This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Tunisia Repays 20% of its Public Debt in January

February 17, 2025

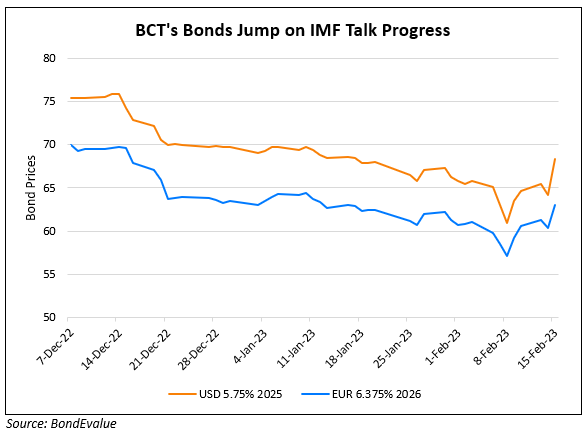

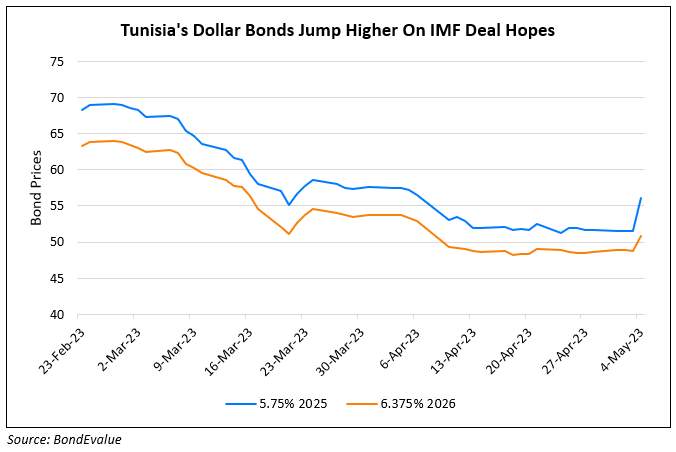

Tunisia has managed to repay external debts contracted on the international financial markets totaling TND 18.1bn ($5.74bn), from 2019 to date, according to Mohamed Salah Souilem, former Director General of Monetary Policy at the Central Bank of Tunisia (BCT). For the remaining year, Tunisia is only left with bilateral and multilateral debts contracted with various donors and friendly countries, representing smaller amounts, he added. Tunisia has managed, according to his own estimates, to repay 20% of its TND 25bn ($7.92bn) public debt servicing for the current year. Analysts have noted Tunisia’s increased ability to meet its financing needs. Tunisia was upgraded by two notches to CCC+ from CCC- by Fitch in September last year.

Tunisia’s dollar bonds have been trending higher with its 8.25% 2027s up by nearly 5 points since the beginning of this year.

For more details, click here.

Go back to Latest bond Market News

Related Posts: