This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

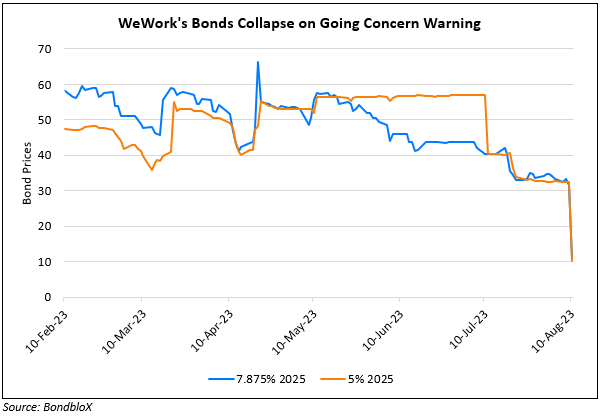

WeWork To Enter Into Grace Period for 2025s

November 1, 2023

WeWork entered into a 7-day forbearance agreement with bondholders after the expiration of a grace period to pay interest on several of its bonds. As per a filing, WeWork held back on paying $37.3mn of cash and $57.9mn of in-kind payments on the above debt, post which a 30-day grace period began. Earlier in October, when the grace period began, WeWork came out saying that it had sufficient liquidity to make the above payments and that it might do so in the subsequent weeks. WeWork also separately said that will not pay $6.4mn in cash coupons on today on its 7.875% 2025s. The notes will now enter a 30-day grace period. WeWork is said to be planning to file for a Chapter 11 bankruptcy as early as next week, as per a source. The co-working company is reeling under losses and a large debt pile with net long-term debt of $2.9bn and over $13bn in long-term leases as of end-June.

WeWork’s bonds are trading at deeply distressed levels of 3-5 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: