This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasury Yields Jump Higher; Pakistan Secures Bilateral Commitments to Rollover Debt

August 7, 2024

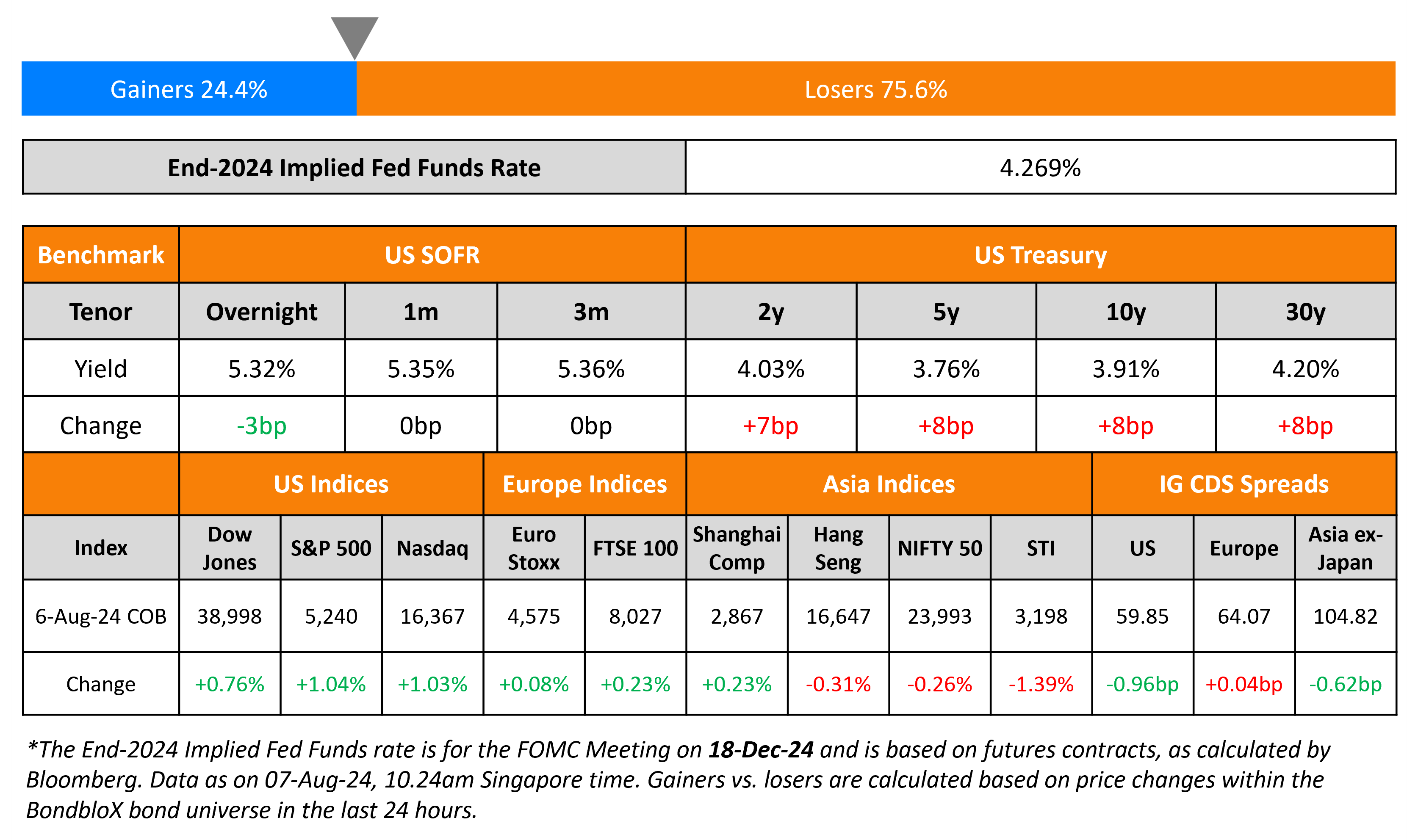

US Treasury yields jumped higher again on Tuesday, up by 7-8bp across the curve. The US Treasury’s $58bn 3Y bond auction saw solid demand, with a bid-to-cover ratio of 2.55x and an indirect bidder acceptance rate of 64.4%. The auction saw a final yield of 3.81%, stopping through the when-issued yield. US equities rallied yesterday, with the S&P and Nasdaq up by over 1% each. US IG and HY CDS spreads tightened by 1bp and 0.5bp respectively.

European equity markets also moved higher. Looking at Europe’s CDS spreads, the iTraxx Main spreads were flat and Crossover spreads tightened by 1.9bp. Most Asian equity indices have opened higher again today. Asia ex-Japan CDS spreads were tighter by 0.6bp.

New Bond Issues

- Chinalco $ 3.5Y at T+145bp area

Rating Changes

- Fitch Upgrades Pakistan Water and Power Development Authority to ‘CCC+’ on Sovereign Upgrade

- Moody’s Ratings upgrades Howmet Aerospace Inc.’s senior unsecured to Baa1, outlook stable

- AMC Entertainment Holdings Inc. Upgraded To ‘CCC+’ From ‘SD’ Following Transaction; Outlook Negative

Term of the Day

Regulation S

A Regulation S or Reg S bond is one that is issued in the international bond market and is usually cleared through Euroclear and Clearstream. These bonds cannot be sold in the US, except to qualified institutional buyers (QIBs) under the SEC 144A Rule. The 144A Rule, issued in 1990, modified a two-year holding period rule on privately placed securities by permitting (Qualified Institutional Buyer) QIBs to trade in these securities among themselves. Thus, a 144A bond, with a unique identifier, is privately placed to US based QIBs and usually clears through DTCC.

Talking Heads

On US corporate bond market issuance set to slow amid market volatility

Chris Forshner, BNP Paribas

“The recent equity and credit market volatility won’t eliminate the pipeline altogether, but it will have an impact… The issuers that will be most impacted are those that … need a very solid backdrop from which to sell new-issue bonds”

Andrew Jackson, head of fixed income at Vontobel

“They are better value now than they were. Having taken quite a lot of risk out of our positions, we’re now adding at the margin risk on the credit side.”

On Volatile Markets Adding to Pressure on Fed and Peers to Ease Stance

James Knightley, ING Financial Markets

“The news flow still suggests a soft landing is possible… in order to achieve it central banks — not just the Fed — will need to bring policy rates to a more neutral footing more quickly”

Robert Sockin, Citigroup

“The narrative of weaker activity and recession fears could become self-reinforcing. While this time might be different, the global economy has shown remarkable resilience time and time again in this cycle”

Rob Subbaraman, Nomura

“It’s an environment where defaults can start to become more significant, and that can feed back into the economy… I feel the environment’s becoming a bit more ripe for where we can start to see stresses”

On Carry Trade Unraveling Only Half Complete – JPMorgan

“We are not done by any stretch. The carry trade unwind.. is somewhere between 50%-60% complete… A good case outcome is stabilization in markets around current levels, maybe a shallow recovery at best”

Top Gainers & Losers- 07-August-24*

Go back to Latest bond Market News

Related Posts: