This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Sell-off on Strong Jobs Report

January 13, 2025

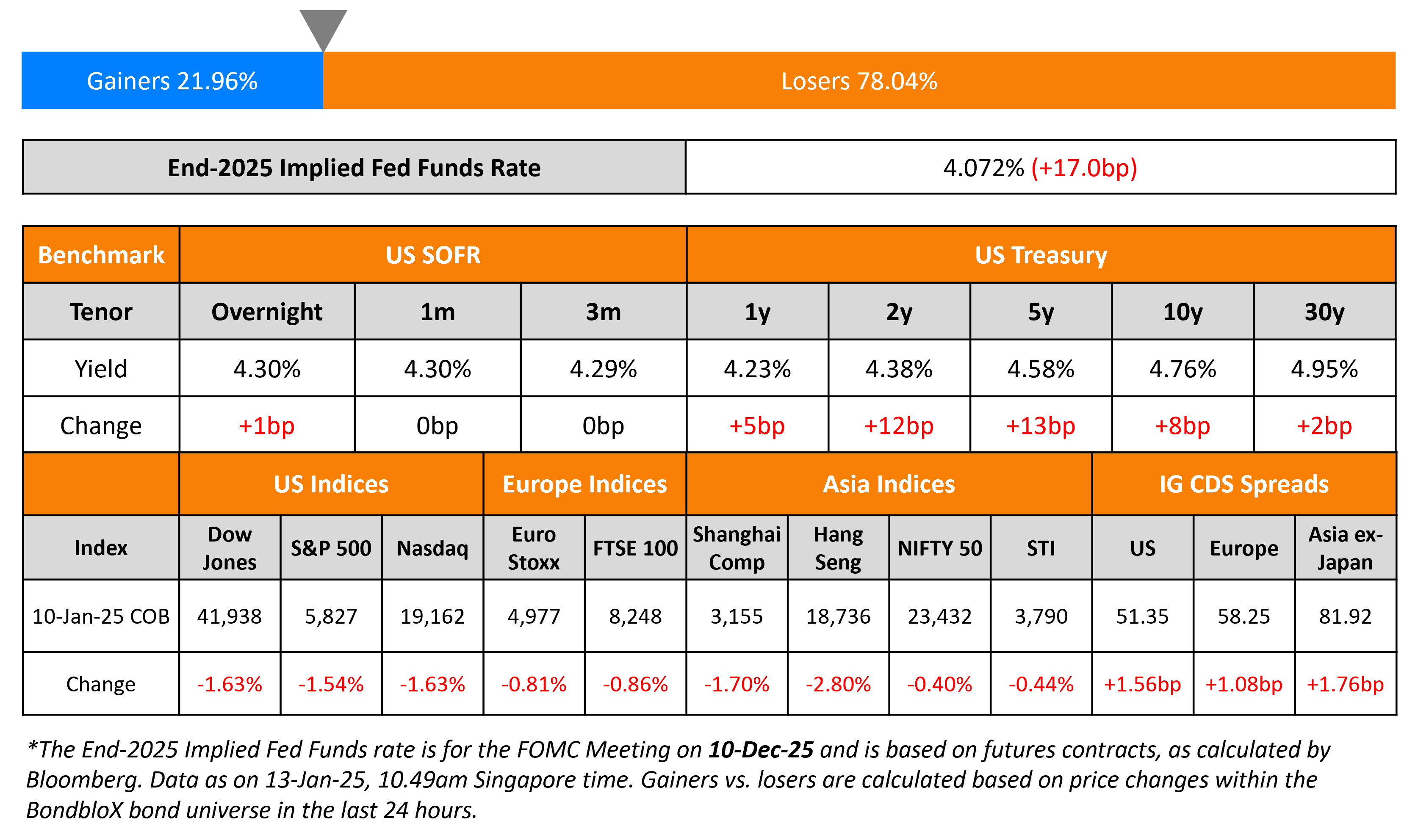

Equity and bond markets witnessed a sea of red following the US jobs report. US Treasury yields surged higher, with the yield curve bear flattening, as the 2Y yield rose 12bp and the 10Y yield rose 8bp. US NFP for December saw a growth of 256k, much higher than the expected 165k and the prior month’s revised 212k print. The Unemployment Rate dropped to 4.1%, better than the expected 4.2%. Average Hourly Earnings (AHE) eased slightly to 3.9% YoY from 4.0%. At present, markets are pricing-in a 25bp rate cut by the Fed in September/October as compared to June, prior to the jobs data. However, Chicago Fed President Austan Goolsbee said that the jobs market was stabilizing at full employment and that rates should continue to drop towards neutral. He added that rates could be a “fair bit lower” over the next 12-18 months.

US IG and HY CDS spreads widened by 1.6bp and 6bp respectively. US equity markets saw the S&P and Nasdaq fall 1.5% and 1.6% respectively. European equities ended lower too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.1bp and 5bp respectively. Asian equities are lower across the board this morning. Asia ex-Japan CDS spreads were 1.8bp wider.

New Bond Issues

-

BPCE S$ 10NC5 Tier 2 at 4.85% area

-

KHFC $ 5Y FXD/5Y FRN at T+95bp area

New Bonds Pipeline

-

IIFL Finance hires for $ 3.5Y bond

- Tata Capital hires for $ 3.5Y bond

- Hyundai Capital Services hires for $ 3Y/3Y FRN bonds

Rating Changes

- Fitch Upgrades Banco de Sabadell to ‘BBB+’; Outlook Stable

-

Fitch Revises Austria’s Outlook to Negative; Affirms at ‘AA+’

-

Calpine Corp. ‘BB-‘ Ratings Placed On CreditWatch Positive Following Constellation Energy Corp.’s All-Stock Bid

Term of the Day: Formosa Bond

A Formosa bond is a bond that is issued in Taiwan by a foreign issuer that is denominated in a currency other than the New Taiwanese Dollar. It is a way for foreign issuers to raise capital in Taiwan. To qualify as a Formosa, borrowers must have credit ratings of BBB or higher. Formosa bonds are listed and traded on the Taipei Exchange.

FAB and Emirates NBD recently launched 5Y Formosa FRNs.

Talking Heads

On Wall Street Economists Paring Back Fed Rate-Cut Views After Data

BofA

“After a very strong December jobs report, we think the cutting cycle is over… conversation should move to hikes”

Citigroup

“Not particularly concerned about scenarios in which the Fed does not cut this year or considers hikes”

On Bond Selloff Exposes ‘Vulnerability’ in Markets – Mohammed El-Erian

“It confirms, one, the economy remains solid, and two, the US continues to meaningfully outperform other advanced economies. That theme of dispersion is going to become really important as we go forward… US leads a global bond selloff”

On IMF chief sees steady world growth in 2025, continuing disinflation

“Not surprisingly, given the size and role of the U.S. economy, there is keen interest globally in the policy directions of the incoming administration… uncertainty is particularly high around the path for trade policy going forward”

Top Gainers and Losers- 13-January-25*

Go back to Latest bond Market News

Related Posts:

Unifin Downgraded to B+ by S&P

March 17, 2022