This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

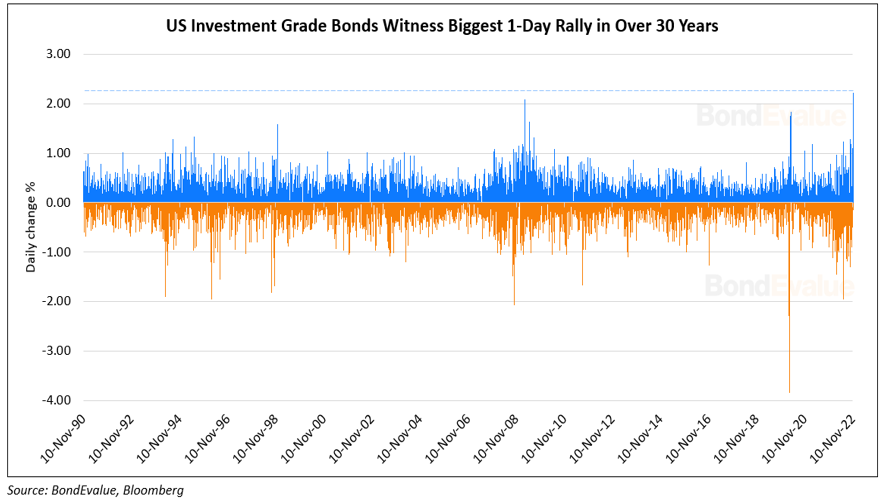

US Investment Grade Index Sees Its Largest 1-Day Change in Over Three Decades

November 11, 2022

The US Investment Grade dollar bond index saw its biggest single-day rally in over three decades as treasuries rallied by 25-30bp across the curve (see chart above). Some of the top gainers from yesterday’s rally included sovereigns like Egypt and Nigeria that saw its dollar bonds rise by over 5%. IG names including the likes of Apple, Amazon, Alphabet and others saw their bonds rise by over 3 points across the curve. Investment grade bonds typically have a higher duration than high yield bonds, making them more sensitive to the moves in US benchmark treasury yields. US CPI came in at 7.7% for October, lower than expectations of 7.9%. Core CPI came at 6.3%, also lower than expectations of 6.5%. The softer than expected inflation print saw a risk-on rally across treasuries and credit markets with US IG CDS spreads tightening by 9.4bp and HY CDS spreads seeing a 54bp tightening.

Go back to Latest bond Market News

Related Posts:

StanChart’s Profits Up 2x to $1bn

April 30, 2021