This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US PMI Data Comes in Stronger Than Expected

June 24, 2024

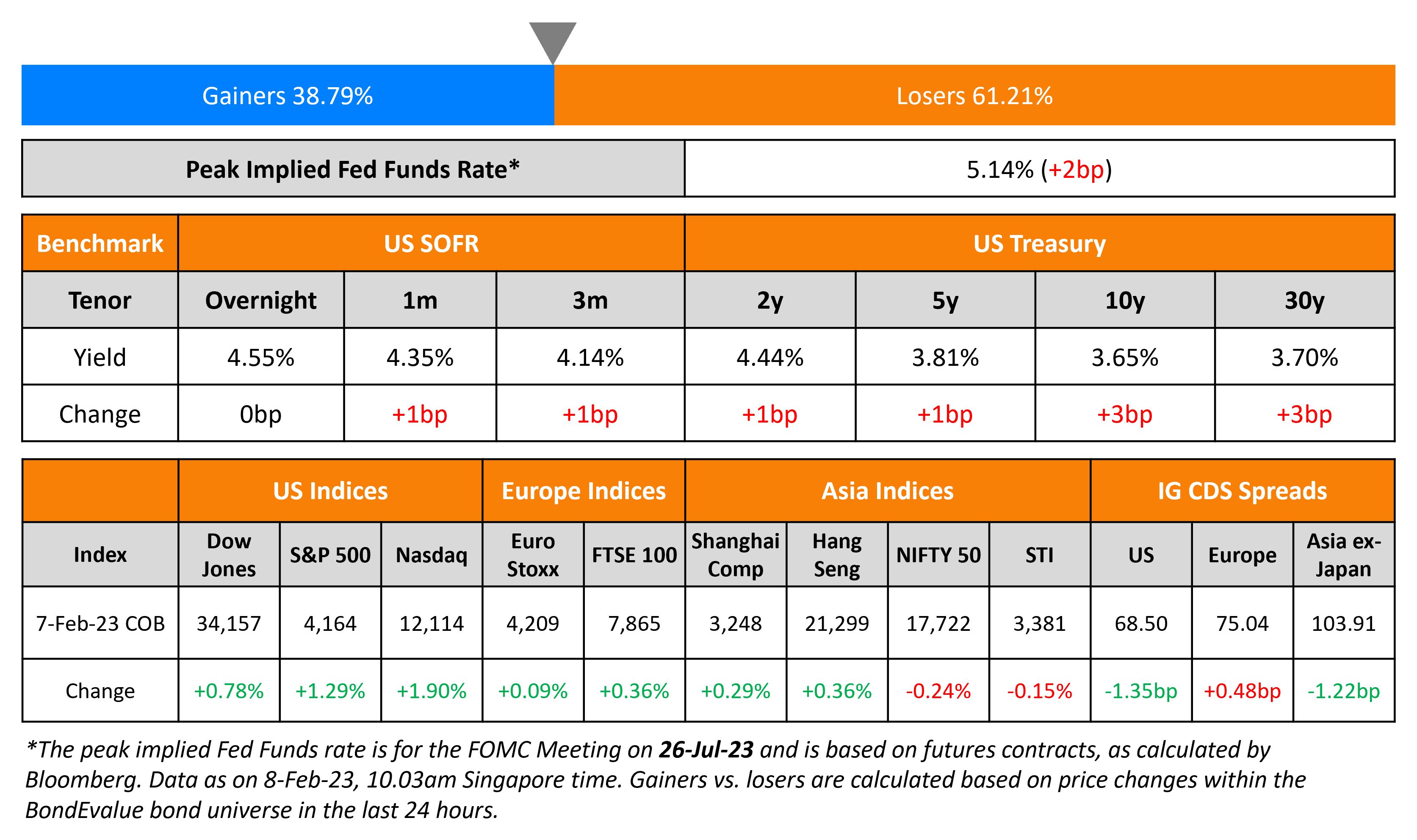

Treasuries traded stable across the curve with the 2Y and 10Y at 4.73% and 4.25% respectively. The preliminary US S&P PMIs for June were released on Friday, with data coming in stronger than expected. The Manufacturing PMI came at 51.7 vs expectations of 51.0 and the Services PMI came at 55.1 vs. expectations of 54.0. The Leading Index for May dropped by 0.5%, worse than expectations for a 0.3% drop. Looking at equity markets, S&P and Nasdaq closed lower by ~0.2% each. US IG spreads remained broadly stable with HY CDS spreads tightening by 1.3bp.

European equity indices ended lower across the board. In credit markets, the iTraxx Main and Crossover spreads were wider by 1.6bp and 4bp respectively. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads were largely unchanged.

New Bond Issues

New Bonds Pipeline

- Bangkok Bank hires for $ 10Y bond

Rating Changes

- Moody’s Ratings upgrades Autopista Central’s ratings, outlook stable

- Office Properties Income Trust Downgraded To ‘SD’ From ‘CC’ Following Debt Exchange

- Samvardhana Motherson Automotive Systems Group Outlook Revised To Positive; ‘BB’ Ratings Withdrawn At Issuer’s Request

- Fitch Revises Georgia’s Outlook to Stable; Affirms at ‘BB’

Term of the Day

PMI

PMIs or Purchasing Managers’ Index are an index composed of a monthly survey of purchasing managers/supply chain managers across industries. This is a diffusion index, a statistical measure of summarizing the common tendency of a series – if there are more number of values rising than falling, the index is above 50 and the index goes below 50 if the falling values exceed those rising. For PMIs, a value below 50 indicates contraction and a value above 50 shows expansion. These surveys are taken over different areas of the supply chain business: New Orders, Employment, Inventories, Supplier Deliveries and Production covering imports, exports, prices and backlogs. In most countries, Markit publishes the PMI numbers while other organizations publish them too. Markit generally publishes the month’s PMIs in last week of the month.

Talking Heads

On High-Grade Company Bonds Increasingly Trading Near Junk Levels

Michael Best, a PM at Barings

“We are going up there and finding good credits with comparable spreads and yields to high-yield bonds”

Yuri Seliger, strategist for BofA

“In investment grade, for your BBBs you are making as much spread income as BBs are offering”

Taylor Huffman, client PM at PT Asset Management

“We currently believe the best value is in BB”

On Global Bonds Up as Weak European Data Boosts Rate-Cut Bets

Mark Haefele, CIO Global Wealth Management at UBS Group

“The global rate-cutting cycle is likely to gather momentum in the second half… expect bond yields to fall as the market shifts focus from the timing of the first Fed rate cut “

Valentin Marinov, Credit Agricole.

“The French PMIs are out and we’re maybe getting the first glimpses of the contagion from the political turmoil “

On Potential Shocks Mean ECB Can’t Precommit on Rates – ECB Member Isabel Schnabel

“We could be threatened by new price shocks. That’s why we are on alert and haven’t precommitted to a fixed rate path… staying data dependent”

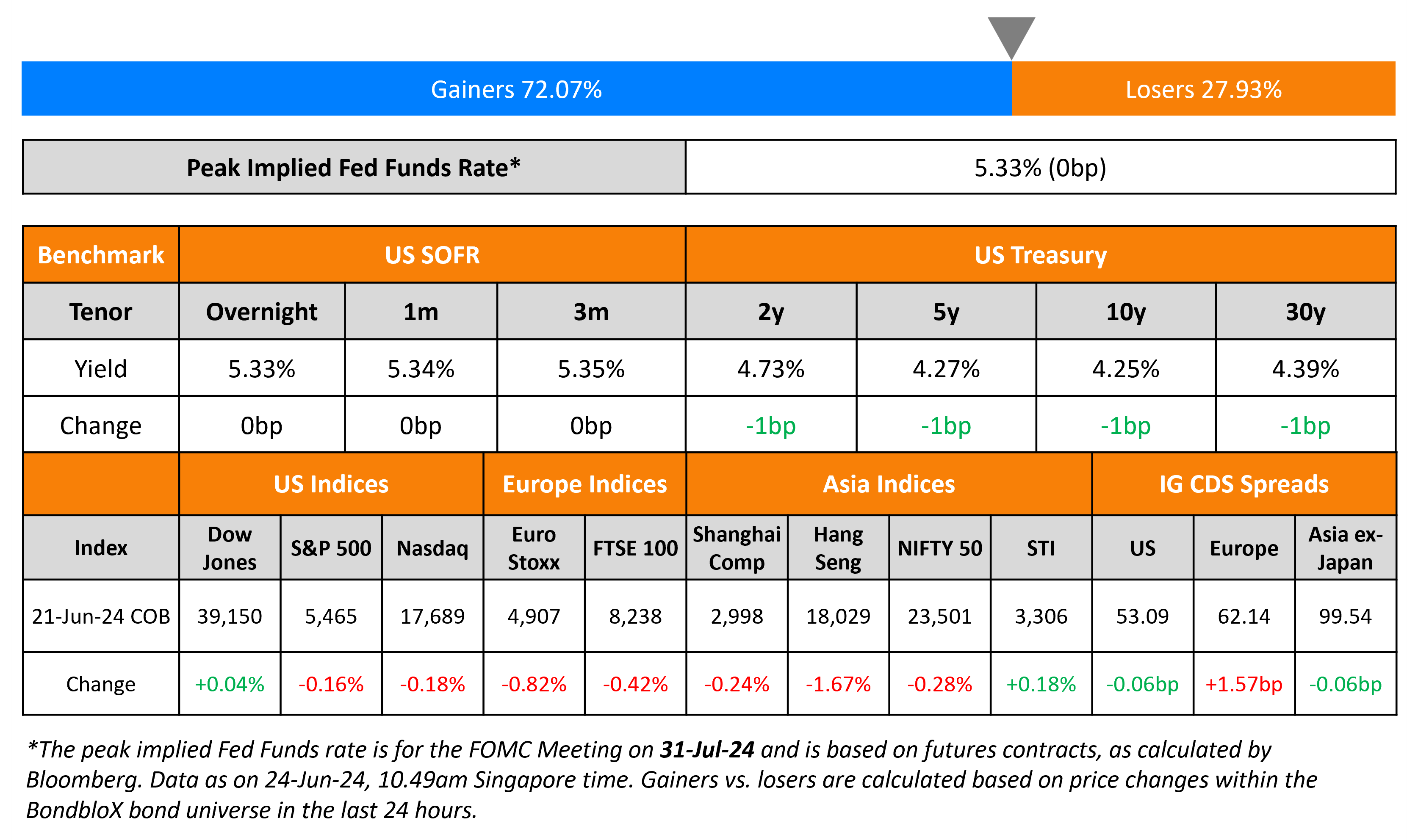

Top Gainers & Losers- 24-June-24*

Go back to Latest bond Market News

Related Posts: