This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

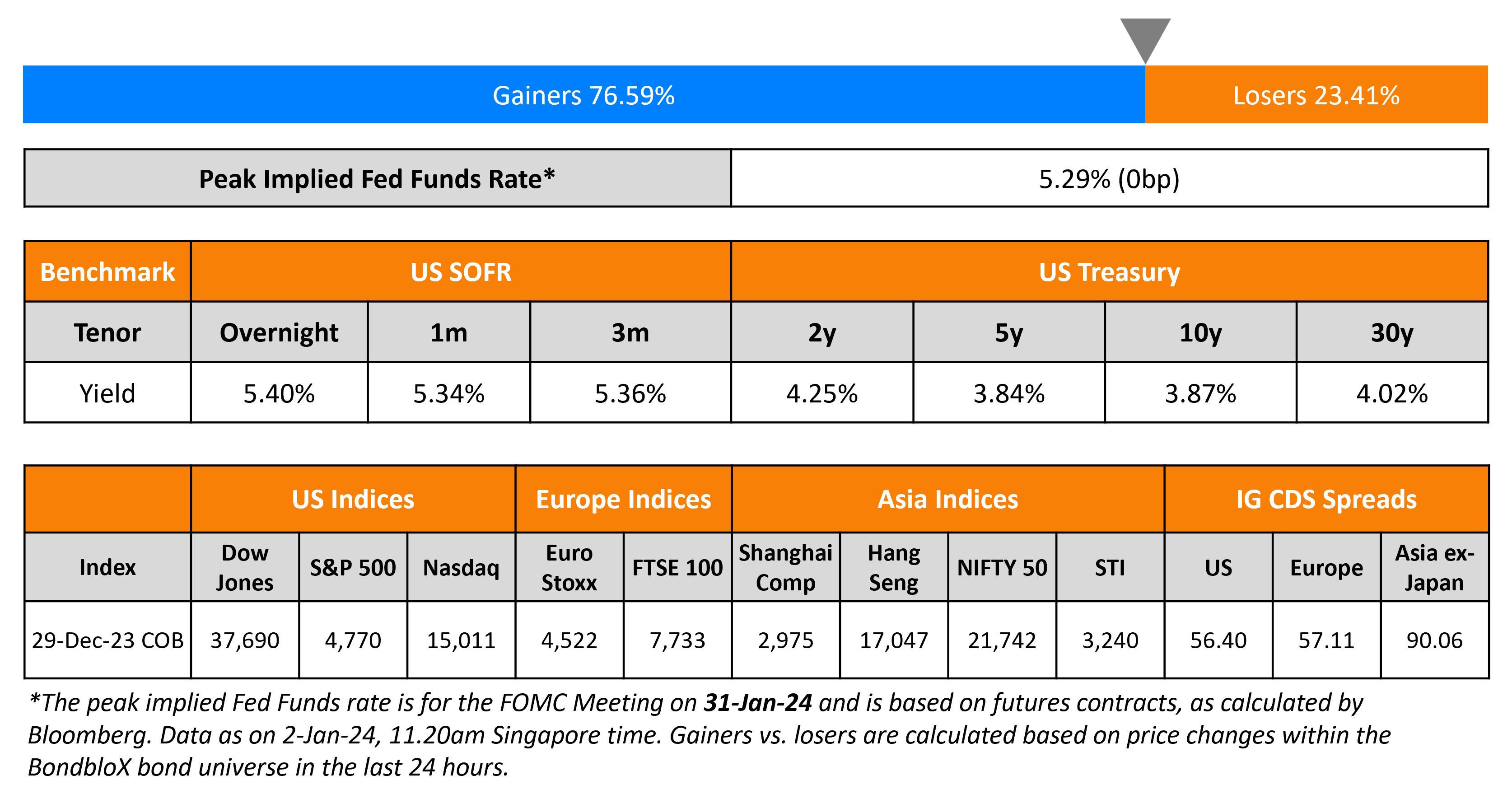

Treasuries Stay Stable on Veteran’s Day Holiday

November 12, 2024

US Treasuries were largely flat yesterday due to the Veterans’ Day federal holiday. CPI data for the month of October will be released tomorrow evening, where the annualized figure is expected to come-in slightly higher than the prior month at 2.6%, while the core inflation figure is expected to come in-line with the prior month’s value at 3.3%. US IG CDS spreads were flat while HY CDS spreads tightened by 3.2bp. Looking at US equity markets, S&P and Nasdaq both closed higher by 0.1%.

European equities followed suit and closed higher across the board too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1bp and 3.5bp respectively. Asian equities opened broadly mixed this morning. Asia ex-Japan CDS spreads widened by 0.1bp.

New Bond Issues

New Bond Pipeline

-

People’s Republic of China Ministry of Finance hires for $ 3Y/5Y bond

- Singapore Medical Group hires for S$ 5Y bond

- Tata Capital hires for $ bond

Rating Changes

-

Fitch Upgrades Air Canada to ‘BB’; Outlook Stable

-

Fitch Upgrades Mongolian Mining to ‘B+’; Outlook Stable

-

Moody’s Ratings affirms JPMorgan Chase & Co. senior unsecured debt at A1 and changes its outlook to positive

Term of the Day

Clean-up Call

A clean-up call refers to a call provision, whereby once a stated percentage of a security is retired, the issuer is obliged to call the remainder of the tranche. While clean-up calls are generally more commonly observed in mortgage-backed securities (MBS), they may also be present as a feature in some bonds. This is different from a normal call option in a bond where the issuer has an option to redeem their bond fully during the specified call date/period.

Talking Heads

On Wall Street Strategists Sticking to Neutral Stance on US Treasuries

Jabaz Mathai and Alejandra Vazquez, Citigroup

“The rates market is caught between expectations of significant policy changes in 2025 and the easing cycle which is driven by near-term data. We don’t see an imperative to take outright duration risk at these levels”

BMO Capital Markets

“After the calendar turn into 2025, the monetary policy outlook will become far more data dependent”

Morgan Stanley

“We maintain a neutral stance on US Treasury duration in anticipation of a ‘buy the dip’ opportunity”

On investors seeing safety in India as Trump win casts shadow on emerging markets

Sat Duhra, Janus Henderson

“Without any major fiscal announcement, China is likely to face downward pressure from Trump’s victory”

Carl Vermassen, Vontobel

Indian government bonds represent an attractive diversification while the central bank’s FX policy of stabilisation makes the rupee one of the best risk adjusted carry trades.

On High AT1 Bond Demand Allowing Banks to Push for More Favorable Clauses

Bruno Duarte, Algebris Investments

“If an issuer has five or six times demand for a deal, it can take advantage by adding clean-up calls or six-month call windows as free options… A simpler, cleaner and more consistent structure is an advantage to everyone”

Top Gainers & Losers 12-November-24*

Go back to Latest bond Market News

Related Posts:

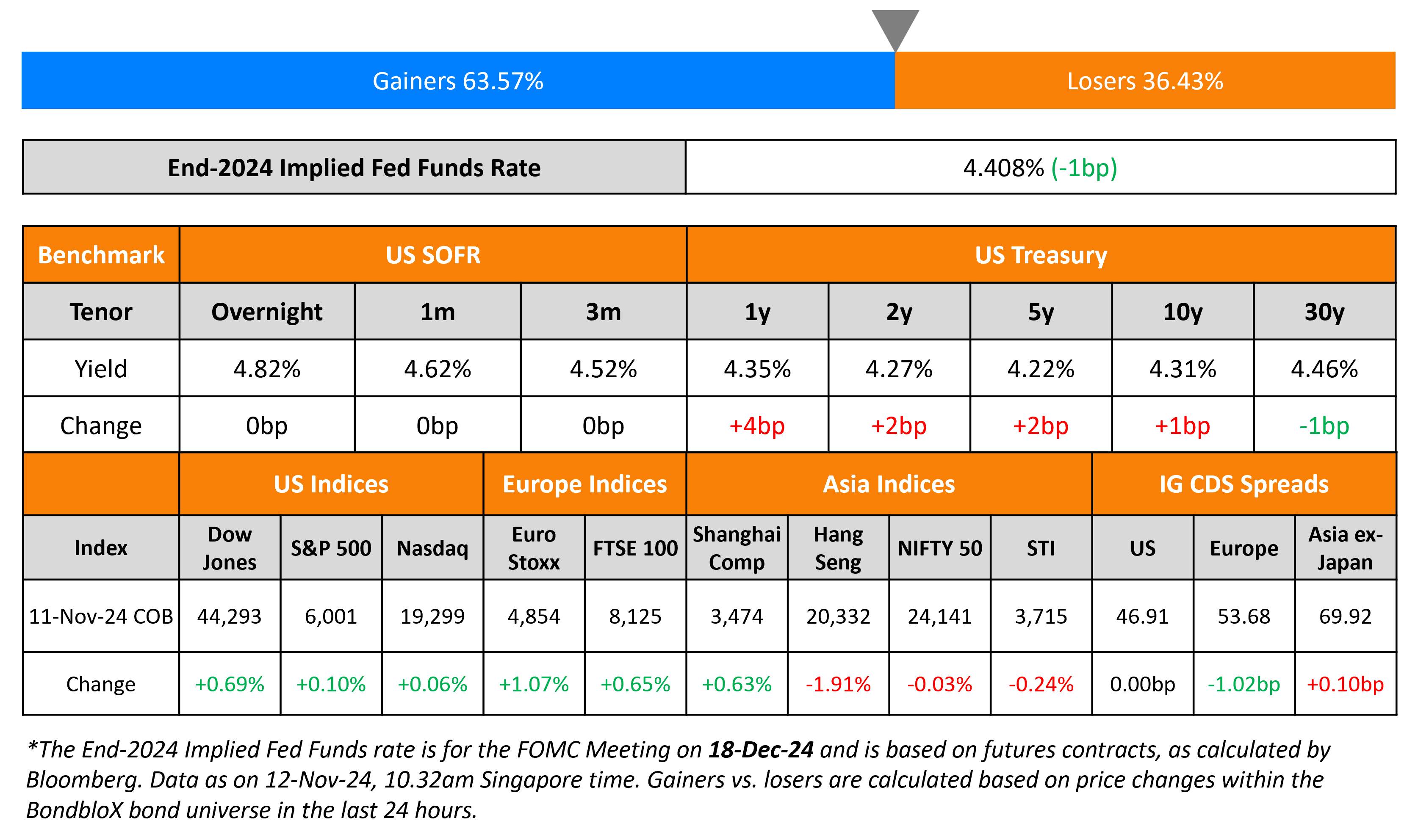

ADP Payrolls Softer Than Expected

December 7, 2023