This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Santander Raises $1.9bn via Dollar & Euro Perpetuals

May 7, 2021

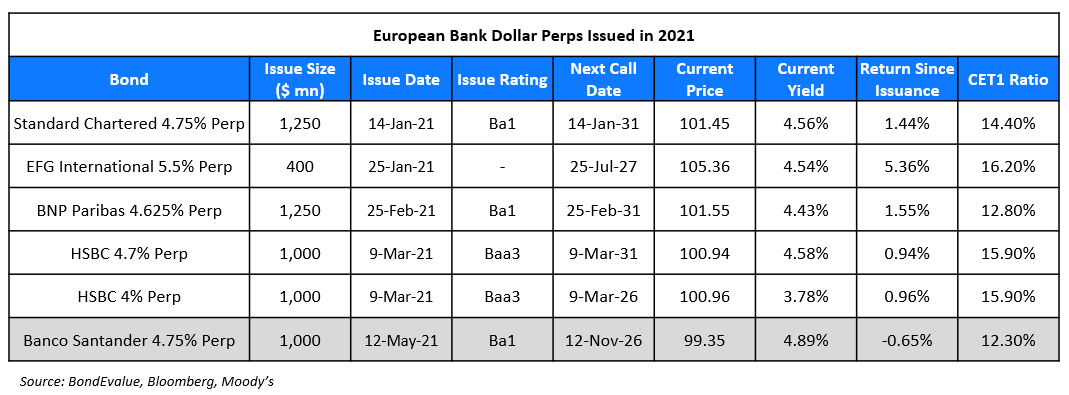

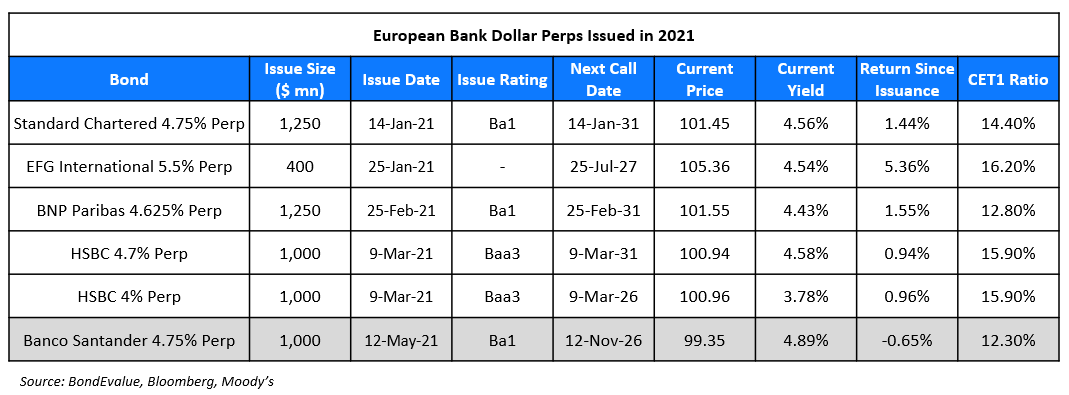

Banco Santander raised $1bn via a non-cumulative Perpetual non-call 6Y (PerpNC6) preferred Tier 1s at a yield of 4.75%, 25bp inside initial guidance of 5% area. The issuance has expected ratings of Ba1 and are callable from (including) November 12, 2026 to (including) the first reset date of May 12, 2027 and each interest payment date thereafter. The coupons are fixed until the reset date and if not called on May 12, 2027, the coupon resets to the 5Y Constant Maturity Treasury rate + initial margin of 375.3bp. A trigger event would occur if the CET1 ratio falls below 5.125% (current CET1 12.3%). There is no coupon step-up.

Go back to Latest bond Market News

Related Posts: