This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

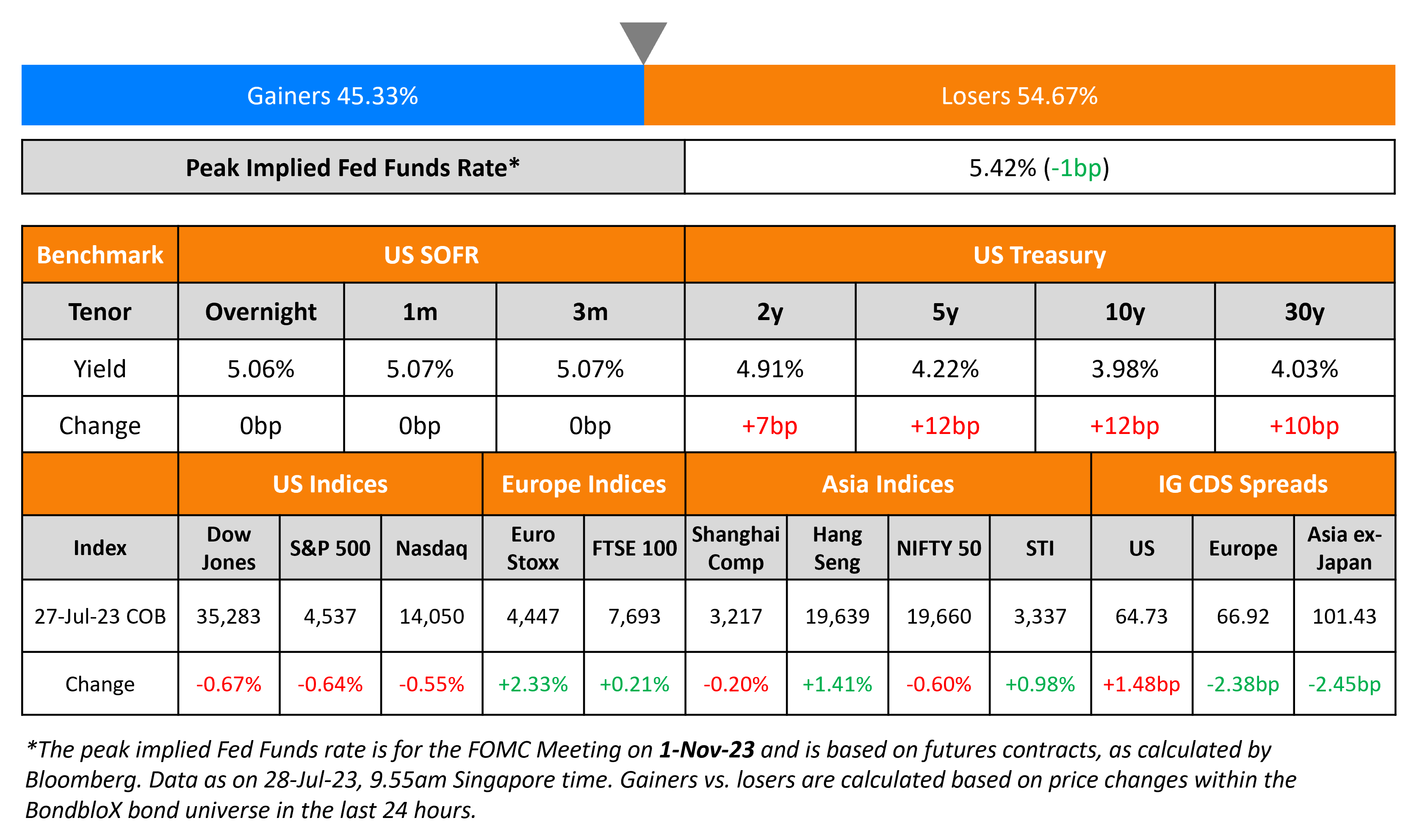

Treasury Yields Jump on Strong US Data; ECB Hikes by 25bp as Expected; BOJ Maintains Status Quo

July 28, 2023

Treasury yields jumped higher on strong economic data that put recession concerns to rest. The 10Y yield soared 12bp to 3.98% and the 2Y yield was up 7bp. US Q2 GDP grew by 2.4%, surpassing expectations of 1.8%, helped by a resilient labor market supporting consumer spending and businesses boosting investment in equipment and factories. Weekly jobless claims fell 7k to 221k, better than forecasts of 235k, indicating a resilient labor market. Durable goods orders jumped by 4.7%, massively beating expectations of a 1.3% increase, the biggest jump since mid-2020. Capital goods orders also rose 0.2%, beating forecasts of a -0.1% print. The peak Fed Funds rate eased 2bp to 5.43%. US IG credit spreads widened 1.5bp while HY CDS spreads were wider by 6.3bp. The S&P and Nasdaq ended lower by 0.6% and 0.9% respectively.

European equity indices closed lower. As expected, the ECB hiked its interest rates by 25bp during its policy meeting yesterday, with the deposit facility rate now at 3.75%. It mentioned that it will continue to follow “a data-dependent approach to determining the appropriate level and duration of restriction” adding that officials have an “open mind” on future interest rate decisions. European main CDS spreads were 2.4bp tighter and Crossover CDS tightened 10.8bp. Asia ex-Japan CDS spreads continued to tighten by 2.5bp to 101.4bp. Asian equity markets have opened in the green this morning. In its policy statement this morning, the BOJ said that it will retain the 50bp limit on the 10Y Japanese government bond (JGB) yields at either side of its 0% target whilst holding its policy rate steady at -0.1%. This comes just a few hours after 10Y JGB yield climbed to 0.505% on Friday, above the upper limit of the 0.5% cap.

New Bond Issues

Rating Actions

- Delhi International Airport Upgraded To ‘B+’ On Stronger Traffic And Profitability; Outlook Positive

- Fitch Upgrades Mercedes-Benz Group AG to ‘A’; Outlook Stable

- Moody’s downgrades Cameroon’s rating to Caa1 from B2; maintains stable outlook

Term of the Day

Cross Default

Cross default is a covenant included in bond and loan documents that puts an issuer in default if it has defaulted on another debt instrument. Cross defaults tend to have a domino effect, which puts the issuer under further pressure of making accelerated repayments and reduces its ability to refinance.

Talking Heads

On the ECB’s Future Rate Decisions – ECB President Christine Lagarde

“We have an open mind as to what the decisions will be in September and in subsequent meetings…So we might hike, and we might hold…(if the ECB does pause it) would not necessarily be for an extended period.”

On US Corporate Bond Issuances – head of IG syndicate at BofA Dan Mead

“If we were to see a move in rates similar to what we witnessed in the earlier part of this year, perhaps we may see more corporate issuers in particular looking to pull forward financing…You pick up a credit spread in addition to the Treasury in investment grade and investors are looking at it on a risk-adjusted basis…It’s an attractive asset class and markets are in a very healthy place right now so the markets are open.”

On the US Fed Hiking Cycle – CIO at Pimco Daniel Ivascyn

“There is a chance inflation remains sticky and above central bank targets…So if the Fed does pause and they don’t go again this year, it will be dangerous to think they are done…There is definitely a chance that this cycle is stretched a lot longer due to the exceptional period of low rates after Covid that helped households and corporations to term out debt.”

“We see this as temporary damage control…We’re up for significant volatility in the coming months until true policy corrections are in place, which should happen with a new administration.”

On Turkey’s Announcement of a “Holistic” Monetary Policy Plan

Tim Ash, strategist at BlueBay Asset Management

“The market just does not think that Simsek and Erkan have a mandate to do whatever it takes to fight inflation, at least not when it comes to policy rates, and that Erdogan is still the rate setter”

Marek Drimal, strategist at SocGen

“(Erkan’s approach) is going to be a difficult sell…Unless the credit and monetary tightening really kick in, investors would expect the central bank to hike more aggressively.”

On Investors Choosing Other EM Assets Over China’s

Malcolm Dorson, senior portfolio manager at Global X

“China’s export dominance is ebbing, creating opportunities for other emerging market countries to fill the gap, including Mexico, India, and Southeast Asian nations.”

John Lau, portfolio manager for APAC and EM equities at SEI

“China is the one major country that investors are most concerned about in EM.”

Jeffrey Jaensubhakij, CIO at GIC

“(GIC has) incrementally moved its capital to sectors and countries benefiting from shifts in the global supply chain and most of it has been basically out of China into countries such as Mexico, India, Indonesia and Vietnam.”

Wong Kok Hoi, CIO of APS Asset Management

“U.S., Canadian, and some European investors are exiting China due to political pressure. On the face of it, the U.S. seems to have started an investment war, following a trade war, and a tech war,”\

Top Gainers & Losers – 28-July-23*

Go back to Latest bond Market News

Related Posts:.png)