This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta Denies Stake Sale Reports in Indian Subsidiary

June 26, 2024

Vedanta Resources denied reports of any plans of the parent company selling a stake in its Indian subsidiary, Vedanta Ltd, as per the company’s spokesperson. This comes on the back of reports that Vedanta promoters were planning to sell up to a 2.5% stake equivalent to ~INR 40bn ($480mn) in the Indian listed entity. Further, Chairman Anil Agarwal said that “there is nothing on the cards to take our holding down below 61.5%”. He also added that they are “very comfortable to address the debt” and also have “a good cash flow and good dividend that should take care of all the debt payment”. Rumors of the stake sale also came amid the gradual decline in the parent’s stake in Vedanta Ltd. since end-2022, from 69.68% to 61.95% as of end-March 2024.

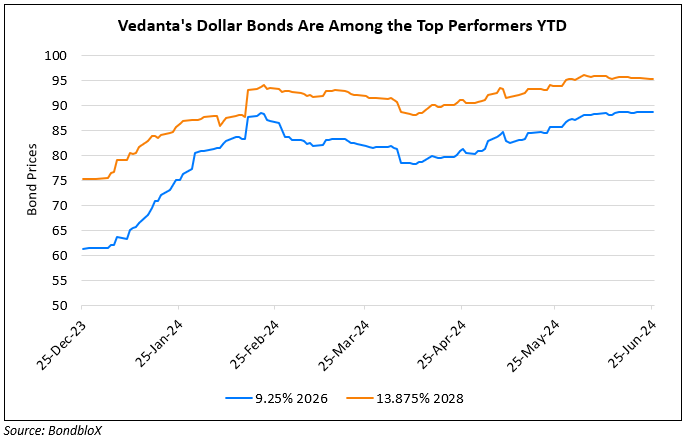

Vedanta’s dollar bonds were trading steady, with its 9.25% 2026s at 88.76, yielding 16.61%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Vedanta Mulling $1bn Share Sale in June

May 28, 2024

Vedanta Mulling Dollar Bond Issuance, Say Sources

June 25, 2024