This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Turkey Upgraded to B+ from B by Fitch

March 11, 2024

Turkey was upgraded to B+ from B by Fitch with a positive outlook. Fitch said that the upgrade reflected “increased confidence in the durability and effectiveness of policies implemented since the pivot in June 2023”. This is on the back of Turkey’s central bank (CBRT) frontloading its monetary policy tightening that helped “in reducing macroeconomic and external vulnerabilities”. Since June 2023, the CBRT has raised its policy rates by 3650bp to 45%. Fitch also noted that Turkey’s “inflation expectations have eased and external liquidity risks have moderated” albeit with inflation still high at 67% in February. Turkey’s lower external risk has been observed via better external financing conditions, its higher reserves, lower FX-protected deposits and a reduced current account deficit, they said. Turkey’s international reserves have risen by $32bn since June 2023 to stand at $131bn to begin this month.

Turkey’s dollar bonds were trading stable with its newly issued 7.625% 2034s at 99.43, yielding 7.71%.

Go back to Latest bond Market News

Related Posts:

Turkey Downgraded to B from B+ by Fitch

July 12, 2022

Turkey Cut to B3 by Moody’s

August 15, 2022

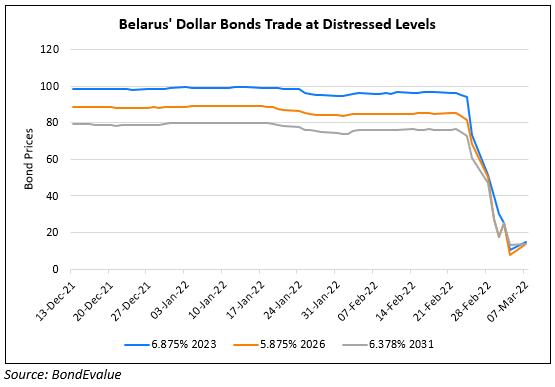

Belarus Downgraded to CCC by S&P

March 7, 2022