This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

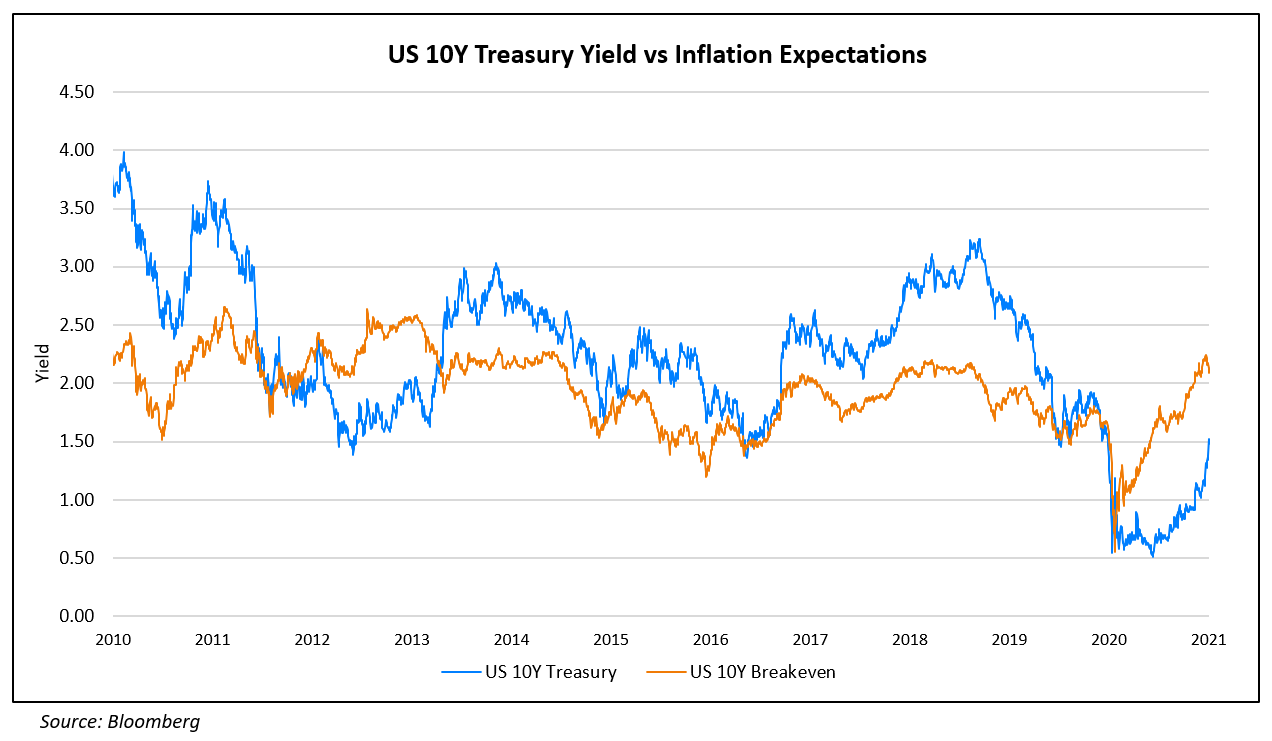

US Treasury Yields Continue Its Journey Upwards

February 26, 2021

US Treasury yields hit an intraday high of 1.61% yesterday before retreating to less than 1.5%. Market participants have attributed this to inflation expectations rising as fiscal and monetary policy has loosened. Here, we take a look at inflation expectations and US 10Y Treasury yields with inflation expectations being measured by the 10Y breakeven inflation rate. Looking at historical moves in US Treasuries over the last 6 years, inflation expectations have been around 1.5% to 2%. During this time period, despite loose policy, 10Y yields have been in the range of 1.5%-3%, hovering largely above 2%. A closer look at the chart also shows that while 10Y yields have risen 40bp MTD and 13bp in the last week, inflation breakevens have fallen 3bp and 9bp respectively.

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed’s Dudley Shakes Up Complacent Markets

June 20, 2017