This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

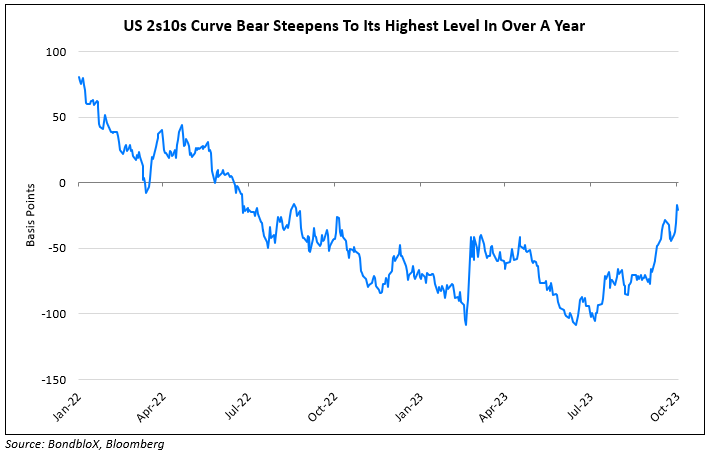

US 2s10s Curve Steepens to Highest Since Sep 2022

October 20, 2023

US Treasuries traded stable on Thursday. The 2s10s yield curve is now at its highest levels in over a year, albeit inverted at -21bp. This also compares with its lowest levels of -109bp seen in July, thus seeing an 88bp rise during this period, primarily led by the 10Y yield and thereby showing a bear steepening. Fed Chair Jerome Powell suggested that the Fed was inclined to hold interest rates steady again at its next meeting, while leaving open the possibility of a future hike if policymakers see further signs of resilient economic growth. This is in-line with market expectations of a status quo at the November 1 meeting. US initial jobless claims for the prior week fell to 198k, the lowest level since January, and below estimates of 210k, indicating strong job growth. US credit markets saw IG CDS spreads widen 3.2bp and HY spreads wider by 15.6bp. The S&P and Nasdaq ended lower by 0.9-1%.

European equity markets closed lower too. In credit markets, European main CDS spreads were wider by 1.2bp and crossover spreads widened 6.7bp. Asian equity markets have opened in the red again this morning. Asia ex-Japan IG CDS spreads widened 4.5bp.

New Bond Issues

- Jinan Hi-tech $ 3Y at 7.7% area

Medco Energi raised $500mn via a 5.5NC2 bond at a yield of 9.25%, 25bp inside initial guidance of 9.5% area. The bonds have expected ratings of B1/B+/B+ and received orders over $818mn, 1.6x issue size. 90% of the deal was allocated to fund and asset managers, 6% to insurers and 4% to private banks and others. Asian investors took 38%, the US 32% and Europe 30%. Proceeds will be used to refinance existing debt or replace committed but currently undrawn facilities.

PIF raised $3.5bn via a two-tranche deal. It raised $2.25bn via a 5Y sukuk at a yield of 6.098%, 30bp inside initial guidance of T+150bp area. It also raised $1.25bn via a 10Y sukuk at a yield of 6.279%, 30bp inside initial guidance of T+170bp area. The senior unsecured bonds have expected ratings of A1/A+ (Moody’s/Fitch). The 5Y sukuk received orders over $14bn, 6.2x issue size, while the 10Y sukuk received orders over $10bn, 8x issue size. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- Oman Telecom hires for $ 7Y Sukuk

- Fujian Zhanglong hires for $ Blue bond

- Korea Investment & Securities hires for $ 3Y bond

- KHFC hires for $ 3Y Fixed/FRN bond

Rating Changes

-

Moody’s upgrades Santander Holdings USA, Inc. (senior unsecured to Baa2) and affirms Santander Bank, N.A. (issuer rating Baa1), outlook stable

- Moody’s places Israel’s A1 ratings on review for downgrade

- Koc Holding Outlook Revised To Stable From Negative Following Similar Action On Turkiye

- Moody’s affirms JBS ratings at Baa3; outlook changed to negative

Term of the Day

Bear Steepening

Bear Steepening refers to a move in the yield curve where the longer-dated bond yields move higher than the shorter-dated bond yield (far maturity bonds sell-off more than near maturity ones). A bear steepening move can occur due to different reasons some of them being long term expectations of inflation picking up, higher supply of longer-dated bonds, central bank tapering purchases with a focus on the long-end bonds etc.

Talking Heads

“The idea was to make AT1s truly perpetual so that we wouldn’t experience one of the worst things in the financial crisis, which was banks calling Tier 1 instruments and seeing them replaced with state aid… As long as calls are viewed as individual decisions that can signal something beyond pure replacement economics, we have a problem… have set in motion a vicious circle of ever-more uneconomic calls”

On Africa Is Already Moving Past Defaults – Citigroup Economist, David Cowan

“We’ve reached a point now whereby the immediate threat of default has probably receded. I don’t think anyone expects a default in the next six months… no clear and obvious reason why we would expect a wider number of defaults across Africa in the coming years, even despite rising debt burdens in a large number of countries”

On Emerging Market Losses Deepening as Treasury Yields Edge Towards 5%

Omar Ghalloudi, head of EM trading at KNG Securities

“Being the benchmark rate for any investment, higher US Treasury yield increases the return expected for any other investment, either equities, real estate, or bonds. Meeting these higher returns requires asset prices to adjust downward… As a consequence of higher borrowing costs and lower expected revenues, default probabilities for most credits increase”

On strong economy may still require rate increases – Fed Chairman, Jerome Powell

“We are attentive to recent data showing the resilience of economic growth and demand for labor. Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy”

On Bond buyers dip toes in long-term Treasuries despite higher-for-longer rate fears

Matt Smith, investment director at Ruffer

“The shift of the bond market from hard landing to no landing is what gives us this investment opportunity in price terms… tightness that (bond yields) are imposing on the economy and markets is rising … this caps the extra work the Fed needs to do”

Leslie Falconio, Head of Taxable Fixed Income Strategy at UBS Global Wealth Management

“At these levels, we believe you have the tailwind of compounding interest and more than likely price appreciation … because we believe yields will come down in 2024”

Top Gainers & Losers- 20-October-23*

Go back to Latest bond Market News

Related Posts: