This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US 10Y Climbs To 2007 High; Turkey Reduces Reliance On FX-Linked Deposits

August 22, 2023

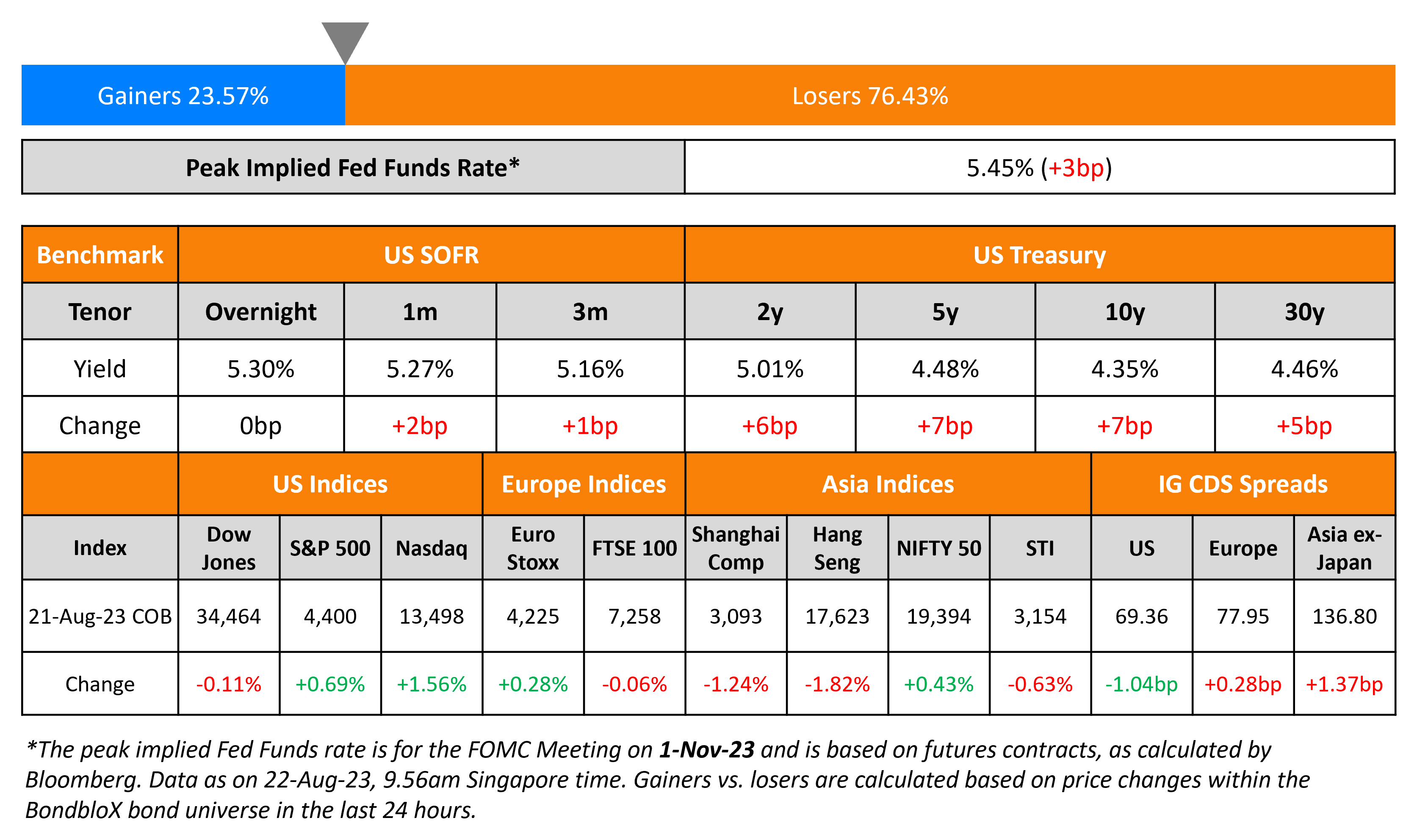

US Treasury yields jumped higher on Monday; the 2Y rose 6bp to 5.01% and the 10Y climbed to 4.35%, its highest since 2007 amid a broad sell-off in US debt. CME probability of a 25bp rate hike remains relatively unchanged at 14% for the September meeting, and 39% for the November meeting. US IG credit spreads were tighter by ~1bp while HY CDS spreads tightened by ~3.9bp. The S&P and Nasdaq closed higher by ~0.7% and ~1.6% respectively on the back of a rally in tech stocks.

European equity markets traded mixed. In credit markets, European main CDS spreads were 0.3bp wider and Crossover CDS widened 1.6bp. In Turkey, the central bank prompted Turkish banks to reduce reliance on FX-linked deposit accounts, and compel banks that fail to meet specific conversion targets (into regular lira accounts) to purchase additional government bonds. The monetary authority also boosted the reserve requirement ratios for short-term FX deposits, forcing banks to park more foreign currency at the regulator. As a result, the yield on Turkey’s 10Y government bonds fell 95bp to 21.1%, the biggest drop since May. Asia ex-Japan CDS spreads widened further by 1.3bp. Asian equity markets have opened broadly higher this morning.

New Bond Issues

Credit Agricole raised €1bn via a 10NC5 Tier 2 bond at a yield of 5.6%, 20bp inside initial guidance of MS+245bp area. The bonds have expected ratings of Baa1/BBB+/A-, and received orders over €1.65bn, 1.7x issue size. Proceeds will be used for bail-in and Basel III Tier 2 Capital purposes. If the new notes are not called on the first call date of 28 August 2028, the coupon will reset to the EUR 5Y swap rate plus a spread of 225bp. The table below compares Credit Agricole’s new Tier 2s with other similar rated EUR-denominated Tier 2s.

New Bond Pipeline

- Singapore’s Monetary Authority of Singapore mandates for tap of S$1.8bn 2072 Green Bond

Rating Changes

- Swiss Reinsurance Co. ‘s Senior Debt Downgraded To ‘A+’ On Changes To Swiss Insurance Supervision Act

- Moody’s downgrades Newell Brands to Ba2, outlook remains negative

- Moody’s downgrades Liquid Telecom’s rating to B3; outlook negative

- Comerica Inc. Rating Lowered To ‘BBB’ From ‘BBB+’ On Reduced Predictability Of Financial Performance; Outlook Stable

- Pertamina ‘BBB’ Ratings Affirmed; SACP Revised To ‘bbb-‘ On More Timely Government Compensation; Outlook Stable

- Moody’s changes the outlook on Constellium to positive; affirms its B1 CFR

Term of the Day

TIPS

TIPS or Treasury Inflation-Protected Securities are fixed income securities issued by the US Treasury whose returns are linked to the inflation rate. TIPS provide investors protection against inflation by adjusting the principal higher with inflation and lower with deflation, as measured by the Consumer Price Index (CPI). At maturity, investors are paid the higher of the adjusted principal or the original principal. Interest on TIPS is fixed, paid out twice a year and is applied to the adjusted principal. As investors expect inflation in the US to climb higher, demand for TIPS is likely to increase.

Talking Heads

Zachary Griffiths, senior fixed-income strategist at CreditSights

“The continued better-than-expected economic data has made it like we are almost contemplating a new reality that we haven’t had for quite some time, where rates could potentially be quite higher for quite longer. That’s the big thing driving real yields.”

Angelo Manolatos and Mike Schumacher, strategists at Wells Fargo

“We recommend buying 10-year TIPS at a real yield of 2%, targeting 1.7% over the next two to three months with a stop at 2.15%. This is our top choice for going long duration. The Federal Reserve is either done hiking or will do only another 25bps, in our view.”

Veronica Clark, economist at Citi

“We see building upside risks for goods prices more broadly as demand for goods is picking up again just as commodity prices have been rising, inventories appear to have reached a peak, and the disinflationary forces from supply chains correcting could be reaching an end.”

On European Stocks Testing Major Support Levels

Ipek Ozkardeskaya, senior analyst at Swissquote Bank

“Global risk sentiment is less than ideal as healthy economic data from the US and darker clouds over China cast a shadow on both stock and bond markets. The fear of a decidedly hawkish Fed is already priced in, and if there is no more hawkish surprise from this week’s Jackson Hole meeting, tensions among investors could ease by next week, and give markets some breathing room.”

Top Gainers & Losers- 22-August-23*

Other News

Goldman Sachs weighs sale of part of its wealth business

Coinbase Sweetens Offer to Buy Back Bonds at Discounted Prices

Go back to Latest bond Market News

Related Posts: