This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

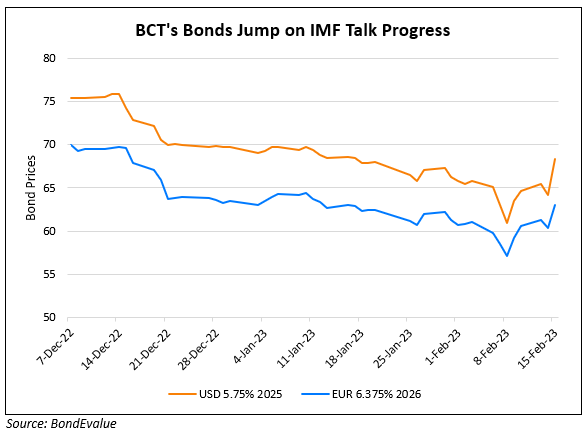

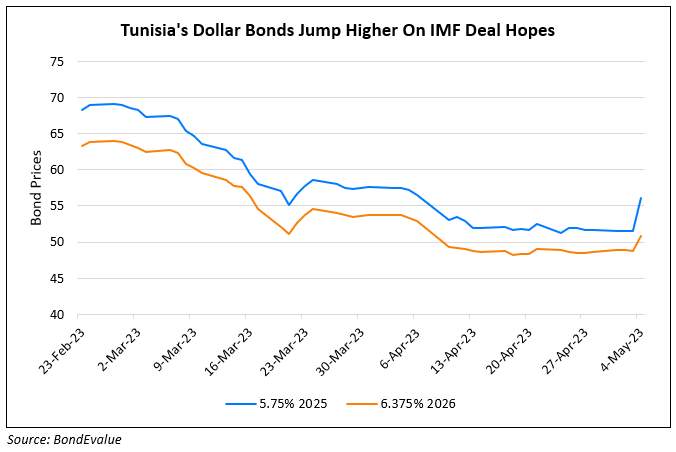

Tunisia’s Dollar Bonds Rally 4-8% as IMF Signals Nearing a Rescue Deal

May 4, 2023

Dollar bonds of the Central Bank of Tunisia (BCT) rallied by 4-8% across the board as the IMF signaled they were “almost there” towards completing a $1.9bn rescue package for the nation. While Tunisia reached a staff-level agreement with the IMF in October, it was yet to be reviewed for approval by IMF directors. Last month, Tunisia’s dollar bonds dropped after its President Kais Saied opposed what he called as “foreign diktats” by the IMF that could lead to more poverty. The IMF has been urging Tunisia to remove state subsidies on basic goods, especially fuel. While Jihad Azour, the IMF’s director for the MENA region highlighted the positive news of the deal, he added “there is a real concern about making sure that some of the measures will have the right distributional impact”.

For more details, click here

Go back to Latest bond Market News

Related Posts: