This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta Launches $ Tap of 2029s; Treasuries Stable

October 21, 2024

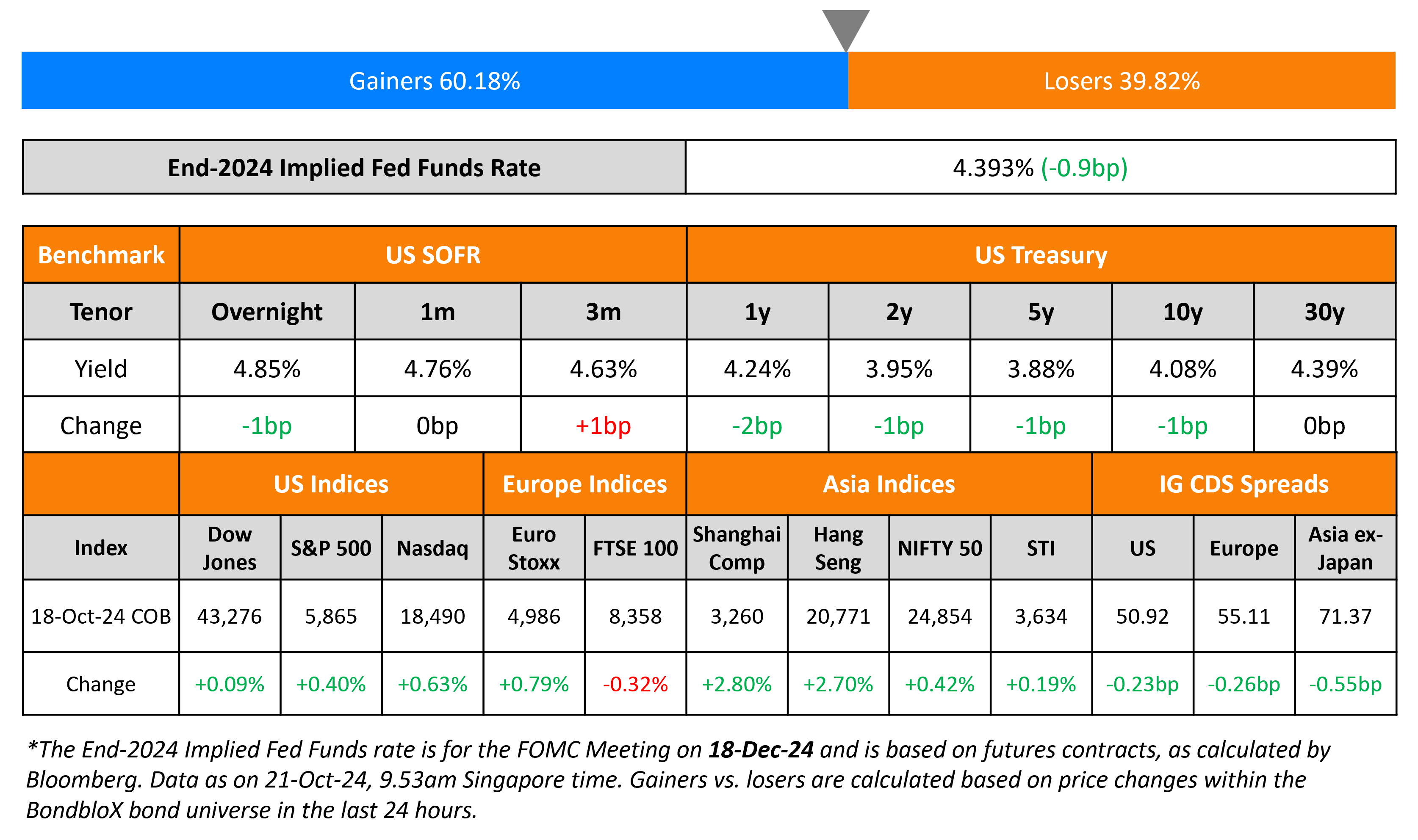

US Treasuries remained largely stable on Friday. Atlanta Fed President Raphael Bostic remarked that he is not in a rush to bring interest rates back to a neutral level, reiterating sentiments he has expressed in the past. He expects inflation to fall towards the Fed’s target by end-2025. On a separate note, economists estimate that the strike at Boeing, and the temporary layoffs of non-striking workers as well as those at its suppliers, could subtract about 50k jobs from the NFP for October. This comes after September’s NFP saw an addition of 254k jobs in with the unemployment rate falling to 4.1% from 4.2%. Looking at US equity markets, S&P and Nasdaq both closed ended flat. US IG and HY CDS saw a tightening of 0.2bp and 4.1bp respectively. US equity markets closed broadly higher with the S&P and Nasdaq up by 0.4% and 0.6% respectively.

European equities closed higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.3bp and 0.9bp respectively. Asian equities have opened broadly higher this morning. Asia ex-Japan IG CDS spreads were 0.6bp tighter. Asia ex-Japan IG CDS spreads are currently at near three-year lows of 71.4bp.

New Bond Issues

- Vedanta Resources $ 10.875% 2029 Tap at 102.5 area

New Bonds Pipeline

- GLP hires for $ 3.5Y bond

Rating Changes

-

EnLink Midstream LLC Upgraded To ‘BBB’; Outlook Stable

-

Cote d’Ivoire Upgraded To ‘BB’ On Strong Support From WAEMU Membership And Declining Budgetary And External Imbalances

-

Moody’s Ratings upgrades Albania’s ratings to Ba3 and changes outlook to stable

-

Fitch Revises Italy’s Outlook to Positive; Affirms at ‘BBB’

-

Senegal Outlook Revised To Negative On Fiscal Slippage; ‘B+/B’ Ratings

-

Benin Outlook Revised To Positive From Stable On Strong Budgetary Prospects; ‘BB-/B’ Ratings Affirmed

Term of the Day

Sustainability-Linked Bonds (SLBs)

Sustainability-linked bonds (SLBs) are bonds wherein the issuer commits to sustainability outcomes within a timeline set in the bond document based on five elements:

– Selection of Key Performance Indicators (KPIs)

– Calibration of Sustainability Performance Targets (SPTs)

– Bond Characteristics

– Reporting

– Verification

Here however, unlike green and social bonds, proceeds can be used for general purposes but the characteristics of the bond can change depending on the issuer meeting their KPIs set in the document. SLBs come with a coupon step-up if the issuer fails to meet its goal(s) within the specified time period in its framework.

Talking Heads

On Case for quick ECB rate cuts mounts as growth weakens and inflation is tamed

Madis Müller, Estonia central bank governor

“Economic growth will be more modest than could have been expected just a month or two ago, and this will probably also reduce the pressure for price increases”

HSBC

“We see inflation heading back up to 1.9% in October and crossing 2% again in December. It should then hover between 1.6% and 1.8% for most of first half of 2025”

On Fears of ‘False Start’ for Fed Leaving EM in Limbo

Paul McNamara, investment director at Gam UK

“We remain in a world with two potentially existential threats to EM – China weakness and Trump. A strong US economy without inflation is good for EM, but persistent inflation will not only postpone further cuts”

Charlie Robertson, FIM Partners

“We’re just weeks away from a US election that might lead to a Trump economic assault on the biggest EM out there, China”

Anders Faergemann, Pinebridge

“Eventually EM local-currency bonds should benefit from global easing”

Top Gainers and Losers- 21-October-24*

Go back to Latest bond Market News

Related Posts:

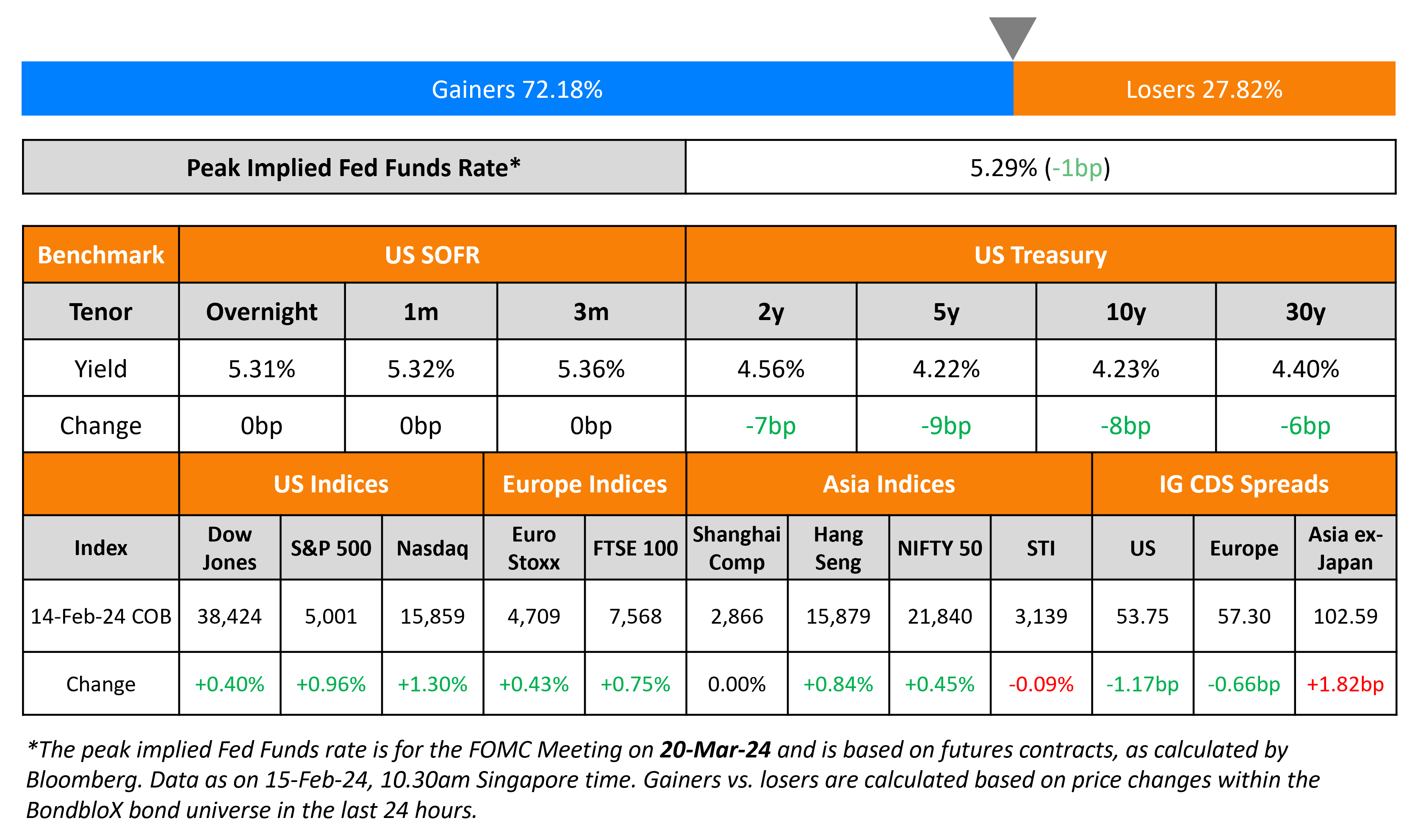

UBS Launches S$ Perp

February 15, 2024