This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Financial Institutions’ Perps Drop; FDIC Plans to Hit Big Banks With Fees for Deposit Insurance Fund

May 5, 2023

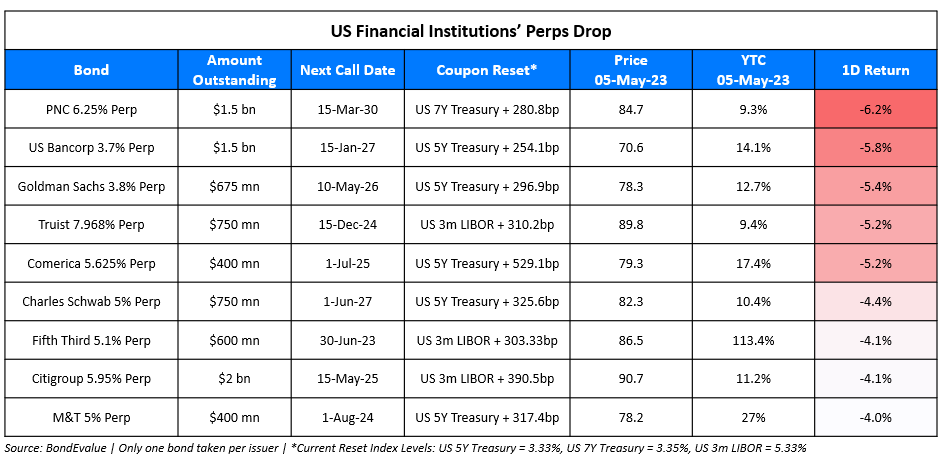

US financial institutions’ perps led by banks fell across the board yesterday as banking sector fears continue to weigh on markets. Perps of PNC Financial Services, US Bancorp, Charles Schwab, Goldman Sachs and several others took a hit, falling 3-6%. Bloomberg reported that the FDIC was planning to release a proposal for refilling its Deposit Insurance Fund by levying “special assessment” fees that would hit big banks. Details regarding the fee charges were not available. As per Bloomberg, smaller lenders with less than $10bn in assets would not have to pay the fee while bigger lenders would all face the same fee structure. They noted that the fee for big banks’ deposits would be the same irrespective of the riskiness of the deposits. Big banks may therefore be required to commit more capital due to their balance sheet size and number of depositors.

In the table above, we have listed the biggest losers across perpetuals in yesterday’s session from the US banking and financial services sector.

Go back to Latest bond Market News

Related Posts: