This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

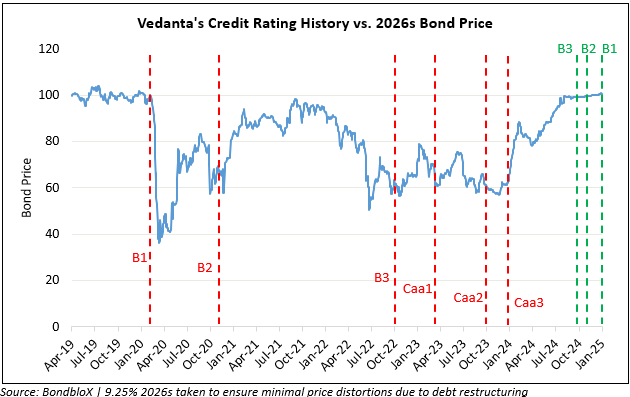

Vedanta Upgraded to B1; Launches Buyback Offer for All of Its 2028s

January 14, 2025

Vedanta Resources was upgraded by Moody’s to B1 from B2, with a stable outlook. Its senior unsecured bonds were raised to B2 from B3. The upgrade reflects reduced refinancing risks due to its proposed bond issue and the recent $300mn syndicated bank facilities, extending its debt maturity profile. The rating agency noted that Vedanta’s proactive liability management and enhanced investor confidence underscore improved governance. The company has reduced holding company debt from $9.1bn in March 2022 to $4.8bn in September 2024, decreasing reliance on operating company dividends. Also Vedanta’s liquidity was assessed to remain sufficient through 2026, though its subsidiaries might face weak cash flow due to capex needs, dividend payouts, and reliance on short-term financing.

Separately, Vedanta launched a tender offer to buyback any or all of its outstanding 13.875% 2028s and up to the maximum acceptance amount of the outstanding 9.25% 2026s on a pro rata basis. The early tender consideration will be $1,000 per $1,000 principal of the 2028s, while the regular consideration would be $990 per $1,000 in principal. For the 2026s, the early tender consideration will be $1,005 per $1,000 principal amount, while the regular consideration would be at $1,000. The early tender deadline is on January 27 while the offer expires on February 11.

Go back to Latest bond Market News

Related Posts:

Vedanta Ltd. Reports Strong Q2 Earnings

November 11, 2024