This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Tencent To Set Up Financial Holding Co as per Regulators

May 27, 2021

Chinese regulators have now put their focus on tech major Tencent, ordering them to set up a financial holding company following a similar move by the regulators towards Alibaba’s Ant Group, as per Caixin. The move is to put the Pony Ma-led company’s financial operations into a separate unit in order to better supervise it. This comes after the regulators conducted a joint supervision interview with 13 tech companies including Tencent, JD Finance, ByteDance, Meituan Finance, Didi Finance and Lufax earlier this month. Similar to Ant, Tencent will be required to submit a reorganization plan to regulators indicating which financial businesses will be absorbed by the new holding company. Regulation Asia reported that this is part of PBOC’s new rules issued in September last year, under which “nonfinancial firms that own financial institutions in at least two different sectors are required to obtain licenses to operate as financial holding companies.” Tencent’s financial businesses include its payments platform WeChat Pay, its wealth management platform LiCaiTong and an online lending service offered by WeBank.

Tencent’s 2.88% 2031s are trading slightly lower at 101.87 yielding 2.66% on the secondary market.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Tencent Beats Estimates with a 175% Jump in Q4 Profits

March 25, 2021

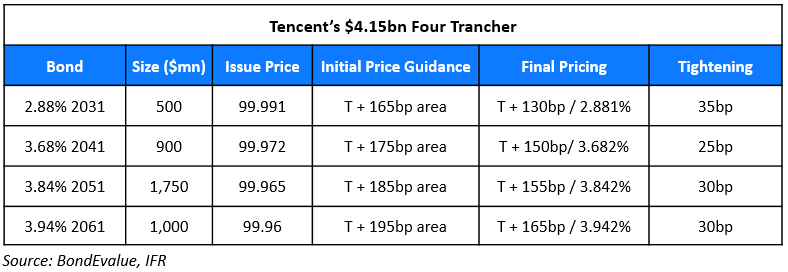

Tencent Raises $4.15bn via Four Trancher

April 16, 2021

Tencent Profits Rise 65% Led By Gaming

May 21, 2021