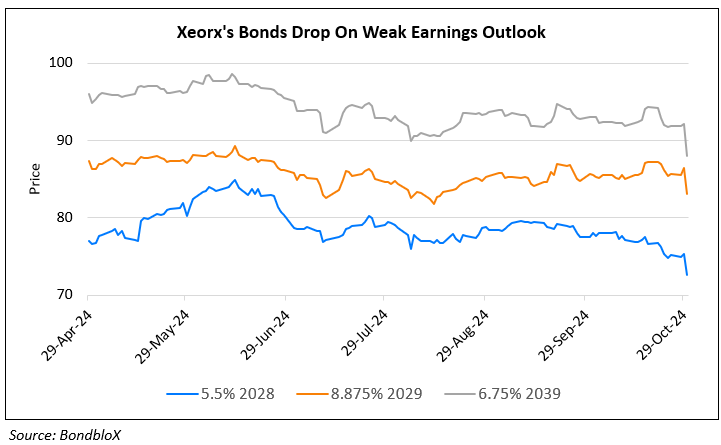

Xerox Bonds Drop on Weak Earnings and Lowered Guidance

October 30, 2024

Xerox Downgraded to B2 by Moody’s

November 13, 2024

Xerox Holdings Downgraded to B+ by S&P

November 19, 2024