This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Tunisia Downgraded to CCC- by Fitch

June 12, 2023

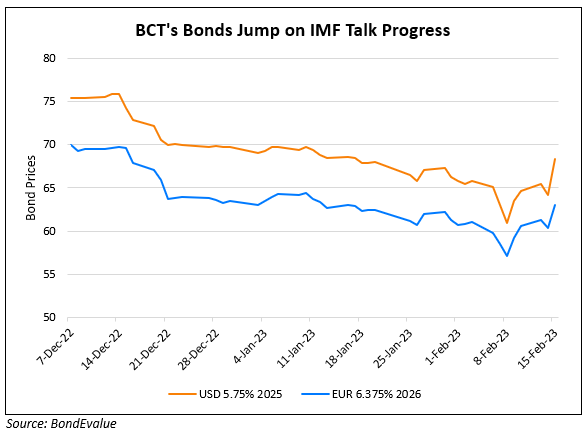

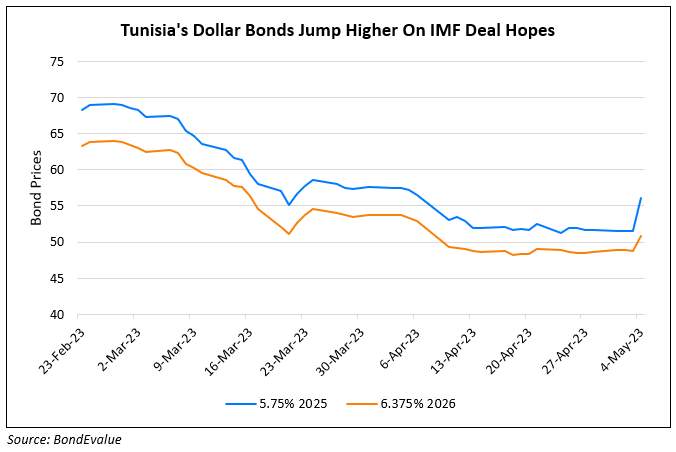

Tunisia has been downgraded to CCC- from CCC+ by Fitch. An intensified financing risk coupled with high government financing needs, high risks to financing plan and unfavorable growth prospects were some of the primary reasons cited. Adding to the reasons was a $1.9bn Extended Fund Facility (EFF) planned by the IMF in December 2022, which was not approved due to the failure of the government to implement specific actions under the multilateral lender’s conditions. Tunisia’s financing needs are expected to remain high at ~16% of GDP in 2023 and 14% of GDP in 2024, higher than the 2015-2019 average of 9%. This is attributed to Tunisia’s high fiscal deficits and large debt maturities. It has $2bn in bonds due in 2023 and about $3bn due in 2024. Tunisia’s GDP growth is also expected to slow from 2.4% in 2022 to 1.4% in 2023 due to factors such as high inflation and unfavorable weather impacting the agriculture sector.

The Central Bank of Tunisia’s (BCT) 5.75% 2025s have trended lower, down by 2.5% over the past week to trade at 65 cents on the dollar, yielding 35.9%.

Separately, in a positive update, the EU said that it may loan Tunisia over €1bn to help develop its struggling economy. The EU could also provide €150mn in budget support this year to the nation it said.

Go back to Latest bond Market News

Related Posts: