This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Walgreens’ Bonds Rally on Reports of Potential Sycamore Acquisition

March 6, 2025

Walgreens’ bonds rallied by 3-4 points after sources reported that major big banks were working on financing options totaling ~$12bn for its acquisition by private equity firm Sycamore Partners. If the deal goes through, it is expected to be one of the largest leveraged buyouts (LBOs) since the 2008 financial crisis. The deal could involve purchasing the entire company, potentially splitting it up later, including its major units like Walgreens, Boots, Shields Health Solutions, and VillageMD. The financing will likely tap dollar, euro, and sterling-denominated leveraged loans, high-yield bonds, and private credit firms, including a possible asset-based lending (ABL) facility, sources noted. The banks are also considering integrating private credit into a syndicated debt deal. Walgreens has been struggling financially, including a DOJ lawsuit over opioid prescriptions.

Walgreens’ bonds were among the top gainers overnight, with its 4.5% 2034s up by 4 points to 86 cents on the dollar, yielding 6.5%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

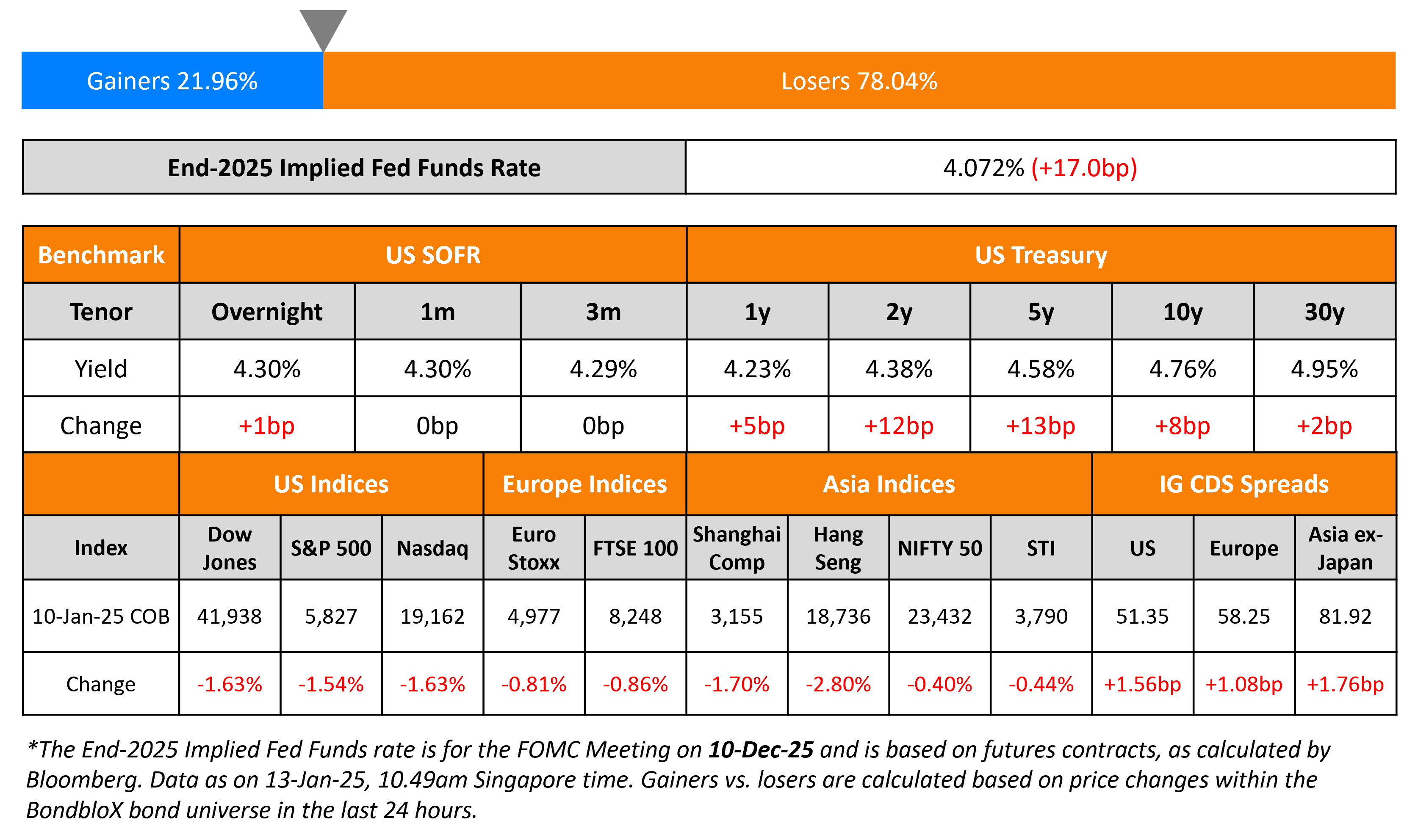

Treasuries Sell-off on Strong Jobs Report

January 13, 2025

Sinopec Returns to the Dollar Bond Market for a Second Time in 2017

September 13, 2017