This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UOB, Singtel, Redco Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

April 7, 2021

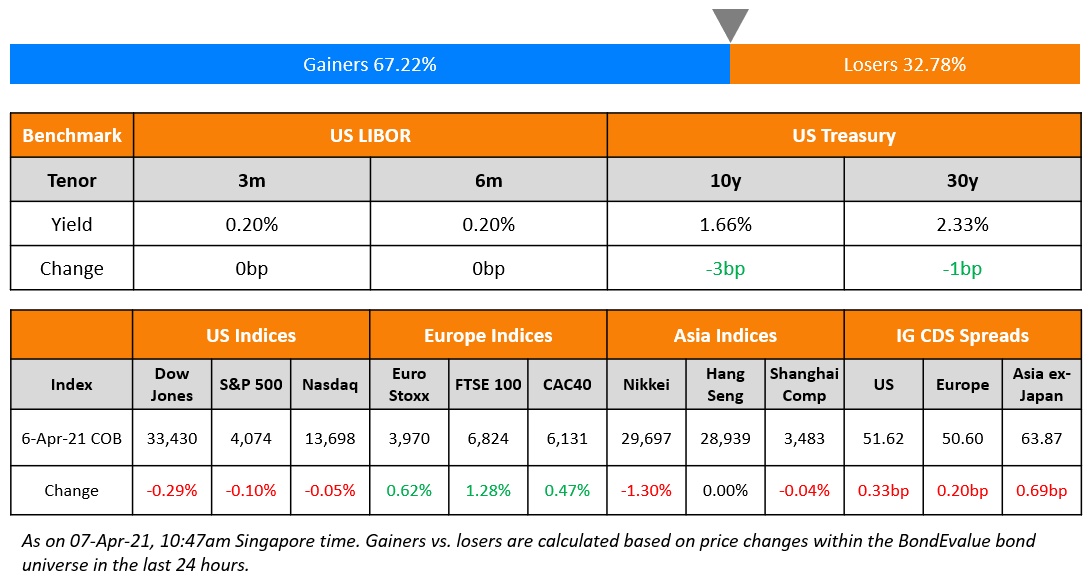

Both S&P and Nasdaq ended modestly lower by ~0.1%. US 10Y Treasury yields slipped 3bp to 1.66%. The IMF raised its global growth forecast for 2021 from 5.5% to 6% citing an improved economic outlook. In Europe, the DAX and CAC rose 0.7% and 0.5% to new closing highs and FTSE rallied 1.3%. US IG CDS spreads were 0.3bp wider and HY was 1.4bp tighter. EU main CDS spreads were 0.2bp wider and crossover spreads widened 0.5bp. Asian equity markets are mixed with China and HK lower by 0.5% and others up 0.3% while Asia ex-Japan CDS spreads were 0.7bp wider. Asian primary markets are seeing three new deals this morning from Singtel, UOB and Redco.

Bond Traders’ Masterclass | Tomorrow at 6pm SG/HK

Keen on learning how to do bond calculations on Excel from an ex-bond trader? Join us for the upcoming session on Using Excel to Understand Bond Calculations at 6pm SG/HK today, April 7.

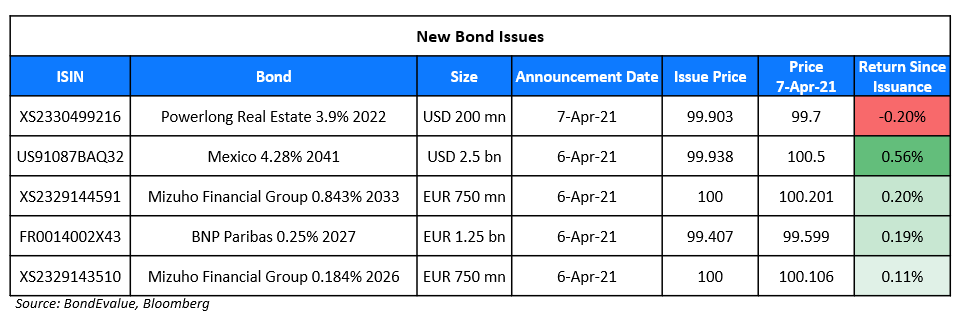

New Bond Issues

- Redco Properties 364-day US$ sustainability notes IPG 10% area; books over $700mn

- SingTel $ PerpNC10.5 at 3.6% area

- UOB $ sustainability 5Y/10.5NC5.5 Tier 2 at T+75bp/T+150bp area

New Bond Pipeline

- Sumitomo Life Insurance $ 60NC10 step-up callable subordinated notes

- Putian State-owned Asset Management $ bond

- Genting Malaysia $ bond

- IRFC $ 5Y bond

- Korea Resources Corp $ 5Y bond

Rating Changes

- Tata Steel Rating Raised To ‘BB-‘ By S&P On Deleveraging And Strong Operating Momentum; Outlook Stable

- Olin Corp. Upgraded To ‘BB’ From ‘BB-‘ By S&P On Improved Credit Measures: Debt Ratings Raised

- Fitch Upgrades First Quantum to ‘B’; Outlook Stable

- Moody’s upgrades EnVen’s CFR to B3, assigns Caa1 to new notes; outlook stable

- Moody’s changes outlook on Azerbaijan’s rating to positive from stable; Ba2 rating affirmed

- Fitch Assigns First-Time ‘B-(EXP)’ IDR to EnVen Energy; Rates 2nd Lien Notes ‘B-(EXP)’/’RR4’

Term of the Day

Sustainability Bonds

As per ICMA, an authority in capital markets, “Sustainability bonds are bonds where the proceeds will be exclusively applied to finance or re-finance a combination of both green and social projects.” These can be issued by financial/non-financial companies, governments or municipalities and should follow guidelines by the ICMA. The green and social aspects would be aligned to ICMA’s Green Bond Principles (GBP) and Social Bond Principles (SBP).

Redco Properties and UOB have come out with sustainability note offerings today.

Talking Heads

On the warning that US yields above 2% will bite amid excess risk

Nouriel Roubini, professor at New York University’s Stern School of Business and former adviser to the US government

“We’re seeing widespread frothiness, bubbles, risk-taking and leverage,” Roubini said. “Lots of players have taken too much leverage and too much risk and some of them are going to blow up.” “Even if in the short-term growth outcomes in the U.S. strengthen the dollar, the direction of the dollar is south over time,” Roubini said.

Christian Mueller-Glissmann, strategist at Goldman Sachs Group Inc

“You’re dealing with peak growth momentum and we’re dealing with incredible pressure from a fund flow point of view as well, where you haven’t really seen major outflows out of bonds,” he said.

“You’re dealing with peak growth momentum and we’re dealing with incredible pressure from a fund flow point of view as well, where you haven’t really seen major outflows out of bonds,” he said.

Don Ellenberger, senior portfolio manager at Federated Hermes

“I think the Fed will stick to what they said. The Fed tells us that they’re not going to raise rates and they’re going to let inflation overshoot,” said Ellenberger. “Longer term, we’re going to see rates continue to grind higher. I wouldn’t be surprised if we see 2.25%-2.50% in the 10-year by the end of the year just from a fundamental standpoint,” said Ellenberger.

According to TD Securities’s research note

“The bar for the Fed to hike rates remains high as the Fed needs to see an inflation overshoot and an inclusive labor market recovery.” “This would require substantial labor market improvement over a longer period in our view. In addition, given the need for the Fed to complete tapering before hiking rates, which can take the better part of a year, we think the market is overpriced for a risk of an early Fed hike,” TD added.

“The divergent recovery paths are likely to create significantly wider gaps in living standards between developing countries and others, compared to pre-pandemic expectations,” said Gopinath. “This has reversed gains in poverty reduction, with an additional 95 million people expected to have entered the ranks of the extreme poor in 2020, and 80 million more undernourished than before,” Gopinath added.

Adam Cohen, Caspian’ Capital managing partner

“People aren’t investing, they’re just chasing,” said Cohen. “Money always burns a hole in your pocket,” Cohen said. “The best thing you can do now is not make a mistake. That can save you a lot more money than mediocre trades can make you.”

Howard Marks, Oaktree co-founder

“To get to higher returns these days, you have to be willing to extend credit to somebody who is not clearly coming back,” Marks said.

Jason Dillow, chief executive officer at Bardin Hill Investment Partners

“If you can only do public-market distress, you just have to hold your position, because if you sell it, there’s nothing else to buy,” said Dillow.

Chris Acito, chief investment officer of Gapstow Capital Partners

“If you had a fundamentally strong business, you could’ve found the liquidity to make it through the challenges of 2020,” Acito said. “Many of the businesses which are still in distress have flawed business models that will be difficult to revive.”

Heike Mai, banks analyst at Deutsche Bank

“Sovereign risk on bank balance sheets has still not been tackled, in contrast to other risk mitigation measures introduced by the [eurozone] banking union,” said Mai. “It remains the elephant in the room. The current pandemic with its surge in public debt highlights the need for reform.”

Nicolas Véron, a senior fellow at the Bruegel think-tank

“The increase in liabilities going between banks and governments is worrying to me and policymakers should look to address it,” said Véron. “But the risk seems a bit beyond the horizon that keeps policymakers awake nowadays.”

Jacques de Larosière, former head of the IMF and Banque de France

“Banks have to respond to the issuance of bonds by the state because they feel it is a good investment to hold in terms of risk and they are encouraged to do so to maintain liquidity,” he said.

“Banks have to respond to the issuance of bonds by the state because they feel it is a good investment to hold in terms of risk and they are encouraged to do so to maintain liquidity,” he said.

Lorenzo Bini Smaghi, chair of French bank Société Générale

“Banks may want to invest mainly in safe assets to protect capital levels in view of the message coming from regulators,” he said.

Top Gainers & Losers – 07-Apr-21*

Go back to Latest bond Market News

Related Posts: