This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

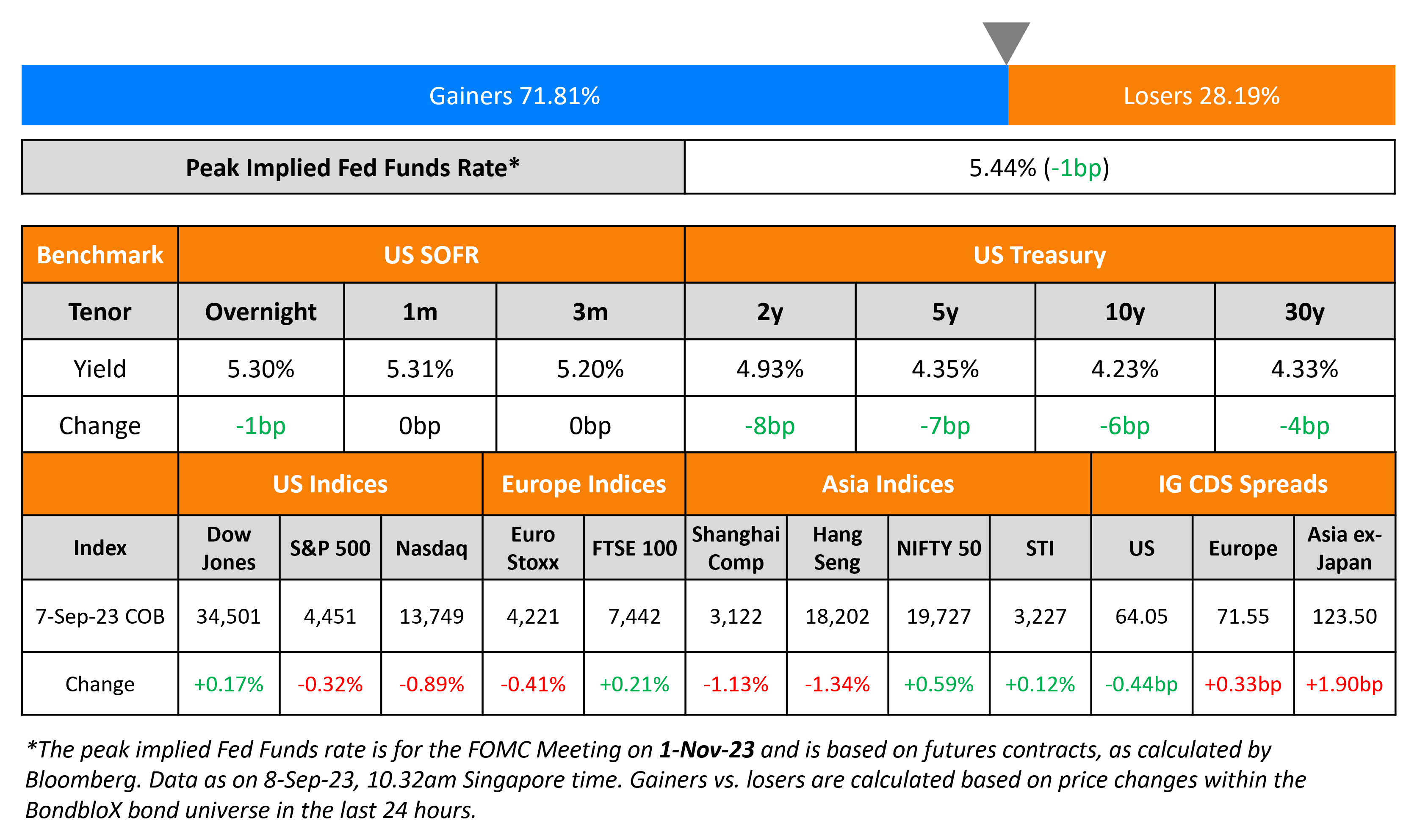

US Treasury Yields Ease Across the Curve

September 8, 2023

US Treasury yields dropped by 6-8bp across the curve on Thursday, reversing the rise in yields seen a day prior. US initial jobless claims for the prior week decreased by 13k to 216k, below estimates of 234k. Dallas and New York Fed Presidents Lorrie Logan and John Williams toned down the scope of a rate hike by the Fed. Logan said that skipping could be appropriate in September, adding that “skipping does not imply stopping”. Williams said that it is still an “open question” regarding future rate hikes. Tech stocks were under pressure with Nasdaq falling 0.9%, partly driven by concerns about Apple iPhone sales in China. This comes after China indicated its plan to expand a ban on the use of iPhones in sensitive departments to government-backed agencies and state companies. S&P fell 0.3%. US IG CDS spreads were 0.3bp wider and HY spreads tightened 3.2bp.

European equity markets were also lower yesterday. In credit markets, European main CDS spreads were wider by 0.3bp with crossover spreads widening 1.3bp. Asian equity markets have opened weaker this morning while Asia ex-Japan CDS spreads widened by 1.9bp yesterday.

New Bond Issues

DP World raised $1.5bn via a 10Y green bond at a yield of 5.5%, 30.2bp inside initial guidance of T+150bp area. The senior unsecured bonds have expected ratings of Baa2/BBB+ (Moody’s/Fitch), and received orders over $3.4bn, 2.3x issue size. The bonds have a change of control put at 101, and a 75% clean up call. Proceeds will be used to fund/refinance certain eligible projects in accordance with the Sustainable Finance Framework.

BOC London raised $600mn via a 3Y green FRN at a yield of 5.925%. The floating coupon will reset at the overnight SOFR plus a spread of 59bps and will be paid quarterly. The senior unsecured bonds have expected ratings of A1/A/A. Proceeds will be used to finance/refinance eligible green projects as defined in the Bank of China sustainability statement.

Braskem Netherlands raised $850mn via a long 7Y bond at a yield of 8.75%, 25bp inside initial guidance of 9% area. The senior unsecured bonds have expected ratings of BBB-/BBB- (S&P/Fitch). Proceeds will be used for general corporate purposes, which may include, but it is not limited to, the prepayment of certain outstanding debt.

Rating Changes

- Credit Suisse Entities Upgraded To ‘A+’ On Improved Support Prospects; Ratings On UBS Entities Affirmed

New Bond Pipeline

- LG Energy hires for $ 3Y and/or 5Y Green bond

Term of the Day

Change of Control Put

A change of control put is a common covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Talking Heads

On skipping September rate hike, but ‘there is work left to do’ – Dallas Fed President, Lorrie Logan

“Forecasts are inherently uncertain. My base case, though, is that there is work left to do. After the unacceptably rapid price increases of the past several years, I’m not yet convinced that we’ve extinguished excess inflation… Another skip could be appropriate when we meet later this month… skipping does not imply stopping”

On ‘open question’ whether Fed will need to hike again – NY Fed President, John Williams

“Things are moving in the right direction and we’ve got policy in a good place, but we’re going to need to continue to be data dependent, watch developments and assess what we need to do… we’re going to adapt and change in a way that is appropriate… it’s pretty clear we’re restrictive… still an open question as we go forward”

On Private Credit’s $10bn Win Being Bad News for Wall Street

Ranesh Ramanathan, co-leader of Akin Gump Strauss Hauer & Feld, private credit

“It’s private credit coming out of the shadows. Private credit is now part of the recognized pool of capital you’d look to”

Barclays strategists

“With alternative financing sources such as private credit and secured bonds continuing to take share from loan primary markets”

On EM Close to Erasing 2023 Gains as Gloom Deepens

Piotr Matys, a currency analyst at ITCM

“Sluggish growth in China, a persistently hawkish Fed and the prospects of stagflation in the Eurozone are not particularly conducive factors for EM currencies”

Top Gainers & Losers- 08-September-23*

Go back to Latest bond Market News

Related Posts: