This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vanke Sets Up $220mn Housing JV With Government Insurers

February 20, 2025

China Vanke has set up a RMB 1.6bn ($220mn) rental housing joint venture with a pair of government insurers, according to an announcement on Tuesday. Vanke said that it has joined with New China Life Insurance (NCI) and Dajia Insurance Group to invest in a new fund that will acquire a 7,700-unit rental apartment project in Xiamen. The two insurers will take a combined 90 percent stake in the fund managed. A pair of Vanke subsidiaries will retain 10% and CITIC Goldstone Fund Management will take a 0.06% stake and act as its fund manager. The cash inflows may help Vanke to repay its $4.9bn debt payments in 2025. This is the second time that Vanke has announced cash inflows since Xin Jie, who heads its largest shareholder Shenzhen Metro Group, took over as chairman of the developer. Vanke had also previously secured a RMB2.8bn ($385mn) three-year loan from Shenzhen Metro. Chinese authorities have previously considered a plan to allocate RMB 20bn ($2.74bn) in special local government bonds to buy unsold properties and vacant land from Vanke.

Its dollar bonds traded stable with its 3.5% 2029s at 63.25 cents on the dollar.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

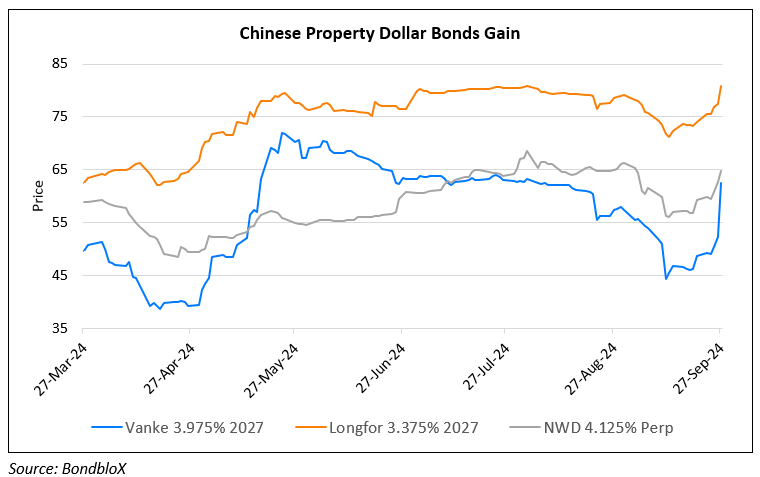

China Property Bonds Continue to Trend Higher

September 27, 2024

S&P Upgrades Yanlord by One Notch to ‘BB’

March 16, 2018