This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta Launches $ 7NC2 Bond; Vakifbank, EDF Price Bonds

September 30, 2025

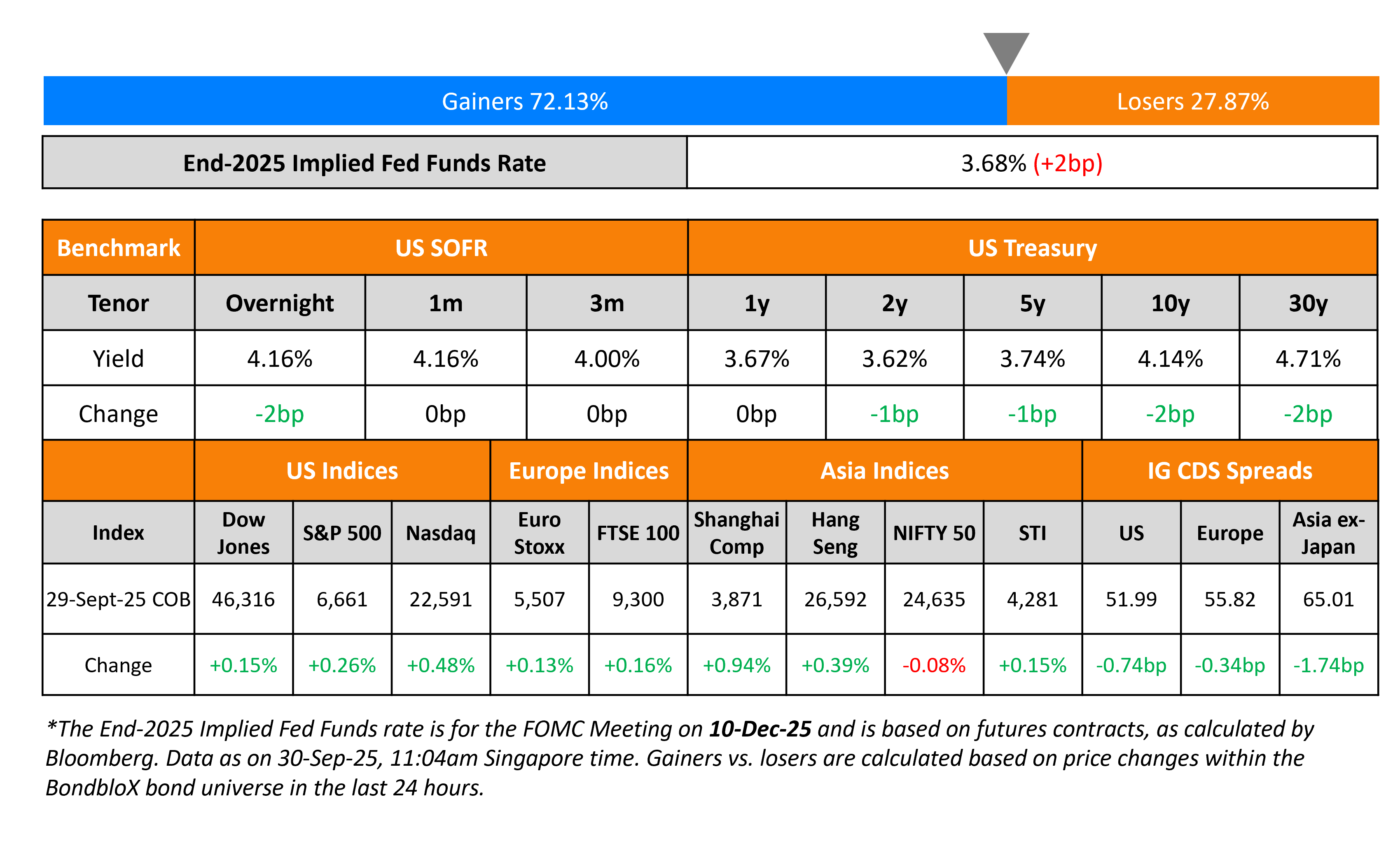

US Treasury yields were marginally lower again, by 1-2bp across the curve. There were no major data points. However, the US government is expected to shutdown as the Democrats and Republicans are unlikely to be able to agree on a spending bill. Separately, more Fed speakers came out with their assessment of monetary policy. Cleveland Fed’s Beth Hammack said that they need to maintain a restrictive policy stance due to inflation concerns. However, New York Fed’s John Williams said that the inflation risks arising from tariffs have been muted and thus it “made sense to move interest rates down a little bit”. St. Louis Fed’s Alberto Musalem said that while he is open to further interest rate cuts, the Fed has to be cautious.

Looking at equity markets, both the S&P and Nasdaq ended 0.3% and 0.5% higher respectively. US IG CDS spreads were tighter by 0.7bp while HY CDS spreads widened by 17.8bp respectively. European equity markets ended higher too. The iTraxx Main CDS and Crossover CDS spreads tightened by 0.3bp and 2.8bp. Asian equity markets have broadly opened in the green today. Asia ex-Japan CDS spreads were 1.7bp tighter.

New Bond Issues

-

Vedanta Resources $ 7NC2 at 9.5% area

- HDB S$ green at 1.838%

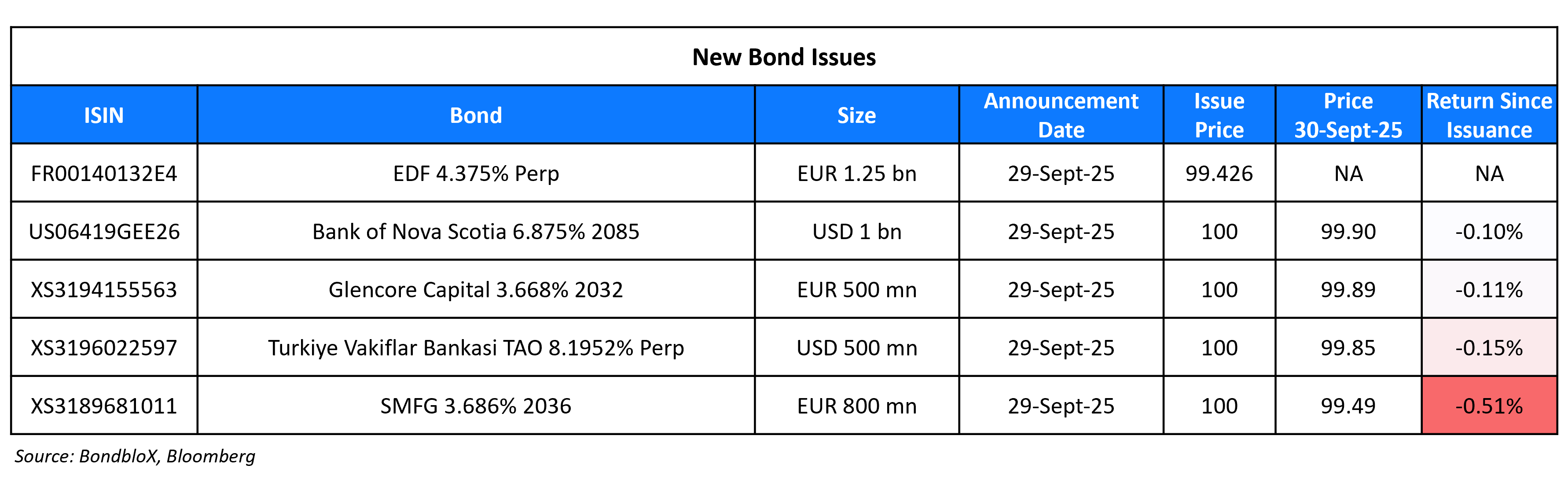

Vakifbank raised $500mn via a PerpNC5.5 AT1 bond at a yield of 8.20%, ~36.25bp inside initial guidance of 8.5-8.625% area. The junior subordinated note is rated CCC+ (Fitch), and received orders of over $1.35bn 2.7x issue size. If not called by 6 January 2031, the coupon will reset to the US 5Y Treasury plus 443.9bp. Proceeds will be used towards general corporate purposes.

EDF raised €1.25bn via a PerpNC5.5 bond at a yield of 4.5%, 50bp inside initial guidance of 5.0% area. The subordinated note is rated Ba2/B+/BBB-. If not called by 6 April 2031, the coupon will reset to the 5Y Mid-Swap plus 207.4bp. Proceeds will be used towards capex in nuclear power generation within the EU and aligned to the EU-Taxonomy, specifically to existing French nuclear reactors in relation to their lifetime extension.

OUE REIT raised S$150mn via a 7Y bond at a yield of 2.75%, 30bp inside initial guidance of 3.05% area. The senior unsecured note is rated BBB- by S&P. Net proceeds raised will be applied exclusively to finance/re-finance, in whole or in part, new or existing eligible green projects.

Glencore raised €500mn via a 7Y bond at a yield of 3.668%, 30bp inside initial guidance of MS+145bp area. The senior unsecured note is rated A3/BBB+. Proceeds will be used towards general corporate purposes, other than related to thermal coal mining.

SMFG raised €800mn via a 11NC10 bond at a yield of 3.686%, 30bp inside initial guidance of MS+130bp area. The senior unsecured note is rated A1/A-/A-. Net proceeds will be used for providing debt/loan financing to SMFG’s subsidiaries or otherwise used for general corporate purposes.

New Bond Pipeline

- Giti Tire Pte. Ltd. plans 5Y S$ sustainability bond

Rating Changes

- Moody’s Ratings upgrades to Ba2 ratings of Autopistas del Sol; changes outlook to stable

- Moody’s Ratings upgrades to Ba1 ratings of ICE and Reventazon; outlook stable

- Moody’s Ratings upgrades Lennox’s senior unsecured rating to Baa1; outlook changed to stable

- Fitch Downgrades Petkim to ‘CCC’

- Fitch Downgrades Maxeda to ‘CCC+’

- First Brands Group LLC Downgraded To ‘D’ From ‘CC’ On Chapter 11 Bankruptcy Filing

- Moody’s Ratings affirms Tata Motors’ Ba1 CFR; changes outlook to negative

- Fitch Revises Outlook on Thailand’s PTT and PTTEP to Negative; Affirms at ‘BBB+’

- Fitch Affirms Ratings on Thai Banks; Revises Outlook to Negative for Five Banks

- Electronic Arts Inc. Ratings Placed On CreditWatch Negative On Announced Take-Private Transaction

Term of the Day: Rising Star

Rising stars are companies that have recently seen credit rating upgrades that pull its rating to investment grade category from its previous junk or high yield category. They are termed as rising stars as their financial and/or operational metrics show an improving trend. The opposite of rising stars are fallen angels, which are issuers that have been recently downgraded to junk category from its previous investment grade rating category.

Talking Heads

On Long Government Shutdown May Boost US Treasuries

Citi

“History has shown more bullish reactivity to prolonged shutdowns, with risk-markets a bit more buoyant… Betting markets imply a greater than five-day shutdown, potentially delaying key labor market inputs, with the administration raising the economic stakes and left-tail of a funding lapse”

BMO Capital Markets

“The implications from a government shutdown increase as the duration of such an event extends… briefer the shutdown, the less damage it does to the real economy”

On Goldman Sachs upgrading global equities on growth optimism, policy support

“We think that good earnings growth, Fed easing without a recession and global fiscal policy easing will continue to support equities”

On Dollar Falling on US Payrolls Risk, Potential Washington Shutdown

Chris Turner, ING Bank NV

“Now that the Fed has firmly swung behind the risk of a weaker jobs market being greater than the risk of inflation, employment data will have to come in on the weak side to maintain both expectations for Fed easing and a weaker dollar”

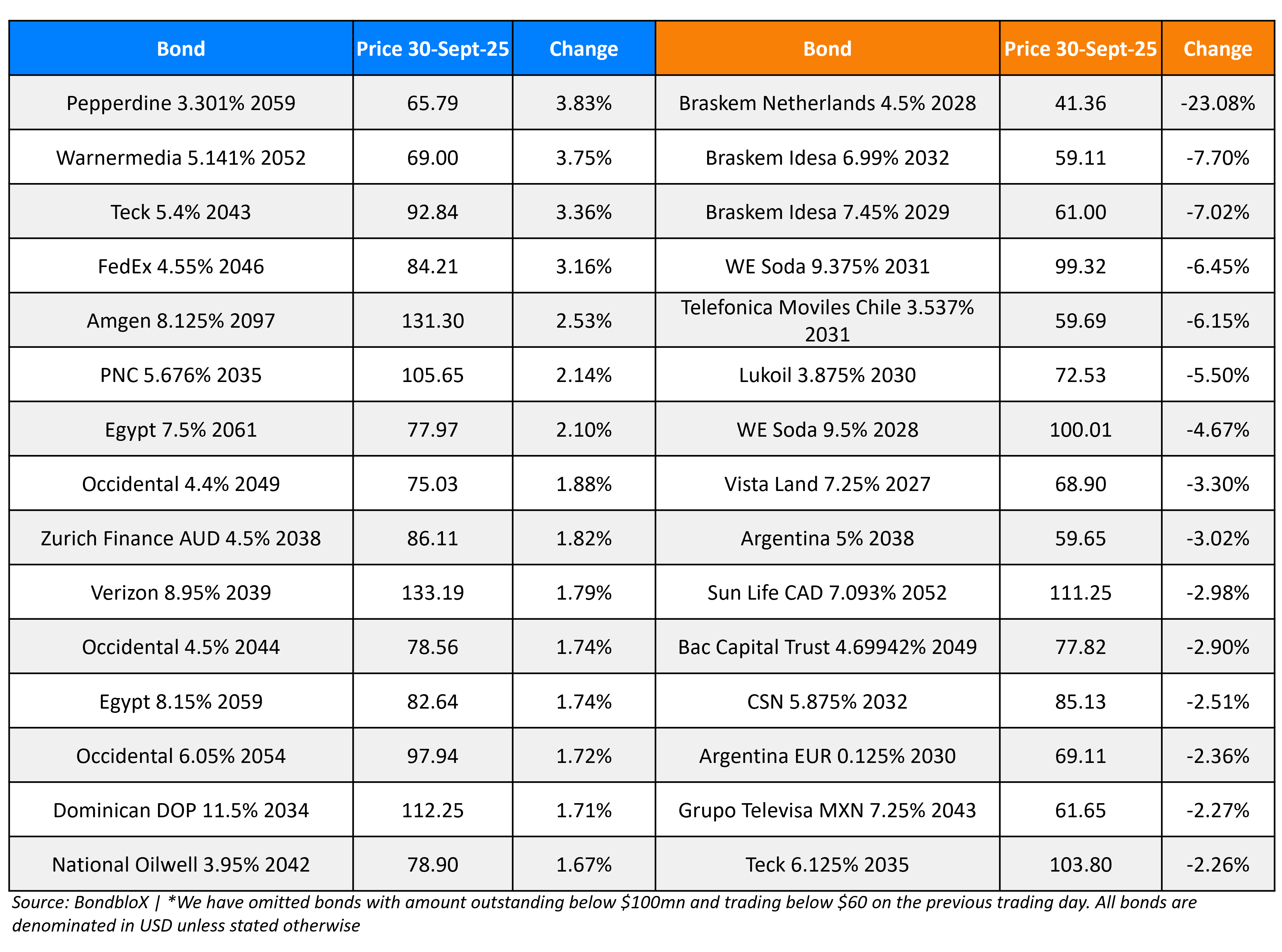

Top Gainers and Losers- 30-Sep-25*

Go back to Latest bond Market News

Related Posts:

Vedanta Launches $ Tap of 2029s; Treasuries Stable

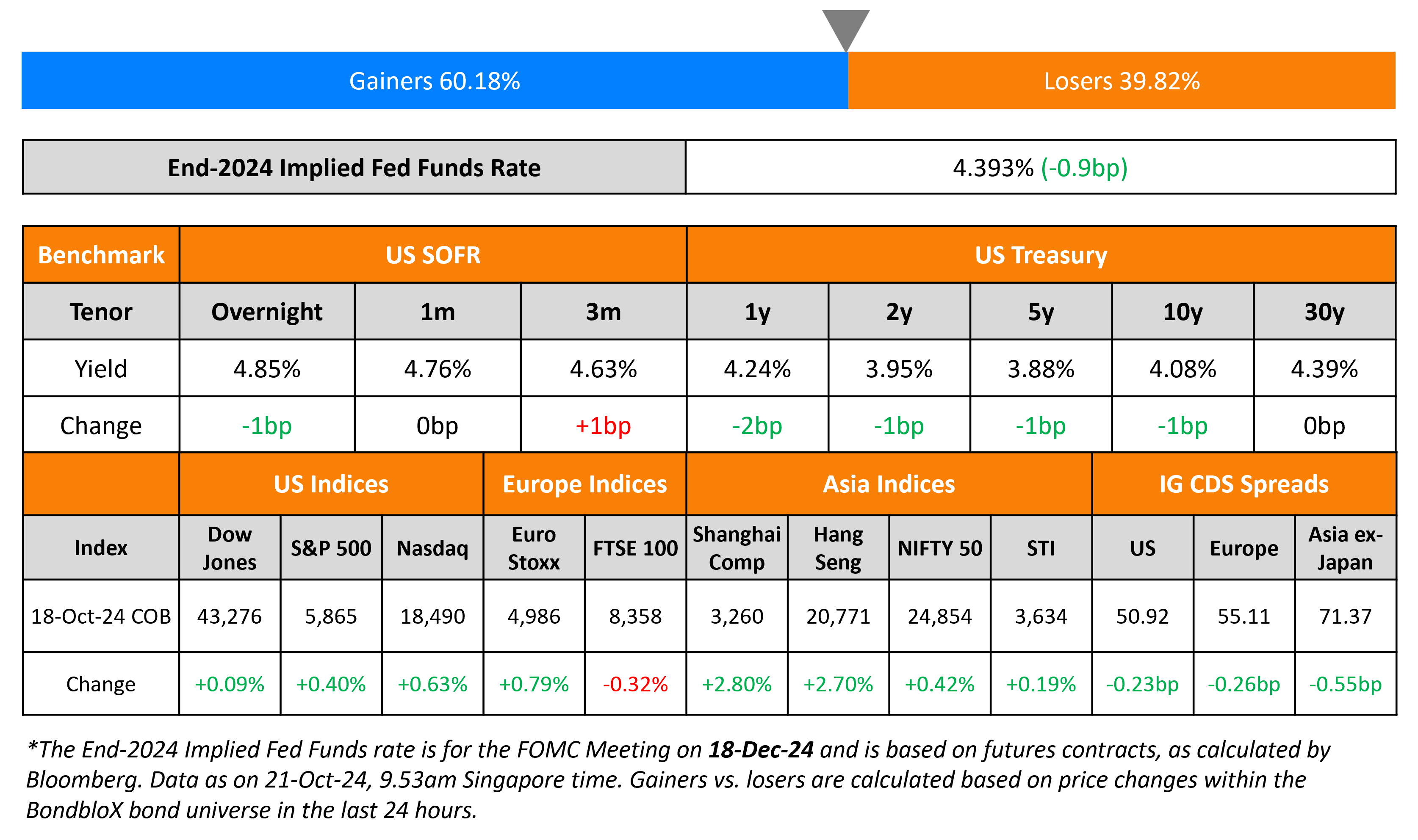

October 21, 2024