This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UBS Raises $1.5 Billion via PerpNC10 AT1 at 4.375%

February 2, 2021

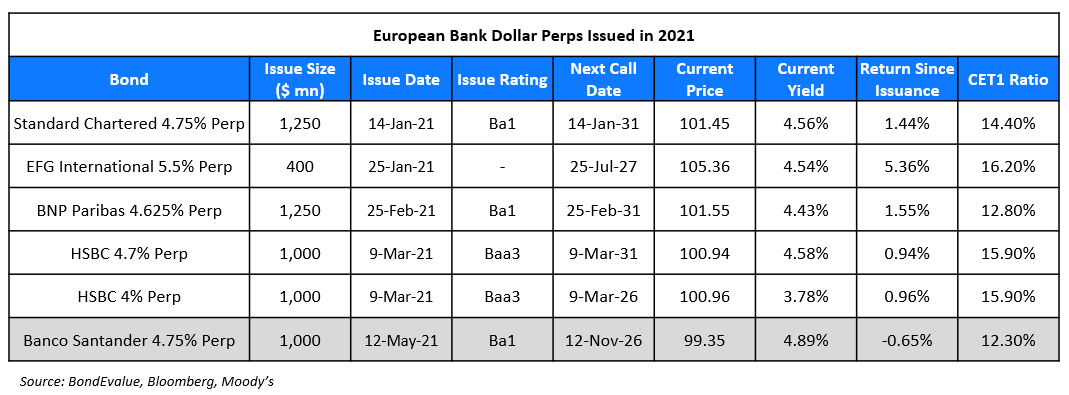

Swiss investment bank UBS raised $1.5bn via a perpetual non-call 10Y (PerpNC10) bond on Monday at a yield of 4.375%. While order book details were not available at the time of writing, investor demand seemed strong based on the 62.5bp tightening. UBS started marketing the AT1s during Asia hours at 5% area, before revising the guidance to 4.75% at about 9pm Singapore, before US open. The AT1s, expected to be rated BB/BBB, are callable on February 10, 2031 and every coupon payment date thereafter. UBS’ new AT1’s coupon resets, if not called in 2031, to the prevailing 5Y Treasury yield plus a spread of 331.3bp. The AT1s also carry a dividend stopper. The notes will be written down upon the occurrence of a Trigger Event, if the bank’s CET1 ratio falls below 7%, or a Viability Event, determined by Swiss regulator FINMA.

UBS last issued a dollar AT1 in late July last year, when it raised $750mn via a PerpNC6 bond at 5.125% with a coupon reset to the prevailing 5Y Treasury plus a spread of 485.5bp if not called in July 2026. The PerpNC6s are currently trading at 107.56 with a yield-to-call of 3.58%. Two of UBS’ older AT1s, 6.875% issued in March 2016 and 7.125% issued in August 2016 have call dates in March and August this year. If not called, the coupon on these older AT1s would reset to the ICE 5Y Swap plus 549.65bp and 5Y Swap plus 588.3bp (~6% and ~6.4% based on current swap rates respectively).

For a detailed analysis of UBS’ new AT1 issuance along with other prominent new bond issues, attend our Masterclass on Understanding New Bond Issues & Credit Ratings today at 6pm Singapore / 2pm Dubai / 10am London. Click here to sign up.

Go back to Latest bond Market News

Related Posts:

SocGen Raises $1 Billion Via AT1 at 4.75%

May 19, 2021