This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UBS, ING, San Miguel, Al Ahli Price $ Perps

September 6, 2024

UBS raised $1.5bn via a PerpNC5.5 AT1 bond at a yield of 6.85%, 77.5bp inside initial guidance of 7.625% area. The coupon is fixed until 10 September 2029, and if not called by 10 March 2030, resets then and every five years thereafter to the prevailing 5Y UST plus the initial margin of 363bp. The junior subordinated notes are rated Baa3/BB/BBB-. Proceeds will be used for general corporate purposes and to maintain or further strengthen its capital base. A trigger event would occur if at any time the non-transitional CET1 Ratio is less than 7.0%. The bonds have a dividend stopper. Below is a table comparing UBS’s latest issuance with other comparable peers’ bank AT1s (sorted by the YTC).

ING Groep raised $1bn via a PerpNC10 AT1 bond at a yield of 7.25%, 62.5bp inside initial guidance of 7.875% area. The coupon is fixed until 16 November 2034, and if not called, resets then and every five years thereafter to the prevailing 5Y SOFR Mid-Swap plus the initial margin of 408.4bp. The junior subordinated notes are rated Ba1/BBB. Proceeds will be used for general corporate purposes and to strengthen its capital base. A trigger event would occur if at any time the group’s CET1 Ratio is less than 7.0%. Below is a table comparing ING’s latest issuance with other comparable peers’ bank AT1s (sorted by the YTC).

Al Ahli Bank of Kuwait raised $300mn via a PerpNC5.5 AT1 bond at a yield of 6.5%, ~50bp inside initial guidance of low-7% area. The junior subordinated bonds are unrated. If not called by 12 March 2030, the coupon will reset to the 5Y UST plus 292.5bp. Proceeds will be used to increase its capital adequacy and for general corporate purposes.

San Miguel Global Power raised $268.1mn via a PerpNC5 bond at a yield of 8.75%, 25bp inside initial guidance of 9% area. The senior perpetual securities are unrated. If not called by 12 September 2029, the coupon will reset to the 5Y UST plus the initial margin of 523.2bp along with a coupon step-up of 250bp. Besides, the coupon step-up can also happen on the occurrence of any of change of control (CoC) and/or reference indebtedness default event if issuer does not redeem the notes. If the CoC or reference indebtedness default event is remedied, then the coupon will decrease by 250bp from the next payment date. The notes have both, a dividend pusher and a dividend stopper. Proceeds will be used for costs and expenses related to concurrent exchange offers and towards pre-development costs of solar energy projects.

Go back to Latest bond Market News

Related Posts:

UBS Raises $750mn Via PerpNC5 AT1 at 3.875%

May 27, 2021

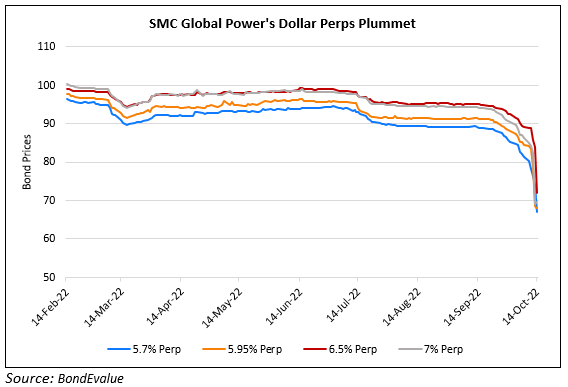

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022

San Miguel’s Dollar Perps Rally on 6.5% Perp Call Announcement

November 1, 2023