This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US CPI and Core CPI In-Line With Expectations; China, BP Capital, Swedbank Price $ Bonds

November 14, 2024

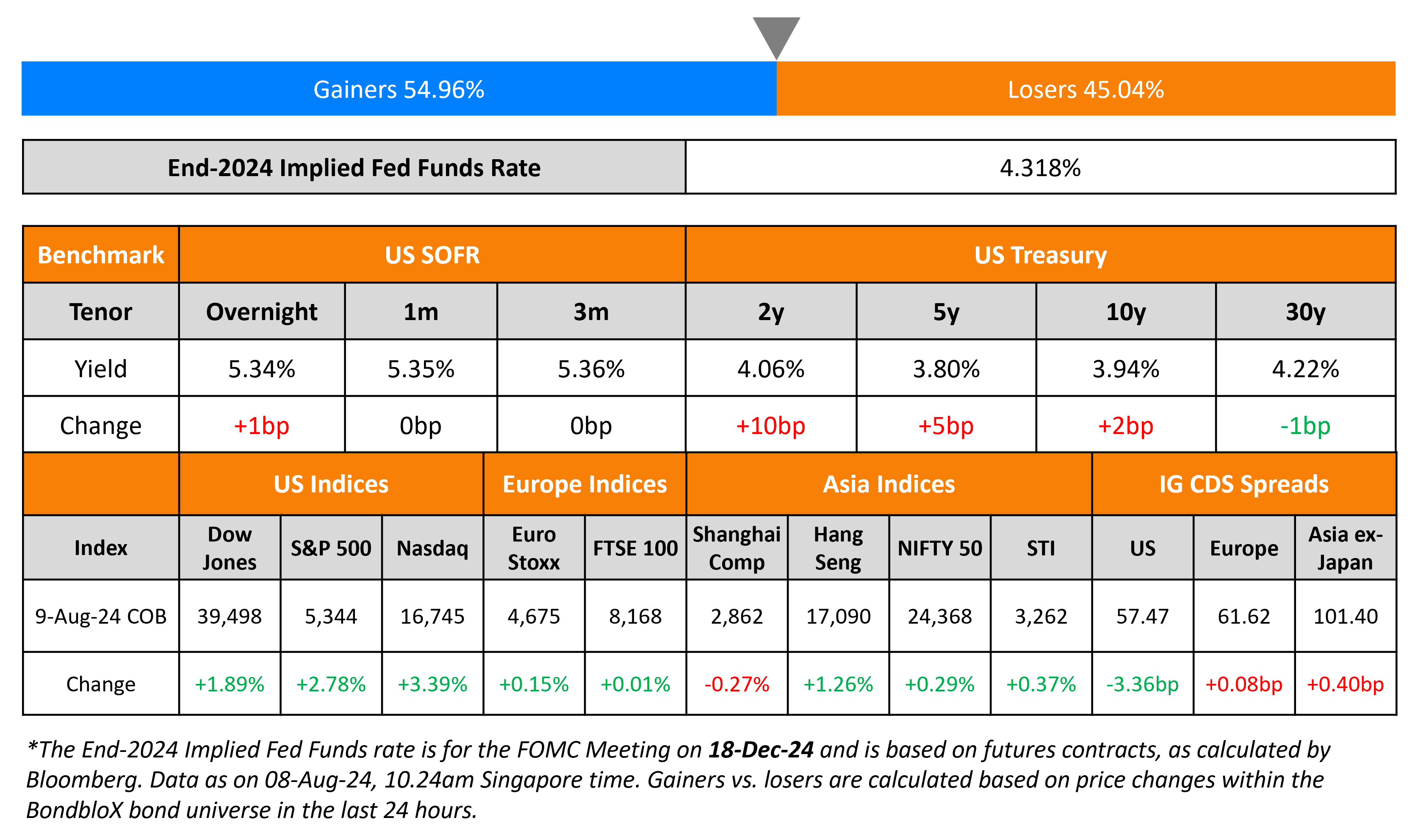

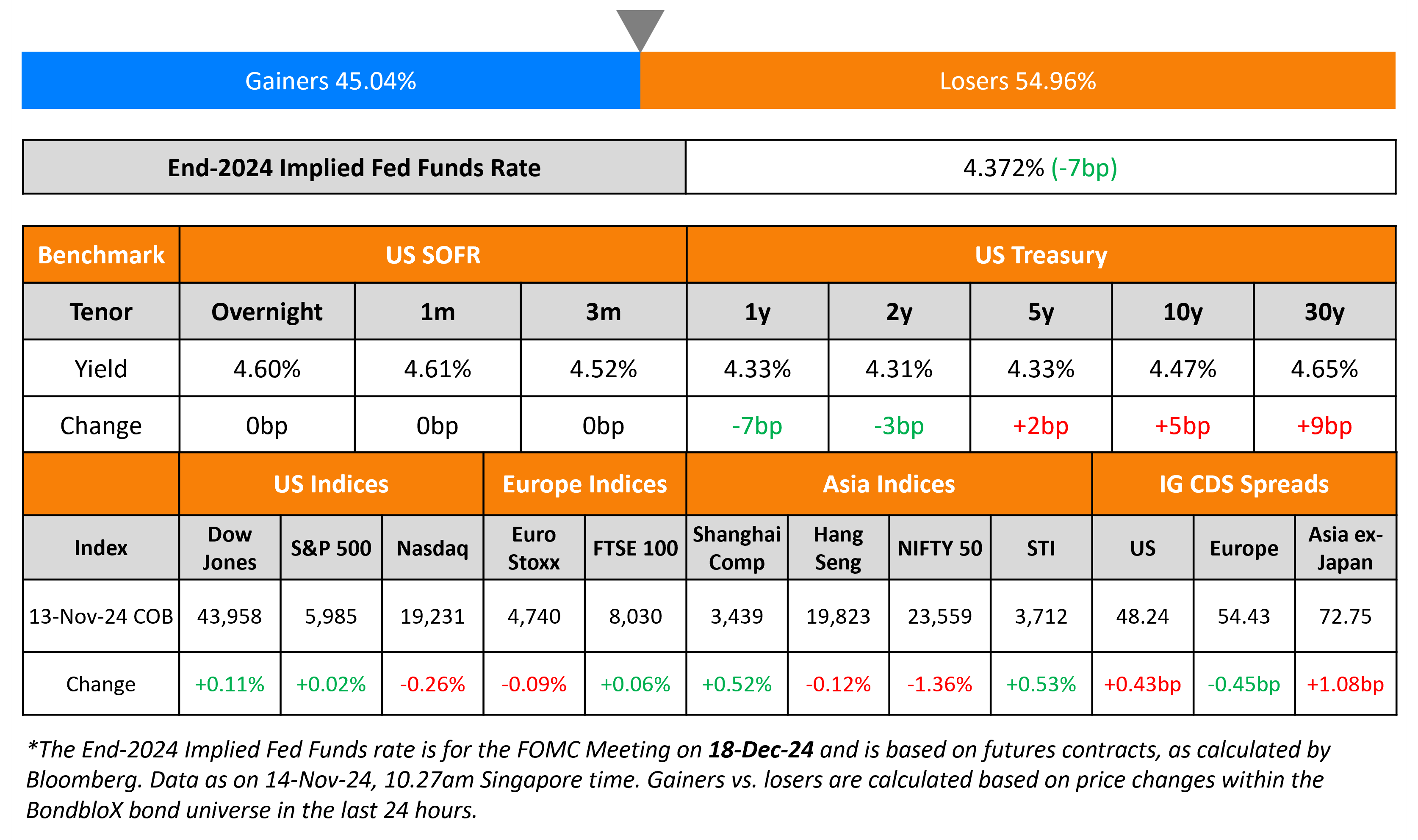

The US Treasury yield curve steepened yesterday, with the 10Y yields rising by about 5bp, while the 2Y fell 3bp. US CPI for October came-in at 2.6% (vs. 2.4% last month), and the Core CPI came in at 3.3% (vs. 3.3% last month). Both readings were in-line with market expectations, and traders have nearly priced-in a 25bp rate cut at the FOMC’s next meeting in December. Over the past week, Fed speakers’ remarks indicate a consensus that, while the restrictiveness of the monetary policy is bound to be dialed back, the Fed must proceed in a cautious manner as persistent inflation risks are still lingering. US IG and HY CDS spreads widened by 0.4bp and 1.4bp respectively. US equity markets closed broadly mixed, with the Nasdaq closing 0.3% lower and the S&P closing relatively flat.

European equities were mixed across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.5bp and 1.4bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads widened by 1.1bp.

New Bond Issues

- Singapore Power $ 5Y at T+75bp area

BP Capital Markets raised $1.25bn via a PerpNC10 bond at a yield of 6.125%, ~31.25bp inside initial guidance of 6.375-6.5% area. The bonds are callable from 18 March 2035 to 18 June 2035, and if not called by then, the coupon resets to the US 5Y yield plus 167.4bp, in addition to a step-up of 25bp. Again, if not called by 18 June 2055, the coupon steps-up for a second time by another 75bp. Proceeds will be used for general corporate purposes, including working capital and repayment of existing borrowings of BP and its subsidiaries.

China raised $2bn via a two-part deal. It raised $1.25bn via a 3Y bond at a yield of 4.284%, 24bp inside initial guidance of T+25bp area. It also raised $750mn via a 5Y bond at a yield of 4.34%, 27bp inside initial guidance of T+30bp area. The senior unsecured notes are rated A1/A+/A+, and received orders of over $40bn, 20x the offer size. As per Bloomberg, traders said this was partly from demand by Chinese investors hunting for higher returns globally as local rates have moved lower. Also, such investors can also benefit from tax exemptions on the nation’s sovereign debt. Proceeds will be used for general governmental purposes. The new 3Y bond was priced at a new issue premium of 19bp over its existing 7.5% 2027s that yield 4.09%. The new 5Y bond was priced at a new issue premium of 20bp over its existing 2.125% 2029s that yield 4.14%. Both new notes were priced almost the same as US Treasuries, having tightened by 24bp and 27bp respectively.

Swedbank raised $1bn via a two-part deal. It raised $650mn via a 5Y bond at a yield of 4.998%, 20bp inside initial guidance of T+90bp area. It also raised $350mn via a 5Y FRN at SOFR+103bp vs. initial guidance of SOFR equivalent area. The senior non-preferred notes are rated Aa3/A+/AA. Proceeds will be used for general corporate purposes. The 5Y fixed rate notes were priced ~8bp tighter to its existing 5.407% 2029s that yield 5.08%.

Commerzbank raised €500mn via a 12.25NC7.25 bond at a yield of 4.248%, 35bp inside initial guidance of T+130bp area. The senior unsecured notes are rated Baa3/BBB-. If not called by 20 February 2032, the coupon resets to the 5Y MS+195bp. Net proceeds will be used exclusively to finance or refinance, in whole or in part, eligible new and existing green assets in accordance with its green funding framework.

New Bond Pipeline

- Tata Capital hires for $ bond

Rating Changes

-

Moody’s Ratings upgrades Royal Caribbean Cruises Ltd.’s corporate family rating to Ba1, outlook positive

-

Moody’s Ratings upgrades China General Nuclear Power Corporation to A1; outlook negative

-

Pactiv Evergreen Inc. Upgraded To ‘BB-‘ On Strengthened Credit Metrics, Financial Policy; Outlook Positive

-

VF Corp. Downgraded To’BB’ From ‘BBB-‘ On Weak Metrics; Outlook Stable

-

Fitch Removes Negative Watch and Affirms BRB’s Ratings; Outlook Negative

Term of the Day Yankee Bonds

These are a type of Eurobond issued and traded in the US and are denominated in USD. In essence, if a foreign company (a non-US based company) issues a USD bond which is traded in the US, the bond is considered a Yankee Bond. This is in comparison to a Eurodollar bond that is issued by a foreign entity denominated in USD, but the bonds are issued and trade outside of the US. About $14.5bn of Tuesday’s issuance in the bond markets came in the form of Yankee bonds.

Talking Heads

On Trump Tariffs to Hit Growth, Fan Inflation – JPMorgan’s David Kelly

“The first smoke signals suggest that the tariff approach will be very aggressive… very few things that are a stagflation elixir.. push inflation up and slow the economy down at the same time. Tariff for tariff will make the whole world poorer… going to be a lot of conflict over the tariffs”

On Wall Street bankers tempering optimism a week after Trump victory

Erika Najarian, UBS

“Banks can’t have everything… “we have to sort of temper enthusiasm when it comes to loan growth for next year” if interest rates stay higher for longer.

Jon Lieber, Eurasia Group

“The administration is going to be this interesting mix of kind of laissez-faire, plus pro-business, plus populism. How those three things interact are going to be happening in weird ways.”

On Treasury Yields Set to Turn Positive for Yen-Hedged Investors

Martin Whetton, Westpac

“FX hedging is still too costly, though that may change slightly if yields go positive after hedge costs. Yields still won’t compete with Japanese government bonds, given 10-year JGBs are around 1%”

Sonal Desai, Franklin Templeton

Drop in currency hedging costs “influences Japanese demand for things like investment grade securities and taxable muni, which is an area we find very interesting”

Top Gainers & Losers – 14 Nov 2024*

Go back to Latest bond Market News

Related Posts: