This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

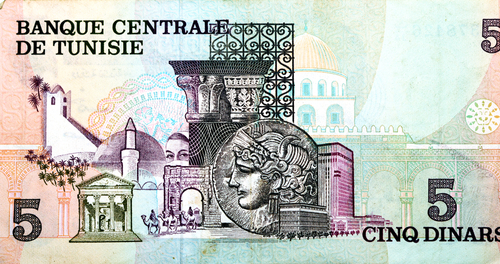

Tunisia Upgraded to B- on Stronger External Position

September 15, 2025

Tunisia was upgraded to B- from CCC+ by Fitch with a stable outlook, as the rating agency cited improvements in the country’s external position and resilience in financing. Fitch expects the current account deficit to widen to 2.2% of GDP in FY2025 vs 1.5% in 2024, still well below the 7.9% average level in 2010-2022 period. Net FDI inflows, at 1.4% of GDP in 2024, have proven resilient to political and external shocks, they added. International reserves are projected to cover about 3.9 months of external payments by 2027, including the outstanding €700mn 6.375% bond due 2026 and also meeting upcoming amortisations. Fiscal financing needs are seen declining gradually, with deficits narrowing from 6.3% of GDP in 2024 to 4% by 2027, said Fitch.

Public debt remains high at ~83% of GDP in 2025, but Fitch expects it to stabilise as lower primary deficits offset external vulnerabilities. The central bank’s zero-interest financing to the government has eased short-term pressures, though reliance on domestic financing is rising. Fitch also cautioned that Tunisia’s budget remains rigid and vulnerable to commodity price shocks.

Central Bank of Tunisia’s (BCT) 8.25% 2027s are currently trading stable at 100.56, yielding 7.94%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: