This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasuries Continue to Rally; OUE Reit Launches S$ 3Y

June 5, 2024

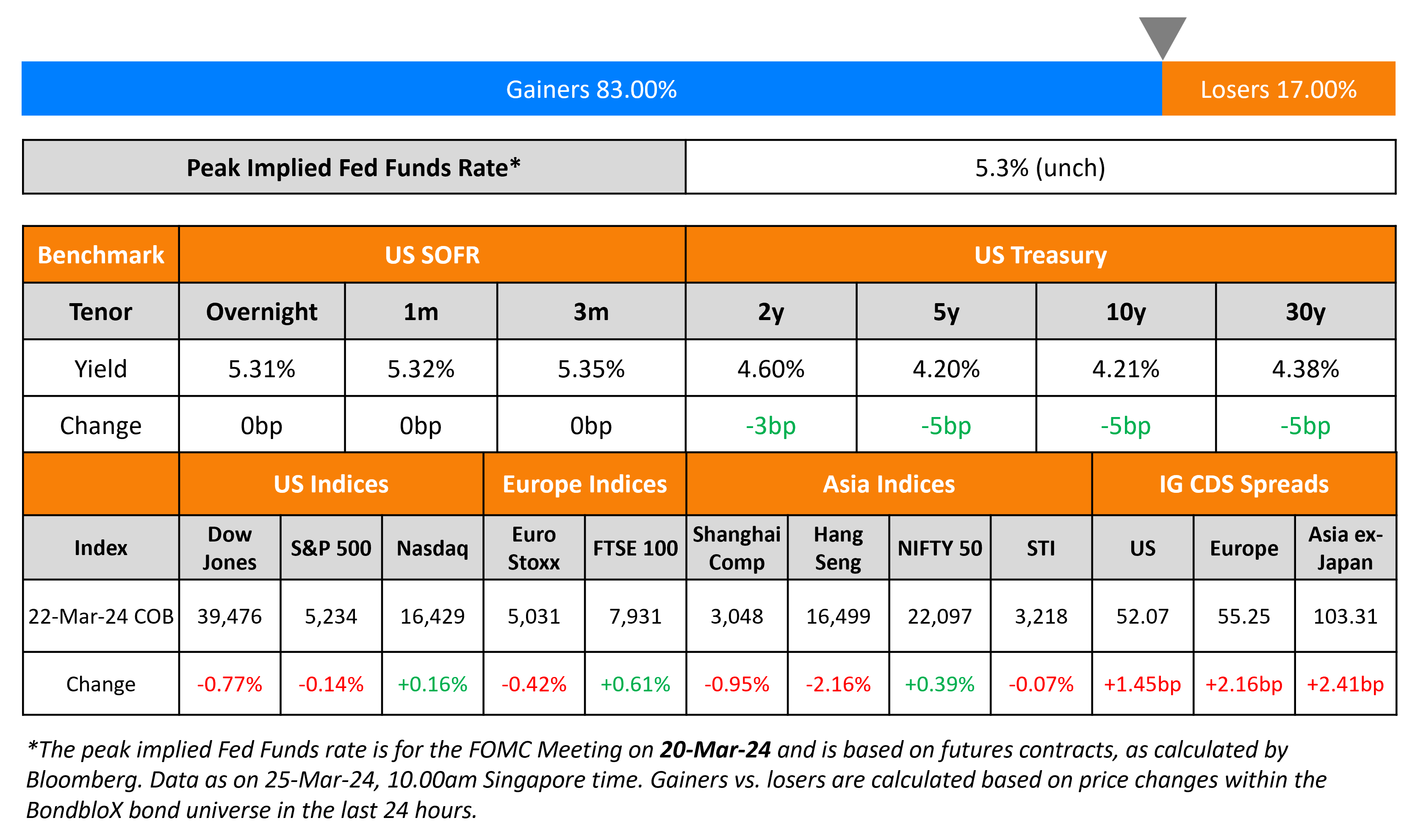

US Treasury yields continued to fall, by 4-7bp on Tuesday, on the back of softer than expected data. The final reading of US Durable Goods Orders showed a 0.6% growth vs. expectations of 0.7% and Core Durable Goods Orders came at 0.4%, inline with expectations. The JOLTS Job Openings fell to 8.059mn in April vs. expectations of 8.35mn, its lowest reading since February 2021. Also, the job openings in March were revised lower. Equity markets ended marginally higher, with the S&P and Nasdaq up 0.2% each. US IG CDS spreads widened 1.2bp and HY spreads were 0.8bp tighter.

European equity markets ended lower. Europe’s iTraxx main CDS spreads were 1.2bp wider and crossover spreads were wider by 6.5bp. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads widened 0.2bp.

New Bond Issues

- OUE Reit S$ 3Y Green at 4.35% area

BBVA raised €750mn via a PerpNC7 AT1 bond at a yield of 6.875%, 50bp inside initial guidance of 7.375% area. The junior subordinated bonds are rated Ba2/BB (Moody’s/Fitch), and received orders of over €1.15bn, 1.5x issue size. Coupons are fixed until 13 June 2031 and if not redeemed, resets then and every five years thereafter at the 5Y MS+426.7bp. A trigger event would occur if at any time, the CET1 ratio of the bank or the group, falls below 5.125%. The new bonds offer a yield pick-up of 30.5bp to Intesa Sanpaolo’s 5.875% Perp callable in September 2031, that currently yield 6.57%.

Citigroup raised $2.5bn via a 11NC10 bond at a yield of 5.449%, 22.5 inside initial guidance of T+135bp area. The senior unsecured notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes and further strengthening its capital base.

Senegal raised $750mn via a 7Y bond at a yield of 7.75%. The original $500mn issuance was sold on Monday and increased by $250mn on Tuesday. It is the fourth sub-Saharan African nation to tap the market this year. This comes after bouts of political uncertainty and is expected to provide buffer to meet potential additional financing needs.

Suntory Holdings raised $500mn via a 5Y bond at a yield of 5.124%, 18bp inside initial guidance of T+95bp area. The senior unsecured bonds are rated Baa1/BBB+. Proceeds will be used for general corporate purposes including repayment of existing bonds.

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

- Continuum Green Energy India hires for $ green bond

- Paratus Energy Services hires for $ 5Y bond

Rating Changes

- Bombardier Inc. Upgraded To ‘B+’ From ‘B’ On Continued Deleveraging; Outlook Stable

- Fitch Upgrades Dubai Aerospace Enterprise to ‘BBB’; Outlook Stable

- Moody’s Ratings downgrades Altice International to Caa1 from B3; outlook negative

- Outlook On UBS Holdings Revised To Stable On Decreasing Tail Risks; Ratings Affirmed

Term of the Day

JOLTS Job Openings

This is a survey number collected by the BLS, measuring the number of job vacancies on the last business day of the month in question. This helps give a more detailed picture of the labor market in the US, besides the typical Non-Farm payrolls (NFP), ADP Payrolls, weekly jobless claims and other metrics. A job is open if it meets all three of the following conditions:

– A specific position exists and there is work available for it

– The job could start within 30 days, whether or not the establishment finds a suitable candidate

– There is active recruiting for workers from outside the establishment location that has the opening

Talking Heads

On US dollar to weaken, but Fed rate cuts are required – Strategists

Jane Foley, head of FX strategy at Rabobank

“We think U.S. inflation could be picking up again by the middle of the year and the Fed easing cycle could be really very short”

Brian Rose, senior economist at UBS Wealth Management

“We’re expecting the dollar to generally lose ground against other currencies…once the Fed starts to cut… not looking for any kind of dollar collapse”

On Higher US Long-Term Treasury Yields Over Time – Fmr. US Treasury Secy, Larry Summers

“Markets should be getting used to rates in current ranges for the foreseeable future… need to adjust ourselves to a 4 1/2% neutral rate as a reasonable best guess.. probably means less Fed cutting”

On ‘Generational Reset’ on Yields to Spur a Bond Revival – Pimco

“Active fixed income is positioned to perform well if there are no recessions over our secular horizon and to perform even better if there are… bonds may be an inexpensive means to hedge that risk (recession risk)

Top Gainers & Losers- 05-June-24*

Go back to Latest bond Market News

Related Posts:

Garanti, Royal Caribbean Price $ Bonds

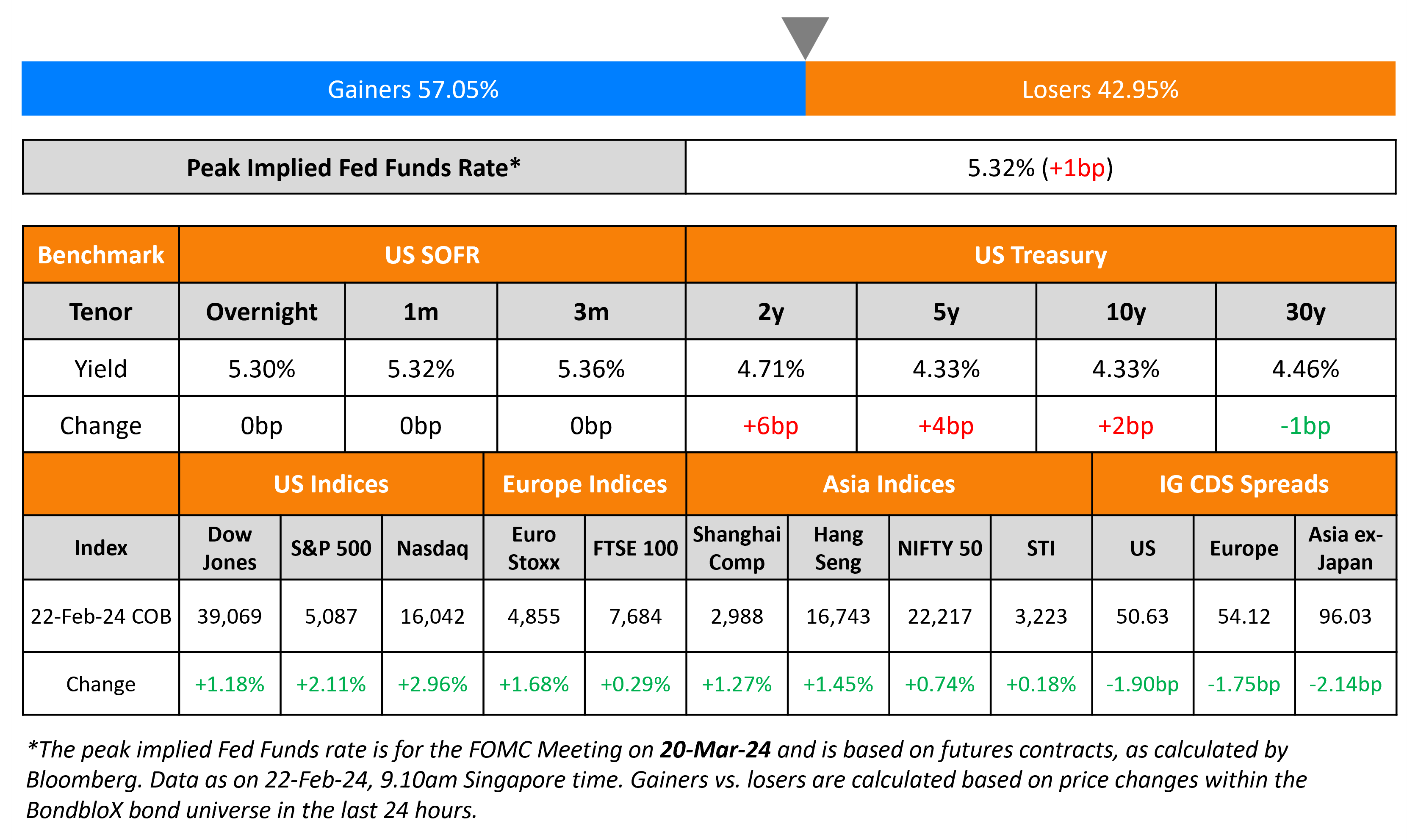

February 23, 2024