This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Turkey Upgraded Two Notches to B1 by Moody’s

July 22, 2024

Turkey has been upgraded by two notches, to B1 from B3 by Moody’s. The rating upgrade comes on the back of the continued orthodox monetary policy that is yielding its first positive results. This comes in the form of reducing major macroeconomic imbalances in terms of inflation, domestic confidence in the Turkish Lira and foreign capital inflows. In June, Turkey recorded a CPI of 71.6% YoY vs. 75.4% a month earlier, marking the first decline on an annual comparison for a year. Its monthly inflation rate of 1.6% was the lowest since December 2022. The sharp monetary tightening has also restored the confidence in and attractiveness of the Turkish Lira, witnessed by an increase in its deposits rates, currently averaging close to 60%. The second driver for the upgrade of the ratings is Turkey’s materially reduced external vulnerability. Its current-account deficit has fallen sharply to $25bn (2.1% of estimated 2024 GDP) in last 12 months vs. $57 bn (5.1% of GDP) a year earlier. Its foreign-currency reserves also improved to $33bn, 68% higher than its low point reached in late May 2023. Turkey was upgraded by S&P to B+ earlier in May after the elections got over. Moody’s has a positive outlook on the entity reflecting balance of risks skewed to the upside. This marks the first upgrade on Turkey by Moody’s in over a decade.

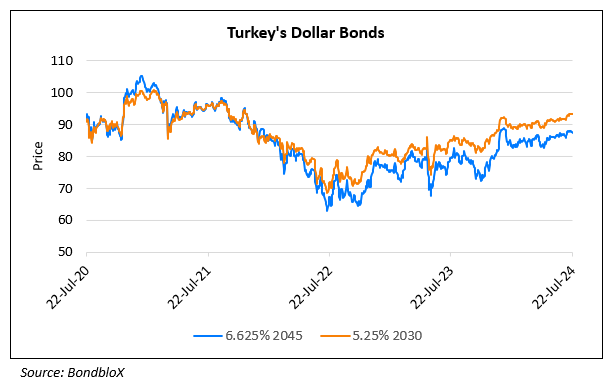

Due to unorthodox monetary policy, Turkey’s dollar bonds had seen a massive drop in prices from the beginning of January 2021, through July 2022. It’s dollar bonds have been on an uptrend since then with their prices reaching near pre-covid levels as seen in the chart above.

Go back to Latest bond Market News

Related Posts:

Turkey Downgraded to B from B+ by Fitch

July 12, 2022

Turkey Cut to B3 by Moody’s

August 15, 2022

Turkey Upgraded to B+ from B by Fitch

March 11, 2024