This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

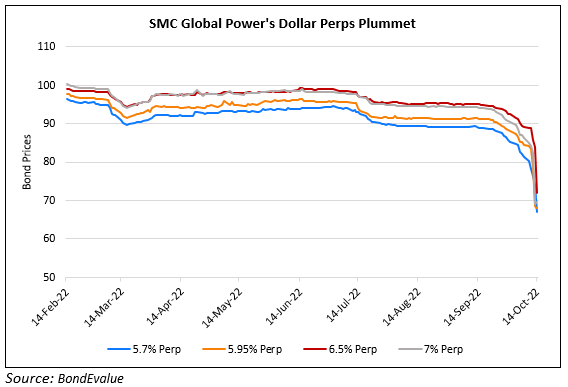

San Miguel’s Dollar Perps Rally on 6.5% Perp Call Announcement

November 1, 2023

Philippines-based conglomerate San Miguel ‘s (SMC) CFO, Ferdinand Constantino, said that it will redeem its 6.5% Perp callable next April. The notes traded at 87 cents on the dollar prior to the announcement. SMC has about $3bn in debt maturing in 2024. The CFO said that SMC has a strong financial position and is fully compliant with loan covenants. He added that their planned capital-raising exercise is aimed at fueling its long-term growth. Bloomberg Intelligence analyst Sharon Chen noted that calling back the perp in April could imply a lower call risk for its 5.95% Perp callable in 2025. The conglomerate’s financial position has been weighing on the nation’s corporate bond market and the above decision may help ease concerns, Bloomberg notes.

SMC’s dollar perps have been trending lower since August. Its 6.5% Perp jumped higher by 3.1 points to trade at 90.15, with a yield to call of 30%. Its other dollar denominated perps also moved higher by 1-1.5 points.

For more details, click here

Go back to Latest bond Market News

Related Posts: