This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasuries Rally Sharply On ‘Flight to Safety’ Flows And Dovish Commentary

October 10, 2023

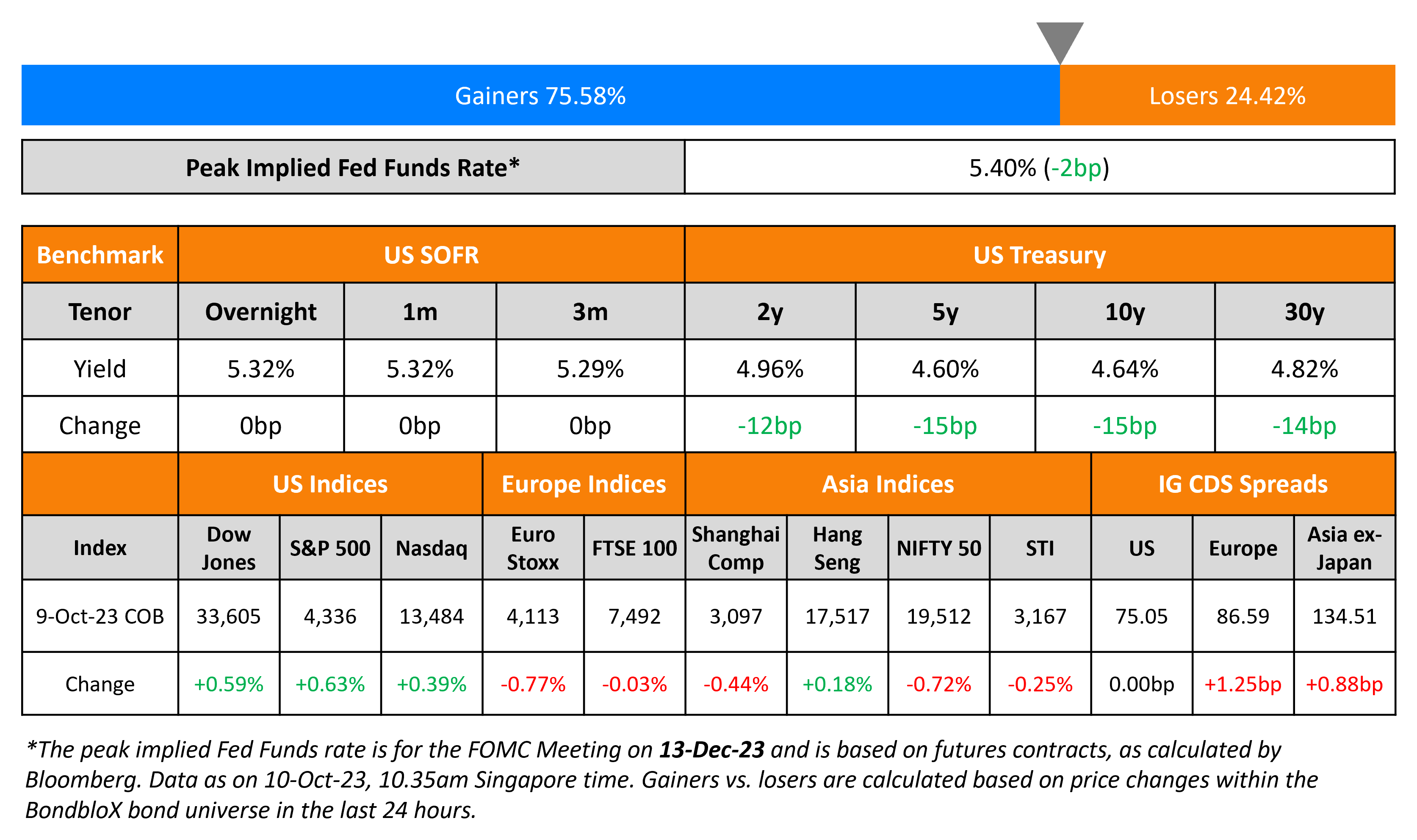

US Treasuries saw a sharp rally, the most since March as yields tumbled by 12-15bp across the curve. This was after the conflict in the Middle East fuelled a flight to safer assets alongside some dovish comments by Fed officials. Fed Vice Chair Philip Jefferson said that he would “remain cognizant of the tightening in financial conditions through higher bond yields” while voting member and Dallas Fed President Lorie Logan said the recent rise in long-term treasury yields may indicate less need for them to raise rates again. US credit markets were closed due to a bond market holiday. US equities jumped higher with the S&P and Nasdaq rising 0.6% and 0.4% respectively.

European equity markets ended lower. In credit markets, European main CDS spreads were wider by 1.3bp and crossover spreads widened 7.4bp. Asian equity markets have opened with a positive bias this morning. Asia ex-Japan IG CDS spreads widened 3.7bp.

New Bond Issues

New Bond Pipeline

- Oman Telecom hires for $ 7Y sukuk bond

Rating Changes

- Fitch Upgrades Tata Steel to ‘BBB-‘; Outlook Stable

- Fitch Upgrades 5 Omani Banks’s IDRs on Sovereign Rating Action; Outlooks Stable

- Moody’s downgrades West China Cement’s CFR to Ba3; outlook remains negative

Term of the Day

Cat Bonds

Catastrophe bonds also referred as Cat bonds are risk-linked securities that are designed in favor of the issuer as these allow the transfer of risks related to a major catastrophe or a natural disaster to the investors. These are generally high yield debt instruments that payout to issuers in case of specific triggers. These bonds essentially act as insurance policies for the issuer against natural disasters, where they pay regular coupons (premium) in exchange for protection. In the event of a natural disaster trigger, issuers will receive a payout from the proceeds of the bond and the principal repayment and interest payments are either deferred or cancelled. If a trigger event doesn’t occur, the issuer continues to pay the coupons as scheduled, similar to a regular bonds and proceeds are returned to the investors at maturity. Cat bonds are generally purchased by governments, insurance and reinsurance companies. These bonds have gained traction as the frequency of natural disasters is on the rise.

Talking Heads

On ‘Stay Boring’ – Riding Out Bond Volatility

Altaf Kassam, head of investment strategy and research for EMEA at State Street

“Stay boring. Euro short-dated investment grade corporates give you the best yield for risk”

Stefan Hofrichter, chief economist at Allianz Global

“While I fully understand that it’s tempting to buy duration today, I’m not sure that we have seen the peak in yields”

Eric Vanraes, head of fixed income at Eric Sturdza Investments

“Nobody wants to buy the long end of the curve. Why should I buy bonds below 5% which have higher duration when I can buy into money markets?”

On Hedging Power of Treasuries Tested by Recent Bond Selloff

Torsten Slok, chief economist, Apollo Global Management

“For investors in the 60/40 portfolio, the ongoing volatility in a high rates environment is stomach-churning. With an outlook of high rates and slowing earnings — which is needed to get inflation under control — the outlook for the 60/40 portfolio remains negative”

Bloomberg Intelligence analysts

“The relationship between US stocks and bonds, which has been largely negative for several decades, has rapidly turned positive… this shift in their correlation hints we could be entering a new era “

On One Bond Market Defying the Global Selloff With Record Returns

Steve Evans, owner of Artemis

“There’s been a repricing of catastrophe risk around the globe, especially in places like California, Florida and Australia… return potential has roughly doubled in the last decade.”

Palmer of Swiss Re

“We’re very bullish” on cat bonds… It’s a very technical, complex financial product that’s not suitable for every investor, but we believe it’s a fundamental part of the reinsurance market today”

On Treasury’s Debt Deluge Finally Straining US Funding Markets

BofA strategists

“Funding markets are evolving to show clearer signs of modest upward funding pressure. Money market cheapening is likely to build further and it may present a greater headwind to liquidity-strained banks… Dealers & investors are likely increasingly long collateral and need help funding it”

Top Gainers & Losers- 10-October-23*

Go back to Latest bond Market News

Related Posts: